Highlights

- Australia’s housing market declined in 2022, rising inflation and successive interest rates could be the anticipated forces.

- The 1.2% decline in October month counted as the sixth consecutive decline in Australian housing market charts.

- Housing value for Australian houses has also dropped, as stated by the Australian Bureau of Statistics (ABS).

According to a report by the Australian Bureau of Statistics (ABS), 2022 has been volatile for Australia’s housing and property market. The Australian housing market has faced continued declines for the last six months. Successive interest rate increases, rising inflation, low consumer sentiment, and declining affordability were among the main factors thought to be causing the Australian housing market to decline in 2022.

Talking about the recent September quarter, the total value of dwellings in Australia dropped to AU$9,674.4 billion (AU$10,033.3 billion in the June quarter) with, a total loss of AU$358.9 billion. Similarly, the mean price of residential properties in Australia fell by AU$36,800, coming to AU$889,800 during the third quarter of 2022.

September quarter's decrease in the value of residential properties in Australia appears to be the largest since the series began in September 2011, said ABS.

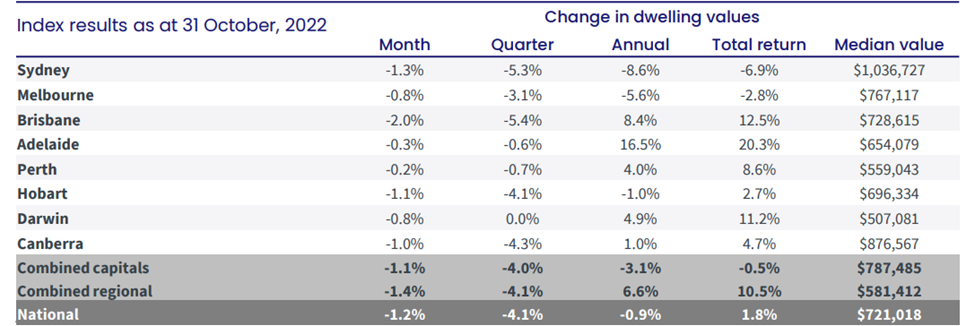

The following month saw an expansion of the geographic scope of Australia's housing crisis as housing values declined in all major cities and rest-of-state regions, with the exception of regional South Australia. The property market in Australia entered its sixth straight month of declines in October as values dropped another 1.2%, as stated in the ABS report (data source: CoreLogic).

A glance at Australian residential property prices: region wise

Housing price declines in the capital cities ranged from a 2.0% decline in Brisbane to a minor 0.2% decline in Perth. In the rest of the state regions, regional New South Wales, regional Victoria, and regional Queensland all experienced monthly declines of greater than 1%.

Brisbane's home prices are currently declining the quickest of any big city. In Sydney over the last two months and Melbourne over the preceding three, the rate of reductions has decreased.

After growing by 25.5% during the upswing, housing values have dropped 6.5% across all capital cities. Only 16 regions, with a preference for the less expensive suburbs of Perth and Adelaide and a range of regional markets, were still at cyclical highs at the end of October.

House values in the capital city increased by 29.9% during the upswing, more than twice the increase in unit values, which increased by 13.2%. Since April, the capital city's house values have decreased by 7.2%, and its apartment values have decreased by 4.2%.

Image Source: ABS (via CoreLogic), dated 1 November 2022

In light of the above, let’s glance at the top three ASX-listed real-estate companies and their recent developments:

| Company Name | ASX Code | Current Price (AU$) | Market Cap (AU$ million) | 52-week Price Change |

|

Goodman Group |

ASX:GMG |

17.360 |

33,284,302,857.60 |

-35% |

|

Scentre Group |

ASX:SCG |

2.880 |

15,311,616,100.05 |

-7.9% |

|

Vicinity Centres |

ASX:VCX |

2.000 |

9,286,641,730.32 |

17.8% |

Goodman Group (ASX:GMG): Australia-based property developer that owns, develops, and manages industrial real estate, including business parks, warehouses, and logistics and industrial facilities.

The group recently shared its annual general meeting (AGM) results via an ASX filing. As per the report, Goodman generated an operating profit of AU$1.5 billion for FY22, a 25% increase from FY21 and a statutory profit of AU$3.4 billion, 48% higher than in FY21. Earnings per share (EPS) also reached 81.3 cents, a 24% rise from FY21.

Scentre Group (ASX:SCG): Scentre Group Ltd offers project management, property management, and real estate investing services. The business manages assets and handles the planning, building, development, operations, and leasing of retail locations in Australia as well as New Zealand.

According to a recent media release by the group, Scentre’s gross rent collection for 9 months ending 30 September 2022 was AU$1,920 million, an AU$285 million increase over the prior comparable period (pcp). The group witnessed a 16.7% boost in the total customer visits of 391 million year-to-date (YTD). Moreover, business partner sales also saw a jump of 23.6% to AU$18.4 billion as of Q3 FY22.

Vicinity Centres (ASX:VCX): A retail real estate investment trust (REIT), operating as a shopping centre owner and manager. Vicinity Centres owns, co-owns, and manages a portfolio of 61 retail properties as of the end of June 2022. The company also develops and makes investments in different retail locations.

Vicinity Centres’ recently released AGM report mentioned generating net profit after tax (NPAT) of AU$1,215 million for FY22, primarily driven by non-cash property valuation and FFO growth. The company’s cash collection for FY22 took a huge leap of 91%, while H2 FY22 sales encountered a 15.5% improvement from sales in the second half of FY19.