Summary

- Lynn Lake in the matured mining neighbourhood

- Lynn Lake hosts open-pit mining opportunities with deeper mineralisation at FLC under drilling

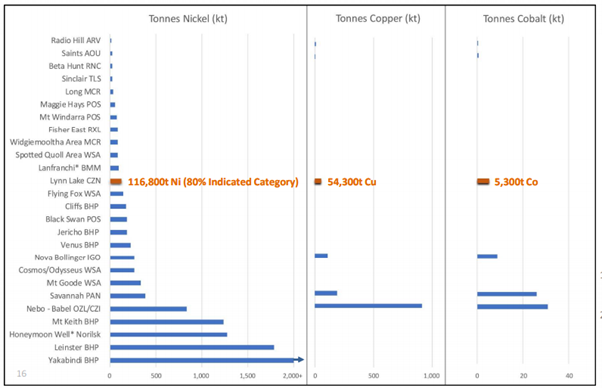

- Existing mineral resources of 116,800 t of Ni, 54,300 t of Cu and 5,300 t of Co

Corazon Mining Limited (ASX:CZN), a diversified base metals explorer with aspirations to grow into a leading supplier of clean energy materials, is advancing on the exploration front of the flagship Lynn Lake Nickel-Cobalt-Copper project.

Source: Corazon Mining

If you would have followed us through, we have been covering Corazon mining and its flagship Lynn Lake Nickel-Copper-Cobalt project. Today, we will talk about some of the regional information and growth potentials for the Lynn Lake project in Manitoba, Canada.

Is Manitoba an established Nickel Mining Centre?

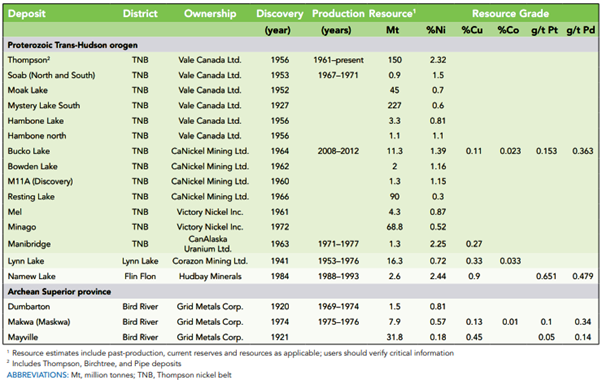

Manitoba is home to modern mining operations applying high-advanced technology and backed by technologically progressive regional industry. The region hosts multiple precious and base metals mining operations and projects. The combined value of mineral production for metals in 2018 in Manitoba was valued around CAD1.31 billion, employing more than 4,500 people directly and many others indirectly.

Source: Government of Manitoba

In times when a substantial growth in demand of Nickel, Copper and Cobalt is anticipated due to the rising adoption rates for electric vehicles, new sources of supply are required to commence operations in the future.

Some of the mining players that operate in the region include one of the largest mining companies, Vale SA and the Canadian precious and base metals major Hudbay Minerals which operate Thomson and 777 mining operations respectively.

The Manitoba province has hosted Nickel mining operations ever since the first discovery in the 1920’s and Vale has been operating the Thompson Nickel operations since 1956.

Historic Nickel Operation in Manitoba, (Source: Manitoba.ca)

Mining friendly neighbourhood with excellent existing infrastructure

Corazon’s Lynn Lake project is located in the mining-friendly neighbourhood with easy access to established infrastructure. The existing regional infrastructure supported with an abundant water supply and rail connectivity could substantially assist in the Nickel mining.

Historical Mining Centre with Re-development Opportunities

The Lynn Lake mining centre hosted historical nickel mining operations functional between 1953 and 1976. The historical mining centres were consolidated in 2015 by Corazon. The Lynn Lake production included the processing of over 20 million tonnes of ore at the average grades of 1.025% Ni and 0.54% Cu to produce over 206,200 tonnes of Nickel and 107,600 tonnes of Copper.

The historical mining production includes-

- A Plug – 18 million tonnes with 0.88% Ni & 0.47% Cu

- EL Plug - 1.9 million tonnes with 2.4% Ni & 1.15% Cu

Large Resource Base with substantial Shallow Mineralisation

Corazon’s recent exploration program focussing on the historically mined regions and shallow mineralisation targets identified multiple shallow mineralisation targets in the historical mining centres.

Significant mineralisation was restricted to mining activities by the historical mining and processing infrastructure.

The current JORC mineral resources stand at 16,321,000 tonnes of ores with a grade of 0.72% Ni, 0.33% Cu and 0.033% Co containing 116,800 tonnes of Nickel, 54,300 tonnes of Copper and 5,300 tonnes of Cobalt at the cut-off grade of 0.5% Ni. Following the recent drilling program, opportunities to add significant mineral resources exist at the Lynn Lake project.

Source: Corazon Mining

Resource Expansion Capabilities to Enhance the Scale of Operations

Corazon holds substantial areas of interests with the potential to add significant mineral resources such as-

- Potential disseminated sulphide mineralisation in the areas surrounding the historical mining centres

- Additional near-surface tonnage with potential for an open-pit operation enhancing the economic aspect and early start-up potential of the project

- The Fraser Lake Complex – Corazon utilised advance MVI technology to define magnetic response to a depth of at least 600 metres. These exploration techniques have identified priority drilling targets for the drilling program at Lynn Lake

Lynn Lake holds the extensive potential for establishing a World-class, large-scale Nickel mining operation. Lynn Lake is described as one of the best brownfield opportunities in North America.

Corazon closed at $0.0020 a share on 10 July 2020, with a market capitalisation of $4.82 million.

All financial information pertains to Australian Currency unless stated otherwise.