Highlights

- Private dental clinics cater to more than 85% of dental care in Australia.

- Dental care stock SDI, which registered record 1H sales, expects new product releases and continued increases in market share to underpin growth momentum.

- COVID-19 remains a challenge for PSQ due to impact on patient attendance and practitioner availability.

Maintaining good dental health is essential for achieving overall good health. It is important to take the right steps daily to take care of and prevent dental health problems. According to the Australian dental association, private dental clinics cater to more than 85% of dental care in the country.

In Australia, most dental care is not covered by Medicare, and only a small amount of government funding goes to dental care.

On that note, let us look at two of the dental care stocks listed on the ASX.

Dental technology company SDI Limited is engaged in the R&D, manufacturing, and marketing of specialist dental materials. Its products are manufactured in Victoria, Australia, and marketed to over 100 countries globally.

The products include a wide range of accessories, adhesives, alloys, cements, composites, and equipment.

SDI registered a 26% increase in sales in the half-year period ended 31 December 2021. The company achieved record first half sales with all product categories growing strongly in most regional markets. Interim fully franked ordinary dividend was maintained at 1.50 cents per share.

Due to freight costs and inflation, the company's Earnings Before Interest, Taxes, Depreciation & Amortisation (EBITDA) and Net Profit after Tax (NPAT) reduced by nearly 30% and 41%, respectively.

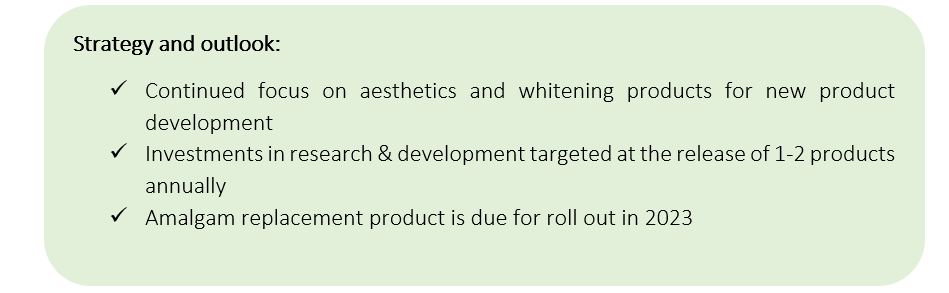

Outlook - Commenting on the company’s outlook, CEO Samantha Cheetham highlighted in half-year results update that SDI expects to witness momentum in its business, on the back of new product releases and continued increases in market share.

Data source: company update

SDI shares last traded at AU$0.78 on 30 May 2022. The company has a market cap of AU$92.71 million.

Pacific Smiles Group Limited (ASX:PSQ)

Pacific Smiles Group Limited, Australia's largest branded dental network, owns and operates the Pacific Smiles Dental Centres and the nib Dental Care Centres.

The dental centres are located throughout the Australian Capital Territory, Victoria, New South Wales, and Queensland. The company operates with a team of over 900 employees and more than 400 dentists.

In the half-year ended 31 December 2021, the company incurred a net loss after tax (NPAT) of AU$2.2 million, a decline of AU$12 million over the previous corresponding period (H1 2021: AU$9.8 million).

PSQ reported year-to-date patient fees of AU$183.8 million, as of 30 April 2022. This represents an 8.2% decline on year on year (YoY) basis. However, the month of April performed comparatively better than January.

The company remains well on track to open 15-20 new centres in FY2022.

PSQ shares were trading at AU$1.555 in the early hours of 31 May 2022. The company has a market cap of AU$247.37 million.