Highlights

- Piedmont informed that North American Lithium (NAL) has received the remaining permit required to restart mining operations.

- Based in Quebec, the NAL operation is likely to start production in the first half of 2023.

- NAL is jointly owned by Piedmont Lithium and Sayona Mining (ASX:SYA).

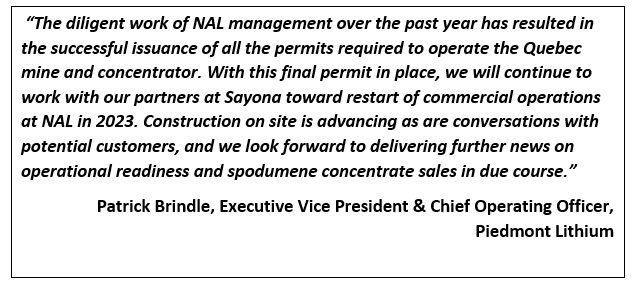

Lithium business focused on enabling the transition to a net zero world, Piedmont Lithium Inc (ASX:PLL), on 13 December 2022, announced that operations at its North American Lithium (NAL), can be restarted now as it the open pit mining and spodumene concentrate operation has received the last remaining permit. The NAL is owned 75% by Sayona Mining Ltd (ASX:SYA) and 25% by Piedmont. Situated in Quebec, NAL can see the commencement of operations now.

Meanwhile, the shares of the company were spotted trading 2.409% strong at AU$0.850 apiece at 3:27 PM AEDT on the ASX today.

Key highlights from Piedmont’s ASX release:

- Piedmont Lithium informed today that its operations at the North American Lithium site in Quebec can be restarted as it has obtained the key permit from Canada’s Department of Fisheries and Oceans.

- The site will be producing spodumene concentrate from H1 2023 onwards.

- As per PLL, commercial shipments of spodumene concentrate from NAL could begin as early as Q3 2023, providing Piedmont with revenue generation from the operation.

- The Company holds an offtake agreement for the greater of 113,000 tons per year or 50% of spodumene concentrate production from NAL at a ceiling price of US$900 per metric ton on a life-of-mine basis.

Recent share price performance of PLL on the ASX:

The shares of Piedmont Lithium Inc have moved up by 1.82% in the last five trading days on the ASX. The shares have lost 16% in the last one month and have gained 18.31% in the past six months on the ASX. In the last one year of trade on the ASX, Piedmont shares have gained 5% and during last five years, the shares have surged 394.12% on the ASX (as of 3:59 PM AEDT, 13 December 2022).