Summary

- Zinc explorers have projected a significant rise in the prices for zinc in the coming months due to further demand from increased global infrastructure development in connection with Covid-19 government stimulus.

- Albion Resources 100% owns three projects in the Lennard Shelf in the Tier 1 Kimberley region of WA, a globally renowned Mississippi Valley Type lead-zinc province.

- Albion intends to go for listing through IPO at 20c in the first half 2021 or vended into a listed company for shares.

- Company boasts of Unmined Resource Area and Support of Highly Experienced Board

- Albion’s Board of Directors comprises of highly experienced professionals who are associated with other mineral explorers, KTA as well as KAU whose share prices have significantly risen in 2020.

A lot has been happening lately, due to the accelerating uncertainty in the international business environment. Things have turned topsy turvy across some businesses while others have been presented with significant upside in the COVID-19 driven scenario.

There has been a significant disruption in the supply chain due to lockdowns, which has had a cascading effect on many commodity prices, right from precious metals to industrial metals have seen their prices appreciate.

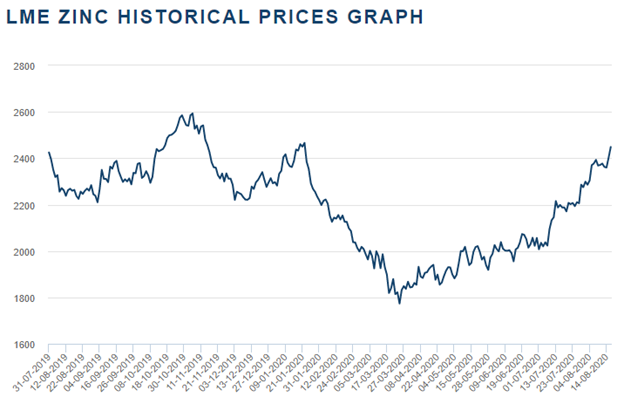

Zinc Historical Price Chart (Source: London Metal Exchange as at 19Aug2020)

Zinc exploration company, Albion Resources Limited (ASX:ALB) owns significant landholding in the Lennard Shelf in the Tier 1 Kimberley region of Western Australia and is confident about the projected price increments for Zinc as well as the anticipated growth in demand for the commodity in coming times.

Anticipated Growth in Zinc Prices

Supply Chain disruptions due to COVID-19 have resulted in a dislocation in demand and supply for resources. Zinc is said to be the fourth most commonly consumed metal around the world and plays a vital role in industries. The metal is currently witnessing warehouse stock levels at around 5-year lows.

Notwithstanding the existing high volatility in the market, prices for zinc are projected to climb higher in the coming months taking heat from the ease in COVID-19 strains. Zinc miners are anticipating for a price rebound due to additional metal demand from increased global infrastructure development linked to Covid-19 government stimulus.

Moreover, prices for several other metals and minerals have gone up, and some are anticipated to increase further in the coming months. Metals and mining companies are looking forward to these price increments and are confident about the demand for the commodity to increase in coming times.

The prices for Zinc bounced off lows in late March 2020 and has since grown 25%. Zinc has seen its prices recover to pre-virus levels in China, on the back of long-term consumption expectations. In fact, thanks to improved downstream consumption, the social inventories of Zinc ingots have seen a consistent drop.

On top of this, the COVID-19 stimulus by the government is expected to boost infrastructure development and demand for Zinc in due course. The recent developments bode well for Zinc players.

Albion’s Landholdings in Proven Underexplored Mineral District

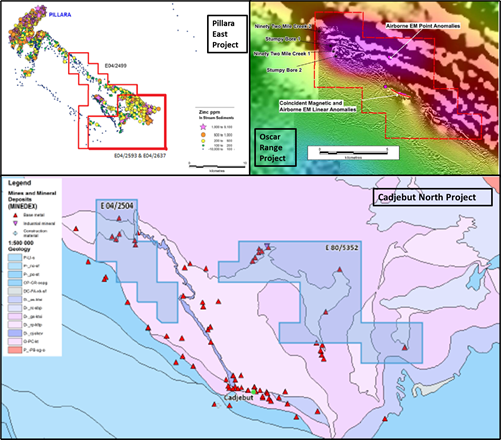

Albion Resources operates in a world-class Mississippi Valley Type lead-zinc province with landholding covering around 100km in the form of a strike of highly prospective base metal loaded geology. In addition to this, the project area contains several high-grade Zinc and lead mines of multi-million tons resources and hosts Pillara, Cadjebut and Goongewa mines.

Interestingly, Albion holds a 100% interest in three projects, which collectively cover a total area of 460km2 in the Lennard Shelf. It is reported that the ground condition within most of the project area is good as the land surface is largely characterised by flat alluvial plains.

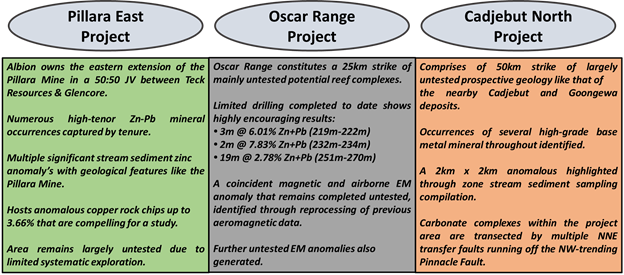

A summary of Albion’s projects is given below:

Albion’s Projects lie adjacent, adjoining and proximal to known MVT mineralisation in the Lennard Shelf

totalling 41Mt @ 7.9% Zn and 3.2% Pb. Albion has a significant opportunity to make new discoveries

in a proven mineral district that is largely underexplored.

The area is believed to contain known resources of 41Mt @ 7.9% Zn and 3.2% Pb, prior to mining in 1987, which included:

- Pillara (23.3Mt @ 7.7%Zn +Pb)

- Cadjebut (3.2Mt @ 14%Zn +Pb)

- Goongewa (2.4Mt @ 10%Zn +Pb) and many other

Albion is of the view that through Cadjebut alone, very high-grade lead and Zinc (± silver) product were produced. Further, these were recognized to be some of the best concentrates of the world, inviting premium prices as the deposit was mined in the 1980s.

Source: Albion Presentation

Recent Events Highlight Renewed Interest In The Region

The recent multi-million-dollar HOA between Mithril Resources (ASX:MTH) and CBH Resources in the March 2020 Quarter reflect the renewed interest in the region. Notably, CBH Resources Limited is the subsidiary of a Japanese multibillion-dollar company listed on the Tokyo Stock Exchange, Toho Zinc and can earn up to 80% interest in the project by paying $4 Million.

From Albion’s perspective, there is a lot that the region has to offer. Interesting observations that indicate a significant upside for Albion are as follows:

- No detailed or systematic exploration has been carried out for nearly 40 years.

- MVT deposits supply over 25% of the worlds Zinc.

- Modern geophysics has the potential to delineate MVT-style mineralization.

This presents a huge opportunity for Albion to make fresh discoveries in an established mineral district that remains majorly unexplored since mine closures.

Leadership Team at Albion

More significantly, the Board members are optimistic that Albion’s proprietary, modern geophysical methods shall locate much more MVT-style mineralisation within the tenement suite, adding significant value to fellow shareholders.

Significantly, Albion’s Board of director comprises of Mr David Palumbo as the Director of Albion. Mr Palumbo is also on the board of two ASX companies, Krakatoa Resources Limited (ASX:KTA) and Kaiser Reef Limited (ASX:KAU) whose share prices have appreciated sharply.

Mr Colin Locke, the Non-Executive Chairman of Albion, is also associated with Krakatoa Resources Limited (ASX:KTA) as the Executive Chairman since 2015. Colin Locke has a depth of experience in business management, mineral processing , financial services and brings mining-related background to stakeholders.

Notably, Albion has signalled its interest towards listing through IPO at 20c in the first half 2021 or being vended into a listed company for shares.

As per data provided by Albion Resources, the company is currently raising seed capital amounting to $300K at 3c. Enquiries should be made directly to the company’s Chairman, Colin Locke on +61 457289582 or email: [email protected].