Highlights:

- CSR marked 20% surge in net profit after tax in 2022.

- Building products business reported 24% increase in EBIT.

- CSR announced full year dividend of 18 cents per share.

Shares of CSR Limited (ASX:CSR) gained on the ASX after the company delivered a strong set of numbers for the full year ending 31 March 2022. In addition to this, the share price movement might be backed by its dividend announcement.

The shares of the building product company gained 1.76% to AU$5.79 per share at 10:34 AM AEST. CSR shares outperformed its benchmark index, ASX 200 Materials (XMJ), which was down by 1.13%. Also, the broader index, ASX 200, was lower by 42 points. Including today’s gain, the share price of CSR has increased by 4% in one month and by around 2% in a year.

Suggested reading: ASX 200 to fall after Wall Street closes mixed; oil slips again

CSR financial performance

Australia’s one of the oldest manufacturing companies, CSR has reported improvement in its financial performance. All the businesses of CSR’s performed well.

Image Source © 2022 Kalkine Media ®

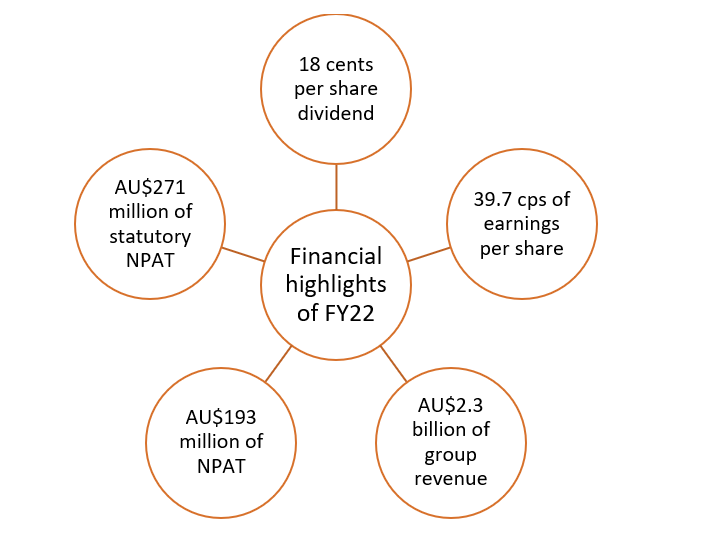

- CSR recorded a net profit after tax (NPAT) of AU$193 million, up by 20% within a year.

- The statutory NPAT reached AU$271 million. It includes significant items such as carry forward capital tax losses of AU$86 million.

- The group revenue surged by 9% to AU$2.3 billion, and group EBIT increased by 22% to AU$291 million within a year. The building products contributed 72%, aluminium 13% and property 15% in EBIT.

- The building products business delivered a record EBIT of AU$228 million, 24% higher than the previous year. This represents strong performance, operational efficiency and cost control. EBIT from property business decreased from AU$54 million to AU$47 million. EBIT from the aluminium business increased to AU$40 million. The surge in aluminium price was offset partially by higher production costs.

- Earnings per share increased by 20% to 39.7 cents per share.

- The company ended the year with a cash balance of AU$178 million and total assets of AU$2.4 billion.

Dividend announced by CSR

Image source: © Jirsak | Megapixl.com

In 2022, the company declared a final dividend of 18 cents per share, after which the full-year dividend reached 31.5 cents per share. The full-year dividend represents the top end of the company’s dividend policy. The dividend policy of CSR is to pay dividends of 60 to 80% on NPAT for a full year.

CSR is expected to pay a fully franked dividend of 18 cents by 1 July 2022. Also, CSR has a dividend reinvestment plan, under which the shareholders get the option to receive dividends in the form of shares instead of cash.

Management comments

Julie Coates, CEO and managing director of CSR commented on the results,

Outlook

In the building products segment, CSR expects that business would return to normal levels of investment and assist in delivering strategies. In the property business, the expected EBIT is around AU$52 million in full-year 2023. Lastly, for the aluminium business segment, the company expects to generate earnings of AU$33 million to AU$49 million. The estimations have been provided based on current cost and pricing scenarios.

Must read: AMC, REG: 2 ASX All Ordinaries shares hitting their 52-week highs yesterday