Highlights

- Multiple indicators help us to anticipate how any economy will behave in the near-to-medium term

- From macroeconomic indicators like inflation and job growth to the health of stock markets, many elements can be looked at

- Retail spending by households has had a major influence on how any economy reacts to even weak macroeconomic indicators

The stock market is considered as one of the most prominent indicators of any country’s economic growth. The penetration of the stock market across developed and developing economies has deepened. However, listed securities can chart their own path independent of how the wider economy is performing.

For instance, over the past couple of years, when the COVID-19 pandemic was wreaking havoc on the economic output across the globe, stock markets were scaling new peaks.

Is retail spending, also dubbed consumer spending, a better barometer of a country’s economic growth? Arguably yes. Regardless of whether any economy is developed or developing, the retail market forms a big chunk of gross domestic product (GDP).

How are things unfolding in the developed economy of Australia?

Australia and retail sales

The good news is that despite a slowdown in the economic growth of Australia in the March 2022 quarter, household spending did not lose sheen.

In the December 2021 quarter, the economy expanded 4.2% on a year-over-year basis. The ongoing year has been a little dull, with the economy growing 3.3% over the first three months.[i] However, retail spending indicates that there could be a quick reversal over coming months. It was categorically stated by the Australian Bureau of Statistics (ABS) that a big driver of growth during the first quarter was household consumption.

It was reported by the ABS that Australians were consuming more with regard to services like cafés and restaurants, recreation, and transport. The momentum of the Australian economy is not lost, thanks to its citizens’ appetite for retail spending, which has recorded positive growth for many consecutive months, even against the backdrop of rising prices.

Also read: Australia's Q1 GDP data out: How is the economy faring?

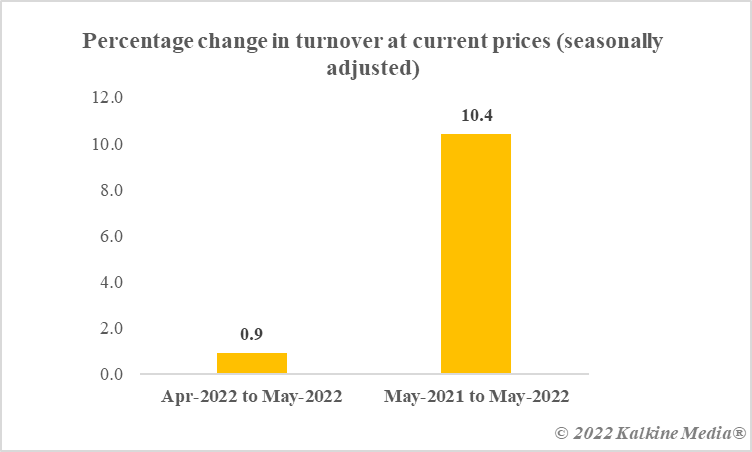

Data source: Australian Bureau of Statistics

Retail market

The retail market is the direct beneficiary of increased consumer spending. Not only revenues of companies operating in the retail space rise but also it contributes to job creation and wage hikes.

In Australia, the ABS reported a whopping 10.4% rise (seasonally adjusted) in retail turnover in May this year as compared to the corresponding month last year.[ii] From restaurants and takeaways to household goods retailing, consumption marked an uptick in May. By this measure, Australia’s economy appears to be in good shape, heading toward expansion in the near term. This is in contrast to the ongoing subdued phase in global stock markets. In Australia, rate hikes by the country’s central bank are weighing on listed stocks.

The global retail market holds the key over the second half of 2022 and even beyond. Inflation is indeed at a high level right now, and this is one concern that is impacting the global economy, including the US where the Fed has been aggressively raising rates to tame prices. In Australia, positive consumer spending is not letting such events deal a blow to economic growth.

Also read: Australia sees impressive retail spending and business conditions data

Retail sector and jobs

According to the Australian government, the retail sector is a big employer, in fact, the second largest in the country.

It is estimated that nearly 10% of all workers in Australia have their primary jobs in the retail sector.[iii] This data, similar to the figures cited above about the growth of the retail industry, includes both shop fronts as well as online retailing with signs that online retailing is fast growing.

Source: Pixabay.com

Within the retail industry, supermarket and grocery stores are the biggest employers, followed by pharma, clothing, footwear and so on.

It is perfectly understandable that the retail market is a super sector, which adds to job growth, wage hikes, and the broader economic output. The highly optimistic consumer spending data indicates that growth in the ongoing year will be largely defined by Australia's retail market.

Takeaway

The retail market, which is shaped primarily by consumer sentiments, is one of the primary forces that can decide the trajectory of any economy’s growth over coming years. In Australia, consumer spending contributed substantially to economic growth over the first quarter, which some market participants see as a trend in coming quarters.

[i] ABS (Jun. 2022) Media Release [https://www.abs.gov.au/media-centre/media-releases/economic-activity-increased-08-march-quarter], accessed July 4, 2022.

[ii] ABS (Jun. 2022) Media Release [https://www.abs.gov.au/statistics/industry/retail-and-wholesale-trade/retail-trade-australia/latest-release], accessed July 4, 2022.

[iii] NSC (Jun. 2022) Labour Market Insights – Retail Trade Overview © Commonwealth of Australia [https://labourmarketinsights.gov.au/industries/industry-details?industryCode=G], accessed July 4, 2022.