Highlights

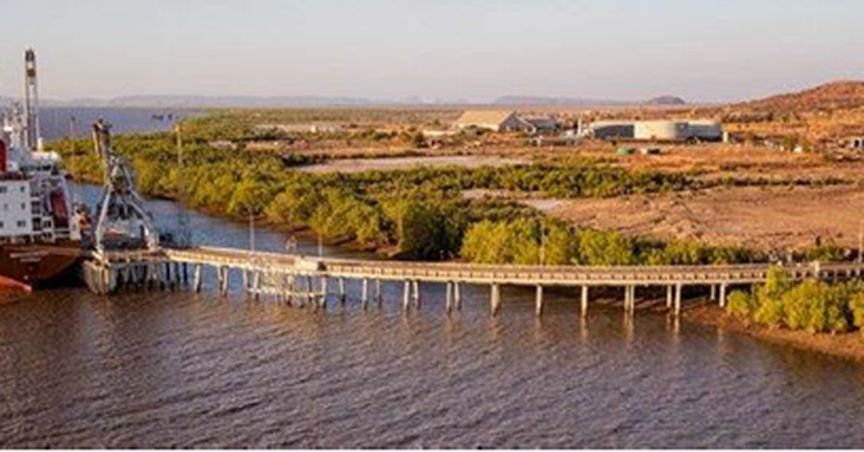

- Boab Metals has signed an agreement with Cambridge Gulf Limited with respect to access and stevedoring services at Wyndham Port.

- The port’s location is strategic in nature as it is located at a distance of 150km from the Sorby Hills Project.

- The port is a vital link within Northern Australia’s primary and secondary industries supply chain.

Western Australia based mineral explorer Boab Metals Limited (ASX:BML) has signed an agreement with Cambridge Gulf Limited with respect to access and stevedoring services at Wyndham Port.

Related read: Boab Metal (ASX:BML) showcases Sorby Hills lead and silver project at Euroz Hartleys conference

The Wyndham Port is the only deep-water port between Broome and Darwin. The port provides a vital link between the primary and secondary industries of Northern Australia. Boab will use the port to store, load and ship the concentrates produced at the Sorby Hills Project.

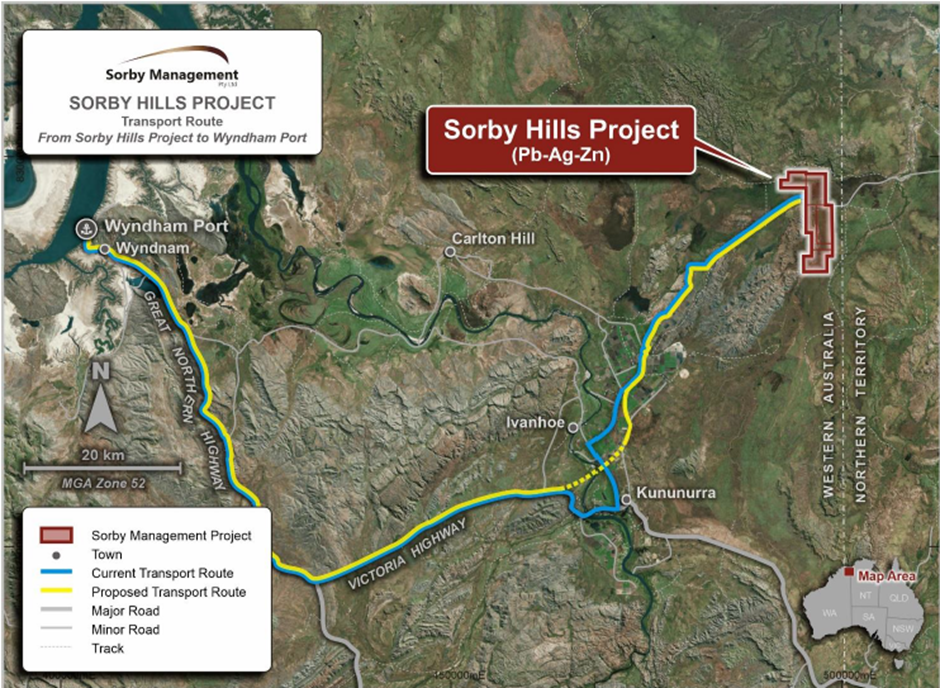

The Sorby Hills Project is located in the Kimberley Region of WA 50km NE of Kununurra and 150km by existing sealed road from the Port of Wyndham.

The agreement is strategic in nature due to its location from the project as well as the timing. Boab is currently engaged in wrapping up the Definitive Feasibility Study (DFS) on the project and expects it to be get completed by the second quarter of 2022. Post DFS, the Company is targeting a Final Investment Decision (FID) on the project by mid-2022.

Related read: Boab Metals' HY report heralds success, DFS on track for early Q2 2022

Location of Sorby Hills Project and Wyndham Port (Image source: Company update, 31 March 2022)

Commenting on the access agreement, Boab’s Managing Director and CEO, Mr Simon Noon, said, “The Agreement with Cambridge Gulf secures a critical element of the path to market for the concentrates that will be produced at Sorby Hills and therefore represents a key project execution milestone.

The experience of Cambridge in the region is second to none and we look forward to working closely with them to ensure an efficient and environmentally conscious transfer of our concentrates from Port to Vessel in readiness for their subsequent shipment to our customers.”

Related read: What is boosting Sorby Hills DFS progress for Boab Metals?

The operation and management of the port is currently overseen by Cambridge. The facility is owned by the Department of Transport and is regulated by the Kimberley Ports Authority.

Details of the services under the agreement

Sorby Management Pty Ltd, a wholly-owned subsidiary of Boab Metals has executed the Agreement for Access and Stevedoring Services. It is also the Manager of the Sorby Hills Joint Venture (Boab controls 75% interest in the project). The agreement extends to April 2034 and can be automatically rolled-over for every 12 months thereafter.

Data source: Company update, 31 March 2022

Boab Metals and Cambridge Gulf are currently engaged in finalising the workstreams and are working closely with each other and other important stakeholders.

Related read: Boab Metals reports High Grade Mineralisation at the Sorby Hills Beta Deposit

Boab Metals receiving strong interest in the project by potential customers

The Sorby Hills concentrate has sparked a lot of interest. Boab has received offtake offers that exceed the planned production capacity. The Company is advancing the negotiation discussions with foreign traders and domestic smelters and has reached to a stage where a detailed offtake terms sheets are being considered and finalised.

The final decision on placement of production under the offtake will be made upon the finalisation of the DFS study on the project. In the meantime, Boab will examine the offtake terms in light of the DFS findings, as well as consider how the proposed offtake financing facilities would interact with future debt facilities from the Northern Australian Infrastructure Facility and commercial banks.

Related read: Boab Metals’ December quarter building momentum for Sorby Hills DFS