Summary

- Amid COVID-19 pandemic, many businesses from the metals and mining sector took the support of technology to reduce their costs.

- Through digitisation, companies were able to gain higher operational visibility.

- Digitisation also supported real-time monitoring capabilities, which helped in achieving safety, reduction of energy consumption, and asset optimisation.

- Mining technology player IMDEX Limited reported an 8% increase in its recurring revenue per instrument. FY2020 revenue stood at A$237.7 million, EBITDA was A$54.4 million.

- The impressive results were driven by growing demand for instrument fleet for rent and cloud-connected sensors and drilling optimisation products.

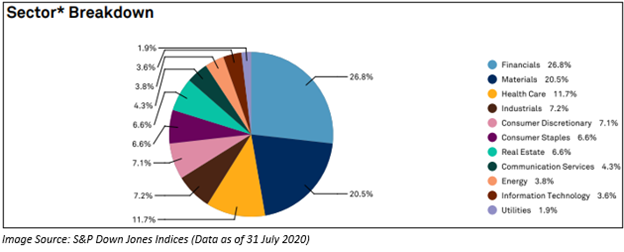

Metals and mining form an essential component of the Australian economy. It contributes over 20% to the S&P/ASX 200 index.

Several miners experienced challenges during the COVID-19 pandemic. Operations were suspended during lockdown restrictions as social distancing guidelines were put in place. Mining players took measures to control their costs by reducing the workforce and capital expenses amid stalled operations. Predictive maintenance, asset optimisation and remote monitoring become more critical.

With different Australian states having different levels of restrictions, miners were relocated to regions where operations were not suspended.

Digitisation became more vital. Through digitisation, the miners during the period were able to gain more operational visibility. Further, the real-time monitoring capabilities became more prominent as it supported in achieving safety, reduction of energy consumption and asset optimisation.

Looking at the performance of the S&P/ASX 300 Metals and Mining index, since 16 March 2020, when it reached its lowest levels of 3,163.0 has now made a new high. On 18 August 2020, the index ended at 4,971.40, up 0.95% from its last close.

In this article, we would look at a mining technology Company which released its FY2020 results and noted an increase in the average monthly revenue per instrument by 8%.

About IMDEX Limited

IMDEX Limited (ASX:IMD) is a leading mining technology Company which facilitates successful & cost-effective operations. At IMDEX, the Company is engaged in the development of cloud-connected devices as well as drilling optimisation products to enrich the process of identification plus mining of mineral resources for drilling contractors & resource companies worldwide.

On 17 August 2020, IMDEX Limited announced its FY2020 for the year ended 30 June 2020. The Company delivered a sustained dividend NPAT payout ratio of 30%. It continued its growth strategy in a year that included unprecedented challenges. On that note, let us take a look at the FY2020 Financial highlights followed by the Company’s operational highlights and outlook.

Financial Highlights:

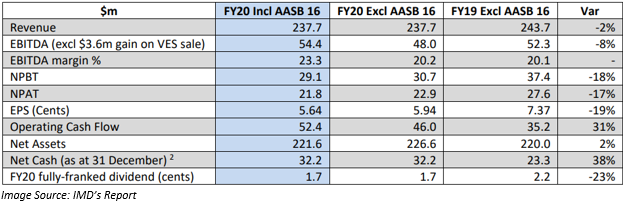

- FY2020 revenue for the full year was A$237.7 million.

- EBITDA for the period was A$54.4 million.

- Paid an interim fully franked dividend of 1 cent and a special fully franked dividend of 2 cents after the sale of non-core asset VES. The final fully franked dividend declared by the Company was 0.7 cents.

- The balance sheet of the Company was robust, and the net cash position by the end of FY2020 stood at A$32.2 million, up 38% as compared to the previous corresponding period.

Operational Highlights:

- IMDEX, during the period, was able to strengthen the quality of the rental fleet. The average monthly revenue per instrument increased by 8% as compared to FY2019.

- The Company also progressed strategy for sustainable growth. In July, IMDEX acquired AusSpec and its unique SaaS product to improve its real-time rock knowledge. It also completed the acquisition of Flexidrill and strengthened Drilling Optimisation offering. It continued to advance BLASTDOG™, which comprises autonomous operation and sensor refinement.

- Amid the COVID-19 pandemic, the Company could realise the benefit of the digital transformation. The resilient supply chain of the Company supported the Company to meet all the requirements. Simultaneously, IMDEX continued to focus on streamlining operations, R&D and accelerating the online Customer Care and IMDEX Academy training platform in response to demand.

- An ESG committee was established to improve reporting and disclosure.

- IMDEX was successful in navigating COVID-19 impact and restrictions to date.

Know About IMD’s strategy for Sustainable Growth:

IMDEX has a clear & consistent strategy to attain sustainable earnings growth. These comprise of:

- Expansion of the core business in exploration and development.

- A further extension to a larger adjacent mining market to build less-cyclical revenue.

Hence, to achieve this growth strategy, the Company invests in strategic acquisitions, continuing and orderly R&D to sustain technical leadership and industry collaboration.

Outlook:

The fundamentals supporting IMDEX’s core business and growth strategy remain. The positive drivers of its business include:

- The large and mid-cap resource companies are increasing their expenses to replace diminishing reserves.

- Resource firms are adopting innovation & new technologies to lower costs, improve safety and achieve higher productivity.

- New discoveries are expected to be under cover & at depth causing in larger drilling campaigns.

- Solid commodity prices and the demand across a broader range of sectors which includes consumer, industrial and government-linked industries.

IMDEX has had an encouraging start to FY2021. The Company noted a recovery from May 2020, and it continues as reflected in IMDEX’s growing instrument fleet. Similarly, demand and opportunities for the cloud-connected sensors and drilling optimisation products have increased to assist remote operations and expedite drilling programs.

Stock Information:

IMDEX Limited stock has generated a return of ~34% in the last three months and approximately 23% in the previous month. On 18 August 2020, IMD share price stood at A$1.375, down 3.169% from the last close. The Company has a market cap of A$557.34 million and 392.5 million outstanding shares.