Highlights

- WAK has secured a 3-year offtake agreement with a distributor in Vietnam's ceramic and paint market.

- The company will soon start production for Stage 1 at the Wickepin Kaolin Project.

- WAK shares have gained over 13% over the last 12 months.

The ASX listed mineral exploration firm, WA Kaolin Ltd (ASX:WAK), has signed a 3-year offtake agreement with a distributor in Vietnam's ceramic and paint market.

Primarily focused on establishing itself as leading supplier of high-grade premium kaolin, WAK is the sole owner of the Wickepin Kaolin project.

WAK shares were spotted trading 2.439% higher at AU$0.210 per share at 12:21 PM AEDT.

As per the release, the agreement is for 1 July 2022 through to 30 June 2025, wherein any renewal will be negotiated by 31 March 2025.

Agreement terms

According to the agreement, WAK will supply a targeted 4,500tpa for three years with pricing competitive to the global kaolin market delivered on a cost and freight (CFR) basis.

The company will negotiate at least the minimum pricing every quarter via mutual negotiation and agreement.

Management commentary

Commenting on the Offtake Agreement, CEO Andrew Sorensen said that this deal builds further momentum for WAK as the company will soon start production for Stage 1 at the Wickepin Kaolin Project.

WAK acquired the Wickepin Project in 1999 from Rio Tinto, located 220km southeast of Perth. This project contains a Mineral Resource of 644.5 million tonnes1,2 of high-grade premium kaolinised granite.

Related read - Reece Limited (ASX:REH) shares fall nearly 5% today

Kaolinised granite is one of the most significant known remaining premium primary kaolin resources in the world. WAK is focused on increasing production from Wickepin to 400,000 tonnes per annum by 2023.

Operational update

Before production commencement, WAK has secured contracts covering 90% of its expected Stage 1 output.

The company further updated that it has now completed the installation of all equipment and infrastructure required for Stage 1 production.

Moreover, the company is just left with the final touches of the plant for the of Stage 1 production.

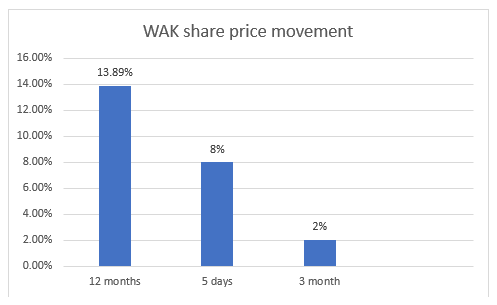

WAK share price movement

Image Source © 2022 Kalkine Media ®

The stock has gained over 13% in the last 12 months; however, it has made slow improvement over the previous five days gaining 8%.