Highlights

- Novo Resources expands high-grade gold anomaly to 1.5 km at John Bull

- RC drilling program of 1,500 metres expected to commence in June 2025

- Strong gold grades from rock chip sampling support drill targets

Novo Resources Corp (ASX:NVO) is accelerating momentum at its John Bull Gold Project in New South Wales, with an extensive exploration campaign revealing an expanded high-grade gold anomaly. This strategic step precedes a 1,500-metre reverse circulation (RC) drilling program planned for June 2025, pending rig availability and final approvals.

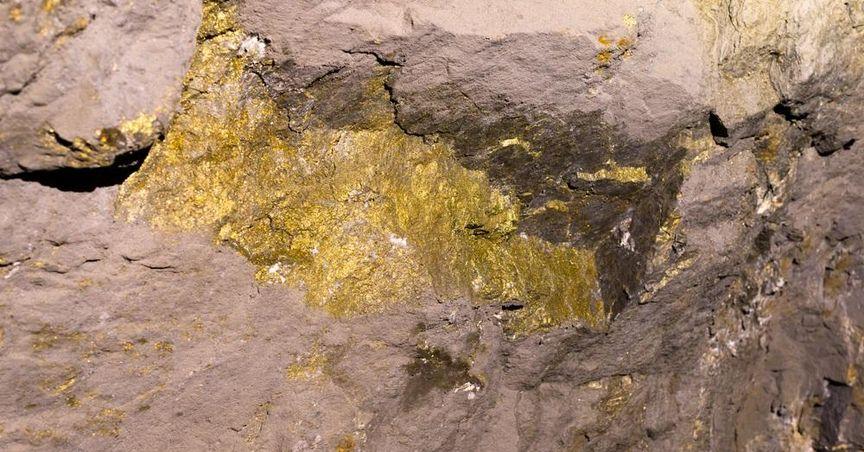

The company’s latest mapping and geochemical survey work has refined the geological framework and highlighted four key drill targets across a 1-kilometre strike zone. Soil sampling extended the >100 parts per billion (ppb) gold anomaly to 1.5 kilometres, with standout soil results peaking at 1.59 grams per tonne (g/t) gold. Notably, rock chip sampling returned exceptionally high grades of 67.9 g/t and 29 g/t gold from quartz vein systems, underscoring the area’s potential.

Detailed mapping has identified a zoned geochemical halo typical of an intrusion-related gold system (IRGS), featuring a tin-bismuth-arsenic core surrounded by gold-copper-molybdenum and a broader gold-arsenic-tungsten shell. This supports the theory of a structurally controlled mineralised system, with the most favourable geology observed in fine arenite-siltstone units hosting quartz-sulphide sheeted veins.

The upcoming RC campaign will test several targets, including:

- John Bull Main: Hosts zones with rock chip grades up to 67.9 g/t gold and historic workings

- John Bull South: Shows elevated soil results near a monzodiorite intrusion

- Hills Creek West: Features coincident soil and geophysical anomalies

- Digger’s North: Reveals a broad soil anomaly with up to 10.0 g/t gold

Historical exploration by TechGen Metals Ltd (ASX:TG1) laid the groundwork for the current campaign. Previous drilling results included 94 metres at 0.95 g/t gold (including 66 metres at 1.14 g/t) and 68 metres at 1.00 g/t gold from surface, including higher-grade cores. These intercepts remain open at depth and strike, suggesting substantial upside.

Pending Phase 1 drilling outcomes, future activities could involve deeper diamond drilling and expansion into porphyry-related zones identified in the tenement’s southwestern area.

As Novo Resources continues advancing John Bull alongside other projects like Balla Balla and Tibooburra, it contributes to the broader landscape of Australian exploration, a sector that remains a strong interest area for investors in ASX dividend stocks. The growing focus on gold and resource-backed plays also reflects trends seen within the ASX200, where companies with exploration potential often draw increased market attention.

With drill rigs soon to arrive and approvals underway, the John Bull project stands at the edge of a new exploration phase that may reshape its profile on the ASX.