Highlights:

- BHP sent a revised proposal to OZ Minerals to acquire 100% of the company.

- The cash consideration of the acquisition is AU$28.25 per OZ Minerals’ share.

On 18 November 2022, the mineral explorer giant BHP Group Limited (ASX:BHP) submitted a revised non-binding indicative proposal to OZ Minerals Limited (ASX:OZL). As per the proposal, BHP will acquire 100% of OZ Minerals through a scheme of arrangements for a cash consideration of AU$28.25 per share of OZL.

Details of BHP’s revised proposal to OZ Minerals

BHP’s offer price of AU$28.25 per share of OZ Minerals represents the best and the final price the company could offer under this proposal in the absence of a superior proposal.

On the other hand, OZ Minerals’ board has assured BHP that it intends to unanimously recommend the revised proposal to its shareholders as being in the best interests of OZL shareholders.

As a result, OZ Minerals will be entering into a binding scheme implementation agreement (SIA) followed by the completion of confirmatory due diligence of BHP and an independent expert stating that the revised proposal is in the best interests of shareholders of OZ Minerals.

Advantages of BHP and OZ Minerals under the revised proposal:

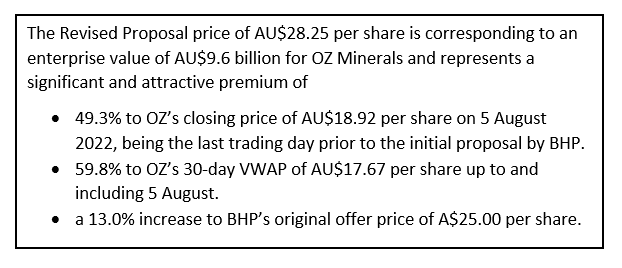

- Significant and attractive premium

- The revised proposal offers full and fair value at a level that rewards OZ Minerals shareholders.

- BHP will be able to retain OZ Minerals’ workforce, who will become associated with a larger organisation with access to industry-leading employee benefits.

- Increased exposure to future-facing commodities, adding copper and nickel resources to BHP’s assets.

Growth opportunity for BHP as it will acquire OZ Minerals’ brownfield copper expansion projects at Prominent Hill and Carrapateena in South Australia and the West Musgrave Nickel project.