Summary

- Based on the predicted post-recovery pace, experts are anticipating that the impact of the pandemic on house prices shall be limited and short-lived.

- According to the RBA, auction clearance rates in Sydney have remained relatively steady of late, at above 60%.

- Charter Hall’s CPIF and a CHC-run international institutional partnership have acquired a A$207 million industrial property from Qube Holdings.

- Lately, Dexus revealed has entered agreements to sell a high-quality portfolio of industrial assets to the Dexus Australia Logistics Trust while contracting future trading profits for Dexus in the fiscal year 2021 and 2022.

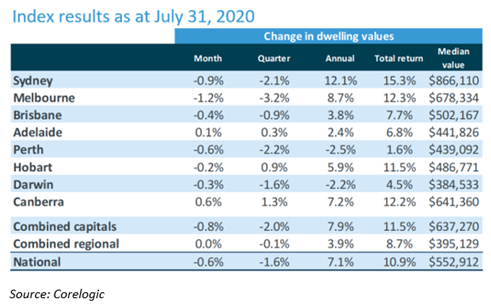

Australian housing values were down for the third consecutive month of drops in July 2020, with home value index of CoreLogic falling by 0.6% over the month. However, it demonstrated a marginal upturn from June when the national series dwindled by 0.7%.

According to CoreLogic’s head of research, Tim Lawless, the housing markets have remained comparatively robust through the COVID-19 period until now.

He also added-

Many Australian experts anticipate that the property market is going the same way as it did during the previous economic crisis in 2008. However, unlike the last recession, this time, the downturn is related to public health that transformed into an economic issue due to short term shut down of the economy.

Based on the predicted pace of the post-recovery, experts are anticipating that the impact of the pandemic on house prices shall be limited and short-lived as compared to the earlier global financial crisis.

ALSO READ: House Prices: Is Revival for Property Stocks set to be seen ahead?

Robust bounce-back, auction clearance rates in Sydney

Further Stage 4 lockdown restrictions in Melbourne this month will decrease activity in the housing market in the forthcoming weeks. By contrast, after a solid bounce-back, auction clearance rates in Sydney have remained relatively steady recently, at above 60%.

Related: Australia’s COVID-19 Battle Continues- Melbourne Lockdown Takes A Toll On Residents

The moderate drop in established housing rates at the national level, and the partial recovery in financial asset prices like equities since March 2020, suggest that household wealth was mostly unaffected in the June quarter and increased a little over the previous year.

The RBA highlighted that in Sydney, new residential bond lodgements climbed steeply in May 2020, consistent with a few tenants entering new leases to realise lesser rents.

According to the central bank, despite this near-term increase to some parts of the new housing market, overall conditions of the housing market remain weak.

DO READ: Property Portfolios and Real Estate Stocks

Let us now shed some light on a few property stocks-

ASX-listed property player Charter Hall Group is engaged in operating office, retail as well as industrial properties through listed and unlisted property funds and partnerships, for institutional, retail and wholesale investors.

On 15 July 2020, CHC revealed that the Charter Hall Prime Industrial Fund and one Charter Hall-managed global institutional partnership have each acquired a 50% tenants with a site area of 30.6 hectares, for a total consideration of A$207 million from ASX-listed Qube (ASX:QUB).

On 28 July 2020, CHC disclosed that the Group had sold its complete 5% holding in Waypoint REIT (ASX:WPR). The stake of Charter Hall was sold at A$2.61 per WPR security, totalling to ~A$101.6 million.

Stock Information: CHC shares delivered 48.63% return in the last three months. On 7 August 2020, CHC last quoted at A$10.880, dwindling by 0.275%. The market cap of the Company stood at A$5.08 billion.

ASX-listed real estate investment trust player GPT Group is one of the most prominent diversified property groups in Australia. The Group owns and operates approximately A$24.8 billion portfolios of retails, logistics, and office property assets in the country.

The Group had earlier announced that another building in the GWOF portfolio got the carbon-neutral certification.

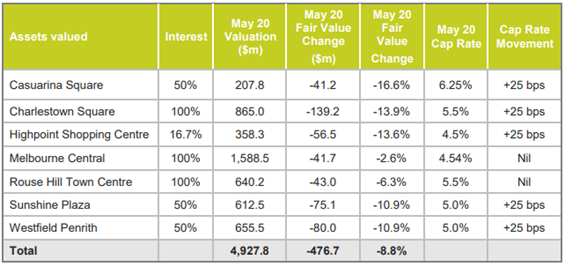

On 9 June 2020, GPT Group announced that it had independently revalued its retail portfolio as of 31 May 2020. Moreover, all assets in the GPT Wholesale Office Fund and the GPT Wholesale Shopping Centre Fund had been revalued individually as of 31 May 2020.

The Group is revising its distribution payout policy to line up with free cashflow. Under the modified payout policy, the Group will target to distribute 95-105% of Free Cashflow, described as operating cash flow less maintenance and leasing capex & inventory movements.

Stock Information: On 7 August 2020, GPT stock last traded at A$3.830, up by 0.525%, with a market capitalisation of nearly A$7.42 billion.

Dexus Property Group (ASX:DXS)

One of Australia’s leading real estate players, Dexus Property Group is in the management of a high-value Australian property portfolio having nearly A$33.8 billion value. DXS invests only in the properties of Australia and owns ~A$16.8 billion of properties, with an additional A$17.0 billion of properties managed for its 3rd party clients.

On 30 July 2020, Dexus revealed that the Company had entered into agreements to sell a high-quality portfolio of industrial assets to Dexus Australia Logistics Trust while contracting future trading profits for Dexus in FY 2021 and 2022.

The portfolio includes five high-quality industrial assets in Victoria, Truganina and a high-quality industrial business park in New South Wales.

DO READ: ‘D’ for Disruptive or Defensive: Dexus and Downer Stocks under Spotlight

Deborah Coakley, Executive General Manager, Funds Management stated-

For the Company, this transaction is steady with the strategy for these trading assets, which was to develop, lease and sell for a trading profit. The sale is anticipated to contribute nearly A$35 million in trading profits pre-tax over the financial year 2021 and 2022.

Stock Information: On 8 August 2020, DXS stock settled the day’s trade at A$8.360, up by 0.966% . The market cap of the Company stood at A$9.04 billion, with nearly 1.09 billion outstanding shares trading on the ASX.

ALSO READ: Real Estate Winners Vs Losers Over the Last Three Months