Highlights

- Rex Minerals was trading 24% higher at 11 AM AEDT on ASX today.

- The company’s cash and cash equivalent stood at AU$36.5 million, as of 30 September 2022.

- Rex owns 100% of its flagship asset – the Hillside Copper-Gold Project.

Shares of ASX-listed gold and copper explorer Rex Minerals Limited (ASX:RXM) were seen marking gains on the ASX on 1 November 2022. Rex shares were trading 24.137% stronger at AU$0.180 apiece at 11:06 AM AEDT on the ASX today.

Rex shares, however, have lost 10% in past five trading days. In the last one month, the stock has lost 14.29%. In the last six months, the shares have shed 25% and in the last one year, Rex has shed 28%. Looking at the broader picture, the stock has gained 157% in the last five years on the ASX (as of 11:17 AM AEDT).

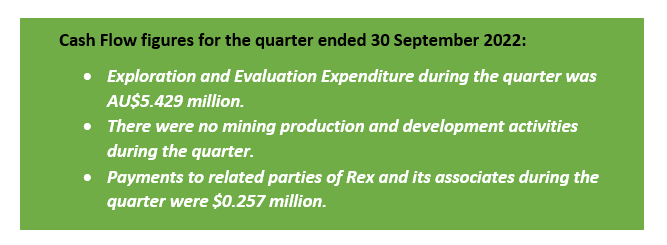

Rex Minerals, on 26 October, released its quarterly activities report for the period ended 30 September 2022.

Here are some of the key takeaways from the release:

As per Rex’s release, during the September quarter, Rex Minerals had signed a non-binding letter of intent with Thiess. Both the companies have plans to collaborate on delivering a mining solution for Hillside Project. Rex stated that if it goes as per its plans, it might enter a mining services contract with Thiess. Also, the company has been working extensively with Ausenco on process plant design and deliverables.