Highlights:

- News Corporation has reported its financial results for the three months ended 31 March 2022.

- The company has said that it has benefitted from a surge in digital advertising revenue.

- News Corp’s shares were spotted trading 9.223% lower at AU$26.180 per share on ASX at 10.25 AM AEST.

The shares of News Corporation (ASX:NWS) grabbed the spotlight on Friday (6 May 2022) after the ASX-listed media and information services company reported its financial results for the three months ended 31 March 2022. During this period, the company saw its revenue and net income rise by 7% and 8%, respectively.

For the third quarter of fiscal 2022, News Corp’s profitability improved by 20%, including one-time transaction costs for the OPIS acquisition.

The company has attributed this growth to its continued transformation into a digital-led company. According to the announcement, News Corp benefited from a surge in digital advertising revenue. This included 21% growth at Dow Jones and over 15% growth in paid digital subscribers across the key markets.

Image Source © 2022 Kalkine Media ®

News Corporation shares were spotted trading 9.223% lower at AU$26.180 per share on ASX at 10.25 AM AEST today. In the last one year, News Corp shares have fallen 14.72%, while the stock is down 18.44% year-to-date (YTD).

Also Watch:

News Corp stated that it has now achieved more in profitability through the initial three quarters of fiscal 2022 at over US$1.3 billion. As per the company, this was more than in any entire fiscal year since 2013.

Image Source: © Volkantaner | Megapixl.com

Read More: ASX 200 tanks 2% amid bloodbath on Wall Street

Highlights from News Corp’s third-quarter results for fiscal 2022:

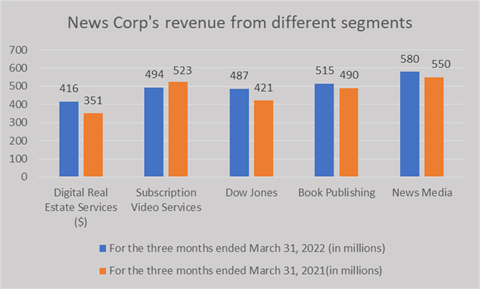

- Revenues in the quarter stood at US$2.49 billion, up 7% compared to US$2.34 billion in the previous year.

- Net income at US$104 million, an 8% jump compared to US$96 million in the prior year.

- EBITDA increased 20% at US$358 million, compared to US$298 million in the prior year, and includes US$15 million of one-time transaction costs. (Mainly because of higher revenues and lower costs in the other segment due to lower employee costs driven by stock price performance).

- EPS at US$0.14 compared to US$0.13 in the prior year – Adjusted EPS remained US$0.16 compared to US$0.09 in the prior year.

- Dow Jones reported its highest third-quarter revenue since its acquisition with 16% growth and experienced sustained digital subscription gains and strong performance in advertising.

- Foxtel’s total paid streaming subscribers grew 62% at the end of March, with both BINGE and Kayo at roughly 1.2 million subscribers.

- Digital Real Estate Services segment revenues grew 19% in the quarter, and Segment EBITDA expanded 17% despite a problematic prior-year comparison.

- News Media revenues increased 5% from the recovery in the advertising market, new content licensing revenues and substantial digital subscriber gains.

Read More: What drove Macquarie’s (ASX:MQG) profit 56% higher