Highlights

- Regis Resources’ shares has outperformed its benchmark index, ASX 200 Materials today.

- Regis share price movement can be linked to changing gold prices.

- Its third quarter results were affected by Covid-19 related issues.

- Jon Latto, CFO of Regis is expected leave company by 11 May 2022.

Shares of Regis Resources Limited (ASX:RRL) have been trading a tad lower on Thursday. At 11:08 AM AEST, the shares of Regis were spotted trading at AU$2.04 apiece, 0.49% lower than the previous close. The shares have underperformed its benchmark index, ASX 200 Materials which was circa 2% higher.

The drop in the Regis share prices can be linked to the fall in precious metal prices. According to media sources, the price of yellow metal reached two-month low overnight because of the strong US dollar.

Today (28 April 2022), Australian gold and mineral explorer has also shared quarterly reports through ASX announcement. Regis said that its March quarter results were affected by the Covid-19 related issues such as labour shortage.

Image source: © 2022 Kalkine Media®

Suggested reading: ASX 200 breaks three-day losing streak to open in green

Financial and corporate highlights

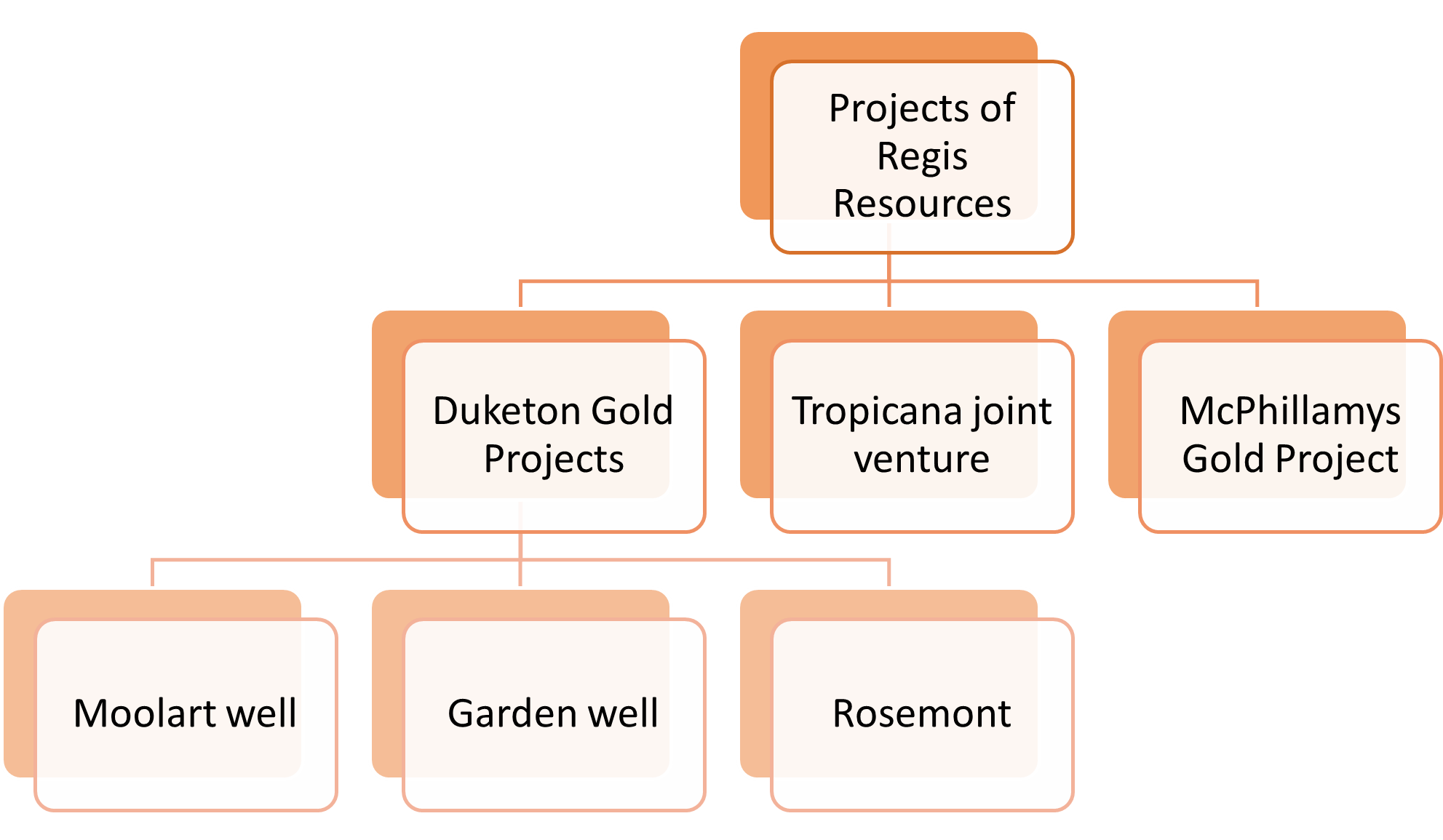

Image source: © Sentavio | Megapixl.com

Regis generated sales receipts of AU$172 million in the three months, with 76.0koz (thousand ounces) gold sales at AU$2,260 /oz average price. The operating cash flow during the quarter reached AU$54.8 million, which includes AU$43.7 million from Tropicana and AU$11.1 million from Duketon. Duketon and Tropicana Joint Venture are the projects of Regis. Noteworthy here is that cash flow from operations has decreased from AU$67.4 million in the previous quarter.

Regis recorded AU$59 million of capital expenditure during the quarter. AU$12.7 million of expenditure was generated from McPhillamys and exploration activities. The company received a net tax return of AU$10 million in the quarter.

Despite Covid-19 impact on both costs and production, Regis has maintained its full-year guidance. The mineral company added that the upper range of the cost guidance is doubtful because of the increased diesel and consumable prices.

Regis announced a change in management during the quarter

Jon Latto has left Regis after offering his services for three years as CFO (chief financial officer). His last day will be on 11 May 2022. Anthony Rechichi will be taking the place of Latto. Rechichi has extensive experience working in the gold sector as a CFO and held accounting and finance positions.

Rechichi is expected to take up the CFO role by the end of the September quarter; till then, Tony Bevan will act as interim CFO.

Operational updates by Regis

The group's gold production was 103.1koz at an all-in sustaining cost of AU$1,574/oz. This includes 74.8koz gold production at Duketon and 28.3koz gold production at Tropicana. The cash cost before royalties was AU$1,283/oz during the quarter.

Growth recorded by Regis in the third quarter

The company commissioned the initial primary pump station at the Garden Well South Underground Project in three months. Regis informed that the work is going to progress further, and more resource down plunge will be defined through drilling.

According to the ASX-announcement, Regis completed additional drilling at Garden Well. The scoping study got delayed because of Covid-19 related factors.

In addition to this, Regis had constructive engagement with the authorities and made significant growth in securing permits for one of Australia's underdeveloped open-pit gold projects – McPhillamys Gold Project. Regus is on track to finalise DFS (definitive feasibility study) for McPhillamys.

Must read: WES, GMG, WOW, TCL: How are these ASX blue-chip shares performing?