Highlights

- Aspire Mining is leaving no stone unturned to develop its world-class Ovoot Coking Coal Project in Mongolia.

- The company is planning open-pit mining on the project, which holds a reserve of 255Mt.

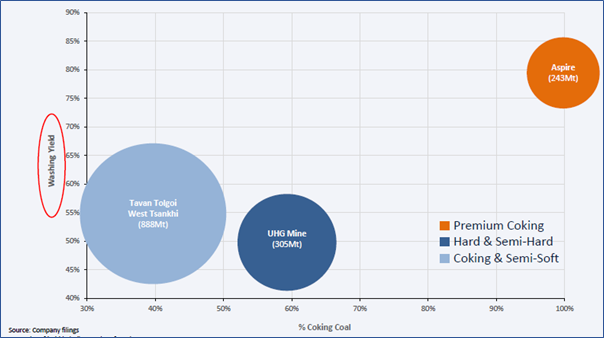

- High washing yield and caking & plastic properties of Ovoot Coal make it a premier product for the market.

- The company intends to deliver the first product by 2024.

Aspire Mining Limited (ASX:AKM) is committed to developing its flagship Ovoot Coking Coal Project (OCCP) in Mongolia as a world-class, long-life source of fat coking coal.

On 14 June 2022, the company released a presentation, highlighting project developments to be discussed by Chairman David Paull at the Fenwei Mongolian Coking Coal Virtual Conference.

Salient features of OCCP (Data source: Company update, 14 June 2022)

The company, which controls 100% interest in the project, has delineated an estimated reserve of 255Mt.

In 2012, Aspire secured a mining licence for 30 years. The company intends to go with an open-pit mining development plan as this method could save considerable development costs associated with infrastructure development required for underground mining.

Related read: Aspire Mining (ASX:AKM) completes CHPP infrastructure FEED study for Ovoot coking coal project

What is Aspire’s mine to market strategy?

Aspire’s development plan for the OCCP includes trucks and railroads to transport the coal produced to the nearest market in China.

The company intends to transport coal from the mine site nearly 560km by road to Erdenet. From Erdenet, coal will be transported using rail containers to further ~1,000km to Erlian and Mandal in Northern China.

Project location with infrastructure in place (Image source: Company update, 14 June 2022)

The company plans to build a special-purpose road to transport washed coking coal to Erdenet.

AKM has completed the Route Geotech survey. Its engineering consultants are advancing the Feasibility Study and Detailed Design for the paved road to be used for hauling coal from the OCCP to Erdenet.

Related read: Why Aspire Mining’s (ASX:AKM) Ovoot Coking Coal Project deserves attention?

What makes OCCP coal a premium product?

The quality of the coking coal deposit at the OCCP is quite exceptional. The deposit has a high washing yield with the highest in-situ value per tonne and the lowest strip ratio. Mining activities will consume the lowest diesel per tonne of the product produced among its peers.

Image source: Company update, 14 June 2022

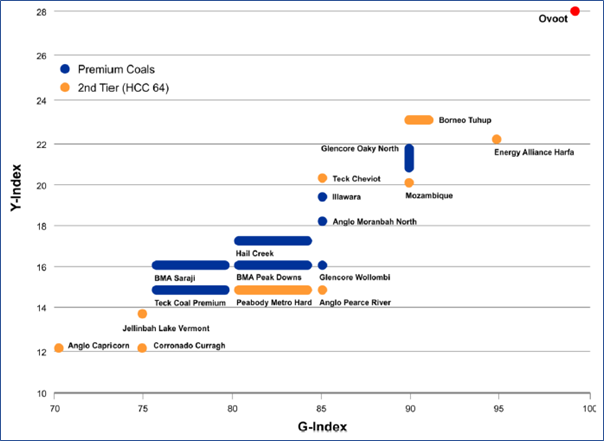

Additionally, Ovoot coal leads in caking and plastic properties at a global scale. Caking and plastic properties are the best in class, leading to superior blending and coking efficiencies.

Image source: Company update, 14 June 2022

Related read: Eye on ESG, Aspire Mining (ASX:AKM) vows to plant 10M trees in Mongolia

Aspire plans a decision to mine in 2022, subject to permits and reach to fundings. The project has shown robust financials and ESG outcomes. The Company has appointed Argonaut PCF to look into debt and quasi-debt funding options. Moreover, the company remains well funded with over AU$30 million in cash and no debt, as at 31 March 2022.

AKM shares were trading at AU$0.090 in the early hours of 15 June 2022.