Highlights

- Northern Star completed selling two of its gold mining assets to Black Cat.

- The transaction cost has been quoted around AU$44.5 million.

- As a result, NST garnered significant investors’ attention on the ASX today.

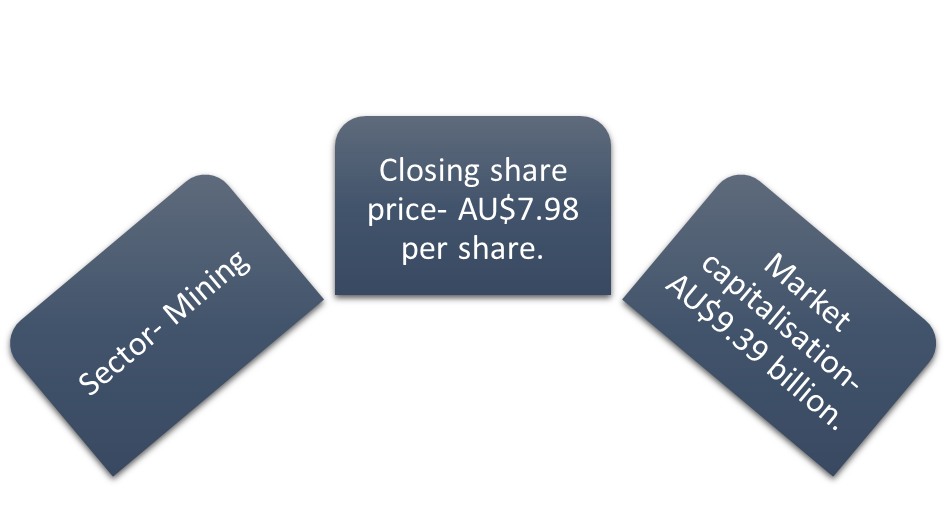

The shares of Northern Star Resources Ltd (ASX:NST) closed 0.992% lower at AU$7.980 per share on the ASX today (15 June).

The share price of Northern Star has fallen over 27% on the ASX over the past 12 months. On the other hand, Northern Star’s year-to-date share price also fell over 15% on the ASX today (15 June).

Why were Northern Star shares on investors’ radar today?

The ASX-listed mining company Northern Star informed today that it has successfully completed the sale of two wholly-owned assets to Black Cat Syndicate Limited (ASX:BC8) for total cash, scrip and contingent cash payment consideration of AU$44.5 million.

The assets that were sold were, the Paulsens Gold Operation and Western Tanami Gold Project. Both the assets are located in the Western Australia.

Northern Star had announced its intention to sell Paulsens and Western Tanami to Black Cat on 13 April 2022. Paulsens and Western Tanami are non-core to Northern Star’s five-year strategic plan and currently on care and maintenance.

Meanwhile, the shares of Black Cat Syndicate Limited (ASX:BC8) closed 3.703% higher at AU$0.35 per share on the ASX today.

Also read: NCM, EVN, NST: How are these ASX-listed gold stocks faring?

What did the management say?

Stuart Tonkin, Managing Director of Northern Star, believes that Paulsens was Northern Star’s ‘foundation asset’. As a result, the asset also contributed immensely to the successful growth of the company into a global gold producer. Tonkin also added that the dedication of his whole team to establish a sustainable cash flow generation based on Paulsens shaped the future of the company and made it what it is today.

Commenting on the divestment of Paulsens and Western Tanami, Stuart said that it is a good outcome for all, and it represents the company’s commitment to actively manage its portfolio and generate value for its shareholders.

According to the statement of Tonkin, Northern Star still holds 50% interest in the Central Tanami Joint Venture and 100% interest in a portfolio of regional Tanami tenure in the Northern Territory, where exploration investment continues.

About Northern Star: \

Image Source © 2022 Kalkine Media ®

Northern Star Resources Limited is an ASX-listed gold miner and producer with a market capitalisation of AU$9.39 billion. The company is also the owner of world-class projects that are based on low-cost, high-grade underground gold mines.

Most of Northern Star’s projects are located in the prospective and low sovereign risk regions of Western Australia and the Northern Territory. At present, the company is focused on having a strong asset base at the back of strategic acquisitions explorations to have better mine lives.