Highlights

- Fortescue Metals Group Limited has slightly reversed the previous five days' losses on ASX today.

- Influencing factors Iron ore is down 1.7%, and the Australian dollar is slightly lower.

- Australian markets are trading higher today with the Materials sector in green.

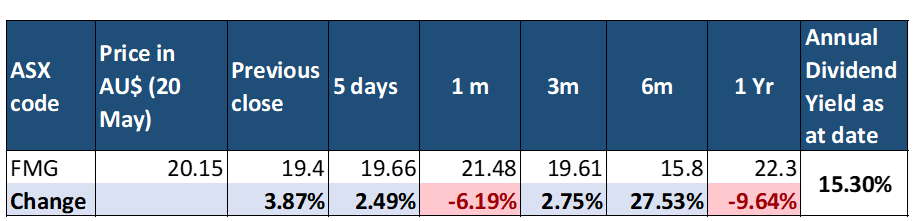

Australia’s iron ore giant Fortescue Metals Group (ASX:FMG) closed the week's trade in the green, up 3.86% on the previous close. FMG shares last exchanged hands on Friday at AU$20.15 a share. While it is still down about 6.19% from its price one month back, FMG shares have turned north this week.

FMG share price performance

Holding a market capitalisation of about AU$59.73 billion, Fortescue Metals Group's share price trades in the 52-week price range of AU$13.90 to AU$25.80 apiece. The annual dividend yield on FMG shares is as high as 15.30% as of Friday.

Image Source © 2022 Kalkine Media®, Data Source-ASX

Lacking any major announcements on Friday, the price spike in FMG shares seems to react to the Australian market gains. Even the materials sector to which FMG belongs was the second highest gainer of Friday's trade. Aligning to the trend, Fortescue shares also closed the week's trade higher.

However, FMG's share price has fluctuated quite a lot over the past 365 days, with a visible dip in October and March. Iron ore prices also dipped around the same time. FMG share price appears to be influenced by iron ore prices, though other factors like company announcements and global geopolitical factors.

What else changes at FMG recently?

In its latest announcement on the exchange, Fortescue declared a leadership change to drive its transition towards becoming a green renewables company. The business will restructure itself to make the CEOs of both Fortescue and Fortescue Future Industries (FFI) to become a direct report to the Board. As per the announcement, Dr Andrew Forrest AO will become the Executive Chairman of Fortescue Group, overseeing the iron ore business until the company transitions to a green business.

The company had also talked about its green business transition strategy at its Macquarie Australia Conference. Fortescue seeks to become a vertically integrated green energy and resources company. The march 2022 quarter highlights were also presented. The iron ore shipments were 10% higher than Q3-FY21. Fortescue also completed its senior notes offering in April 2022. The average revenue of FMG was 70% of Platts and 62% of the CFR Index. The iron miner claimed the strong operating performance to be a result of its supply chain efficiency and the successful integration of Eliwana.

Bottom line

Fortescue appears operationally well placed in its recently reported quarter. Its strategy to move towards a green renewables business seems to be giving a positive ESG push. However, how well the Andrew Forrest business can transition and maintain its efficiency is worth a future watch.