Highlights

- New Hope Corporation’s full-year dividend for FY22 stood at 86 cents compared to 11 cents in FY21.

- Coronado’s YTD group revenue was AU$2,854 million, up 107.8% compared to YTD 2021.

- Worley Limited recently bagged a PMA for Anglo American’s Woodsmith project in northeast England.

Mid-cap stocks refer to the companies that lie between the large- and small-cap segments. These stocks are considered relatively more liquid compared to small-cap stocks and less prone to market volatility.

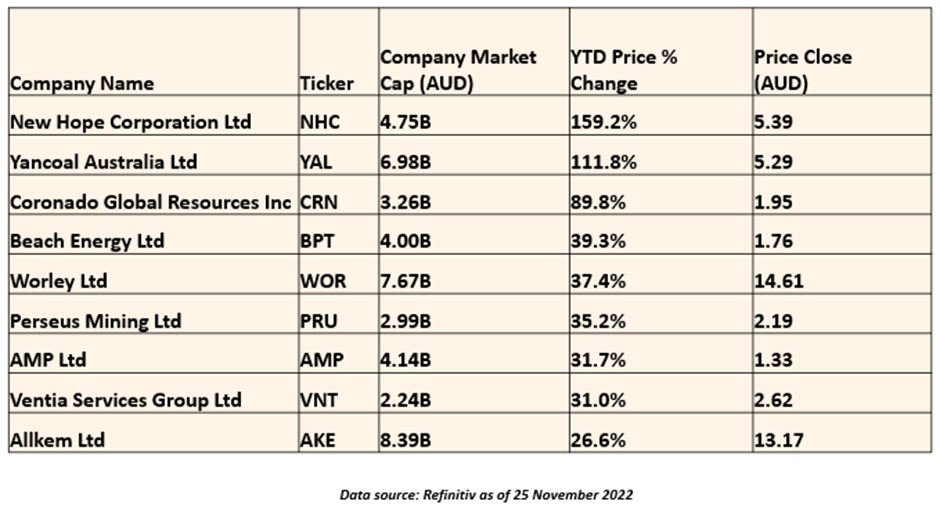

The S&P/ASX MidCap 50 index reflects the mid-cap landscape of Australia. As of 25 Nov, the index is green by about 3.77% on a month-to-date basis and is up by 11% this quarter. However, the index is down by nearly 5.33% this year-to-date (YTD).

On that note, we at Kalkine Media® will discuss some ASX-listed stocks from the mid-cap space that have registered decent price returns this YTD.

New Hope Corporation Limited (ASX:NHC)

New Hope Corporation, a diversified energy company, is engaged in activities including the development and operation of coal mines, handling of ports and logistics, and development and production of oil & gas.

New Hope claims to have generated record cash in FY22 due to demand outdoing supply. The company mentioned that the Russia-Ukraine war had resulted in stronger demand for high-energy, low-emission thermal coal.

The company’s full-year dividend for FY22 stood at 86 cents compared to 11 cents in FY21. Its underlying EBITDA surged by 330% to AU$1,577 million. Similarly, net profit after tax (NPAT) skyrocketed by 1146% to AU$983 million. The company attributed the EBITDA surge to sustained production at Bengalla, irrespective of out-of-hand weather events and the COVID-19 pandemic-led labour disruptions.

Yancoal Australia Limited (ASX:YAL)

Yancoal has a diversified asset portfolio of coal mines in Australia, wherein Tier 1 assets find a significant place. As per the company, during the September 2022 quarter, it achieved a record quarterly average realised price of AU$481/t, an increase of 31% over 2Q 2022 and 210% over 3Q 2021. Below are other highlights of the quarter:

- An Increase of AU$1.9 billion in cash holding.

- Cash balance of AU$3.4 billion as on 30 September 2022.

- 2Mt run-of-mine coal production (100% basis).

- 3Mt of attributable saleable coal production.

- 7Mt of attributable coal sales.

Coronado Global Resources Inc. (ASX:CRN)

Coronado Global boasts a portfolio of development projects and operates mines in Australia and the US. In the September 2022 quarter, owing to record YTD results coupled with good liquidity, the company declared a special dividend of AU$225 million (US$13.4 cents per CDI [Chess Depositary Interest]). The estimated payment date of the dividend is 12 December 2022 (AEST).

The company’s YTD group revenue was AU$2,854 million, up 107.8% compared to YTD 2021. Its September quarter group revenue was AU$875 million, down 15.3% on the prior record June quarter, owing to lower pricing.

Its YTD 2022 group average mining costs per tonne sold were AU$87.6 per tonne. These were primarily affected by sustained higher inflationary pressures and wet weather-hit production at the Curragh mine.

Beach Energy Limited (ASX:BPT)

Beach Energy Limited is a company dealing with the exploration and production of oil & gas with an asset portfolio in Australia and New Zealand.

Recently, the company made an announcement about entering a Scheme Implementation Deed (SID) with Warrego Energy Limited (ASX:WGO). Under the SID, Beach will acquire all the issued shares in Warrego for AU$0.20 cash per share, plus any net proceeds from selling Warrego’s Spanish assets.

As per the company, the proposed acquisition offers a one-of-a-kind opportunity to complement its growth strategy (relating to acreage expansion and a development pipeline) in the Perth Basin.

Worley Limited (ASX:WOR)

Worley Limited provides professional project and asset services worldwide in the chemicals, energy, and resources space.

Last month, Worley bagged a program management agreement (PMA) for Anglo American’s Woodsmith project (a polyhalite fertiliser mine project) in northeast England. As per the agreement, Worley will provide project management, design, and concept engineering services.

Perseus Mining Limited (ASX:PRU)

Perseus Mining Limited specialises in the discovery, acquisition and development of high-quality gold producing assets in Africa. It operates three gold mines in Ghana and Cote d’Ivoire, West Africa.

For the September 2022 quarter, the company reported that it had churned out a record quarterly gold production of 137,460 ounces, an increase of 12% compared to the June quarter of 2022. As per the company, it is working towards achieving a market guidance range of 240,000-265,000 ounces for the half-year 2022 ending 31 December. It generated an average cash margin of US$766 per ounce of gold for the September quarter.

AMP Limited (ASX:AMP)

AMP Limited is an international investment management company with a significant presence in Australia. Its operating divisions are four in number, namely, Australian Wealth Management (AWM), AMP Bank, New Zealand Wealth Management and AMP Capital.

The company’s 'Platforms’ net cash inflows increased to AU$363 million in Q3 2022 compared to AU$205 million in Q3 2021.

The company has already unveiled its digital mortgage and ‘unique-to-market’ retirement offer. As per the company, these key strategic deliverables will support its long-term growth and help people carve out their future.

Ventia Services Group Limited (ASX:VNT)

Ventia Services Group offers essential infrastructure services in Australia and New Zealand. It has a host of industry segments like social infrastructure, environmental services resources, gas and electricity, transport, telecommunications, defence, and water.

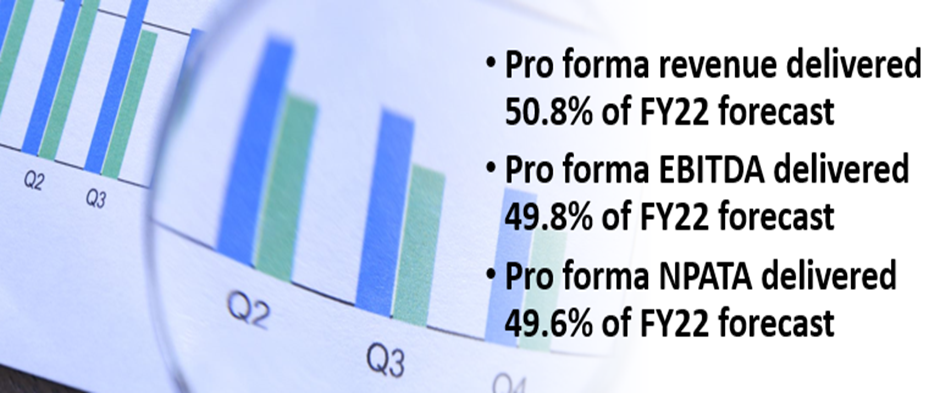

As per Ventia, the company is on track to hit a major forecast metrics target for FY22, as highlighted in its prospectus:

© 2022 Kalkine Media®, Data source: Company update

Allkem Limited (ASX:AKE)

Allkem Limited is a lithium chemicals-focused company having a worldwide portfolio. The company has operations in Argentina, Australia, and Japan.

Below are the highlights of the company for FY22:

- The company claims to have generated record FY22 production along with US$452-million record revenue

- Generated revenue of US$106 million in the September 2022 quarter, with a gross cash margin of 80%

- The company enhanced its mining capacity to achieve back-to-back record volume months of 873K and 946K bcm in September and October, respectively

- The company says it is well positioned to achieve the annual production guidance of 140-150kt in FY23