A company that has seen its sales skyrocket to register 56% of sales attained in entire FY19 in just Q2 20, as social distancing measures force people to limit their outdoor shopping. This company has been growing in all the geographies that it operates.

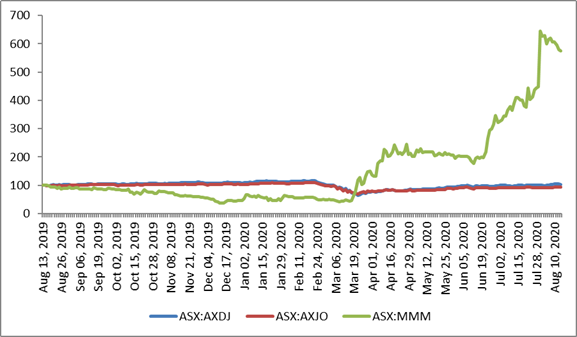

ASX listed Marley Spoon Ag (ASX:MMM) has been riding high since the onset of the coronavirus pandemic. Founded in 2014 in Germany, the company got listed on ASX in July 2018. During the coronavirus pandemic, the share prices of Marley Spoon skyrocketed by almost 962% (past 6 months) giving exuberant returns to its investors. Since hitting the March low of $0.23 on 17 March, the company has experienced a share prices surge of 1,239% to close at A$3.080 on 13 August.

We can also, clearly see that Marley Spoon has performed astonishingly well when compared to the representative index of ASX, S&P/ASX 200 (ASX:AXJO) and S&P/ASX 200 Consumer Discretionary (ASX:AXDJ)

What does Marley Spoon do?

Marley Spoon Ag (ASX:MMM) provides pre-packaged meal kits weekly with a kit containing a collection of recipes and the ingredients in the proportion required to cook the meals at home. The company positions itself as a supporter of cooking healthy food. The company pre-portioned meals allow minimal wastage and boosts healthy cooking cost-effectively. The company is currently servicing in the United States, Australia and Europe.

The price rally is backed by an extraordinary demand for its meal kits with customers increasingly preferring and adapting home cooking during the lockdown. The meal kits assisted the customers in avoiding flocking the local supermarkets and yet prepare tasty meals at home without the need to risk and go grocery shopping.

Healthy Growth even before COVID-19 Kicker

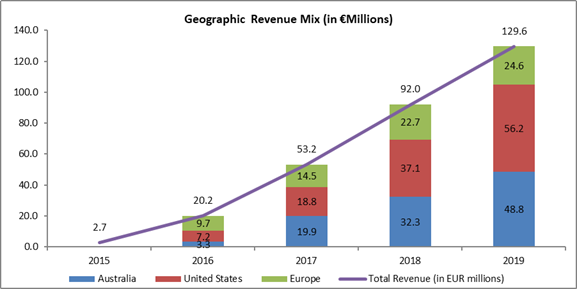

Even before the pandemic the company has been able to deliver good top-line growth. Over the five years to FY19 ending 31 December, the company has grown its Revenue from €2.7 million in 2015 to €129.6 million in 2019 at a CAGR of 163.21%.

The company’s growth in the United States has seen very good traction with sales reaching €56.2 million in 2019 from €7.2 million in 2016 with a CAGR of 98.37%. Revenues from Australia hit €48.4 million from €3.3 million clocked in 2016, marking a CAGR of 144.78 %. Growth has been slowest in its home turf with revenues from Europe growing at a CAGR of 36.37 %.

The revenue growth was driven by the rising number of active customers and repeat purchases.

For FY2020, the company expects a minimum 70% growth in revenue.`

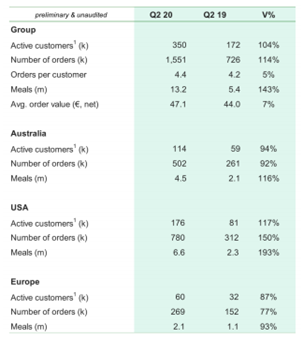

Latest Quarterly Performance- Customer base grows 2x

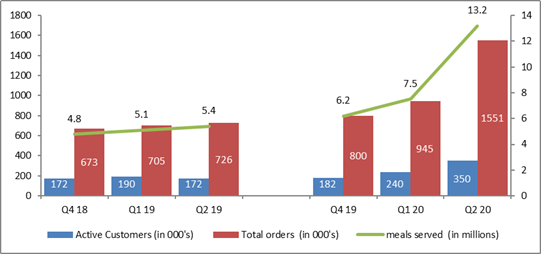

The company recently announced its Q2 performance ending June 2020, highlighting increased demand for its meal kits. The demand was backed by the customer’s preference for home-cooked food and a shift towards online grocery shopping during the lockdown. The company experienced a record increase in its customer base with the total number of active customers almost doubling in 2Q 20 compared to the previous comparative period.

The customer base growth has had a direct impact on revenue in the 2Q 20. The company in 2Q quarter registered revenue of €73.3 million, representing 129% jump over the previous corresponding period. When taking the twelve-month revenue of €129 million for FY 2019 into consideration, the 2nd quarter numbers are noteworthy. Active customers and total order numbers jumped by a whopping 104% and 114% respectively.

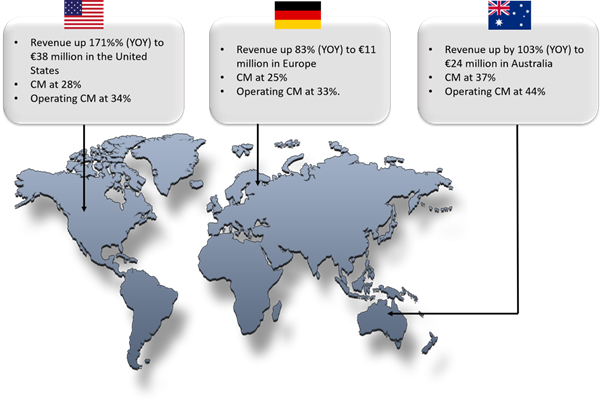

Region wise performance breakup

- Revenue jumped by 171% (YOY) to €38 million in the United States in 2Q 2020. CM was recorded at 28% with operating CM reaching 34%

- Revenue jumped by 103% (YOY) to €24 million in Australia in 2Q 2020. Contribution margin (CM) was recorded at 37% with operating CM reaching 44%

- Revenue jumped by 83%% (YOY) to €11 million in Europe in 2Q 2020. CM was recorded at 25% with operating CM reaching 33%.

Business growth led to the first operating EBITDA of €4.5 million with global contribution margin (CM) increased by 6 bps to 30.5%. Australia and the United States both experienced a positive operating EBITDA of €3.6 million and €4.6 million respectively, to be offset by an operating EBITDA loss of €3.7 million in Europe.

Meal Orders boosted by repeat orders

The company provided a total of 13.2 million meals in the June 2020 quarter with 90% of revenue contributed by repeat customers. Total orders increased to 1551 in 2Q 2020 from 945 recorded in the previous quarter and from 726 on a yoy basis.

Active customers increased to 350K in 2Q 2020, up by 104% from the previous corresponding period. The United States experienced the highest increase with Active Customers, number of orders, and total meals delivered, registering 117%, 150%, and 193% growth respectively.

The United States was followed by Australia which demonstrated an increase of 94% in number of Active customers, 92% increase in total number of orders, and a 116% increase in total meals delivered

Europe recorded an increase of 87% in the number of Active customers, a 77% increase in total number of orders, and a 93% increase in total meals delivered

1Active Customers are customers who have purchased a Marley Spoon or Dinnerly meal kit at least once over the past 3 months

Source: ASX Update

The company also highlighted that its cost of customer acquisition cost has come down considerably with marketing expenses as sales margin reduced to 13% in 2Q 20 from 18% when compared over the previous corresponding period.

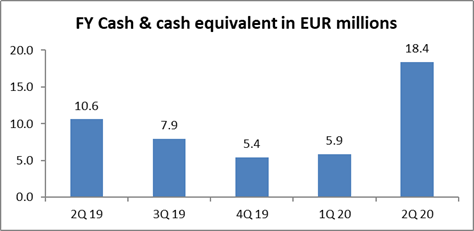

Cash position and Financing

The company recorded a Cash and Cash Equivalent of €18.4 million at 30 June 2020, as against €5.9 million recorded at the end of the previous quarter. The increase in the cash balance was driven by a €9.2 million equity raise offset by €2.6 million capital expenditures.

In May 2020, the company announced closure of A$16.6 million private placement, the proceeds from which will be used to support the company’s balance sheet and facilitate global expansion.

Company to focus on customer acquisition going forward to meet 70% revenue growth

With a shift in consumer shopping towards online purchasing, for the second half of 2020, the company intends to build up its cash balance as the company will be spending on customer acquisition to meet unit economics targets. The Company also intends to build upon its capacity to support business growth. Marley’s 2020 Guidance include a revenue growth of at least 70% year on year for CY2020.

Bottomline

Marley has recorded a positive operating EBITDA in 2Q 20 for the first time, with huge tail winds on back of stay at home orders across many of its operating geographies, demand for its meal kits were driven by the extensive need of customers to look for home cooking. While in the short term stretching to next year, the lockdowns and social distancing is expected to loom, the need for home cooked food remains strong. Consumer preference for healthy home food is also expected to drive the market. However, once life regains normalcy and the hospitality sector starts experiencing an uptick, how the business of meal kit providers pans out needs to be closely monitored.