Highlights:

- On Thursday, Blackmores Limited (ASX:BKL) inked a scheme implementation deed with Kirin Holdings Company for the acquisition of 100% of issued share capital of BKL.

- The scheme consideration values BKL equity at nearly AU$1,880 million and at an enterprise value of around AU$1,840 million.

- The scheme is contingent on certain terms and conditions like formal clearance by ACCC, along with consents from the Australian FIRB and the SAMR of the People’s Republic of China.

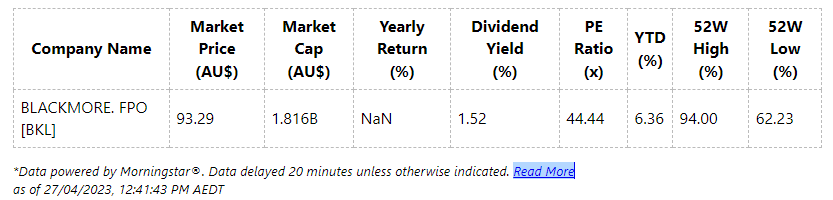

The natural health solutions provider Blackmores Limited (ASX: BKL) was up 21.422% and was trading at AU$93.240 on Thursday, 27 April 2023, at 11:19 am AEST after it announced inking a scheme implementation deed with Tokyo-headquartered food and beverage, pharma and health science company, Kirin Holdings Company, Limited (TSE:2503) for the acquisition of 100% of issued share capital of BKL through a scheme of arrangement (scheme).

Let’s get acquainted with BKL’s takeover bid from Japanese conglomerate Kirin.

Given the scheme is implemented, BKL’s stakeholders will obtain total cash consideration of AU$95 a security (scheme consideration), less any special dividend declared and paid to BKL stakeholders on or prior to the date of implementation of the scheme.

The scheme consideration values BKL equity at nearly AU$1,880 million and at an enterprise value of around AU$1,840 million and represents a 23.7% premium to the last close price of AU$76.79 (as of 26 April 2023), a 30.5% premium to the 1-month VWAP up to and consisting 6 April 2023 of AU$72.80, a 29.7% premium to the 12-month VWAP up to and comprising 6 April 2023 of AU$73.22 and an implied EV/EBITDA multiple of 23.1x BKL LTM December 2022 underlying EBITDA.

A 100% franked distribution of AU$3.34 a BKL security (conditional on availability of franking credits) special dividend is anticipated to be paid, leading towards franking credits of AU$1.43 a BKL security attached to any such special dividend.

BKL’s board collectively advised that its stakeholders vote in favour of the scheme if there is no superior proposal and is conditional on an independent expert drawing a conclusion (and continuing to conclude) that the scheme is in the best interests of BKL stakeholders. Every BKL director plans to vote all of the BKL securities he or she has or controls in favour of the scheme contingent on those similar qualifications.

Marcus Blackmore, the biggest stakeholder of BKL, who has or controls nearly 18% of BKL’s ordinary securities outstanding (to date), had notified BKL that he had consented with Kirin to vote 3,516,834 BKL securities held or controlled by him in favour of the scheme, unless otherwise directed by Kirin.

The scheme is contingent on certain terms and conditions, comprising formal clearance by ACCC, along with consent by the Australian FIRB and the SAMR of the People’s Republic of China.

Further, BKL advised that its stakeholders are not required to take any action at this point of time.