Highlights

- BBN shares made a fresh 52-week low of AU$ 1.350 on Tuesday

- The company today said its sales growth for FY23 as of 4 June 2023 was 1%, while comparable store sales growth was down 3% year-on-year

- The company will likely announce its full-year FY23 earnings on 11 August 2023

Baby Bunting (ASX: BBN) shares took a knock on Tuesday (6 June 2023) after the company provided a trading upgrade and downgraded its profit forecast for FY23. As of 11:03 am AEST, shares of this speciality retailer of baby goods tanked over 22% to trade at AU$ 1.385 apiece compared to its previous closing price of AU$ 1.780. In an ASX announcement, the company today said its sales growth for FY23 as of 4 June 2023 was 1%, while comparable store sales growth was down 3% year-on-year.

The company's key promotional event, Storktake, commenced recently, has not delivered the desired result. Trading in both stores and online platforms were well below expectations during this short period, the company said, adding that since launch, sales have been unprecedentedly low, with comparable store sales showing a decline of around 21.0%.

Now, the baby product retailer believes its FY23 sales could be in the range of AU$ 509-513 million if the current sales trend persists. This will likely result in comparable store sales of negative 4-5%, BBN said.

Worth mentioning here is the month of June contributes a major portion of the company's second-half profit. So, if the current trend persists, it will significantly impact the company's FY23 earnings.

Baby Bunting FY23 Revised NPAT Forecast

The company now expects its net profit after tax (NPAT) for FY23 to be in the range of AU$ 13.5-AU$ 15.0 million, compared to its previous guidance of AU$ 21.5-AU$ 24 million NPAT. Meanwhile, BBN expects its gross margin to be moderately below the lower end of its guidance range of 38.0%-39.0%.

Inventory levels of the company are now expected to end the fiscal year at around AU$ 100 million, as against AU$ 96.7 million in FY22 as the company has limited exposure to seasonal stock.

The company will likely announce its full-year FY23 earnings on 11 August 2023.

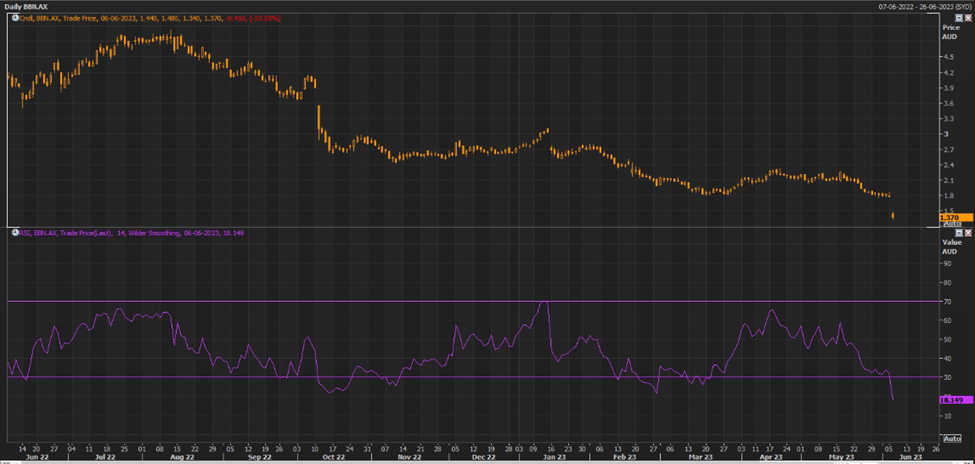

Baby Bunting (ASX:BBN) Share Price Performance

BBN Price Chart; Source: REFINITIV

BBN Price Chart; Source: REFINITIV

Including today’s decline, BBN shares have fallen 36.57% in the last one month and 49.44% year to date. The stock made a fresh 52-week low of AU$ 1.350 today, while its 52-week high of AU$ 5.030 was recorded on 11 August 2022.