Highlights

- In 2021, Australia’s residential property market witnessed the fastest annual growth

- The total combined value of the wealth of property owners in Australia increased by AU$2 trillion in a single year

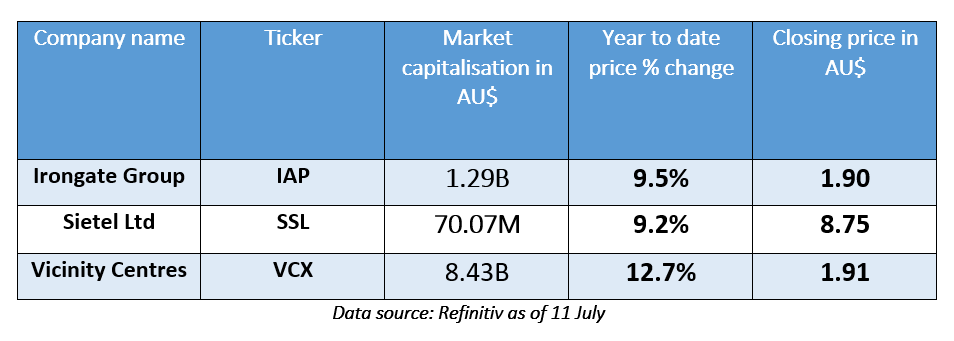

- ASX real estate stocks Irongate Group, Sietel Ltd, and Vicinity Centres made major gains in the share price this year

Australia is witnessing a boom in the residential property market. In 2021, the sector grew at the fastest annual pace, surging the country’s residential market to AU$9.9 trillion. Residential property prices rose 23.7% through 2021, increasing the total combined value of the wealth of property owners by AU$2 trillion in a single year.

On this note, let us read about three real estate stocks from the ASX, Irongate Group, Sietel Ltd, and Vicinity Centres that made year-to-date major gains:

Irongate Group (ASX:IAP)

Image Source: © Jay72274 | Megapixl.com

Image Source: © Jay72274 | Megapixl.com

Irongate Group specialises in the multi-sector acquisition and asset management. Based in Australia, the company invests in real estate assets and manages third-party capital and wholesale funds.

In FY22, the company reported solid financial and operational performances. It completed acquiring six properties worth AU$286 million and undertook two institutional placements, raising nearly AU$100 million of new equity.

Sietel Ltd (ASX:SSL)

Sietel Limited specialises in investing in commercial, industrial, retail, real estate and listed company securities. It also offers finance and lease facilities and plant and management services to its controlled entities and management.

In the half-year ended 31 March 2022, the company provided the following updates:

- A 52% increment in revenue from ordinary activities

- A 105% surge in profit from ordinary activities after tax attributable to members

- A 105% increment in net profit for the period attributable to members

Vicinity Centres (ASX:VCX)

Vicinity specialises in developing, managing and investing in property and leasing and funds management. It has two operating segments: Strategic Partnerships and Property Investments.

Last month, the company updated its earnings guidance for the 12 months ending 30 June 2022. The company is now expecting FY22 Funds from Operations (FFO) to be at or above 12.6 cents per security and Adjusted Funds from Operations (AFFO) to be at or above 10.3 cents per security.