Gold, also referred to as the safe haven asset class, is continuing to attract the investors’ attention amidst the ongoing global turbulence caused by the exponential spread of the COVID-19 pandemic across major countries worldwide.

Gold Shatters 7-year Highs Amidst Oil Shocks

Presently, Gold is trading around the record levels of USD 1,740 an ounce, hitting these levels after a span of 7 years and is very much under the spotlight in the global markets.

The most obvious reason that the investors have been flocking to this yellow shiny metal is the prevalent global uncertainty and weak economic growth figures and forecasts around the world. It is interesting to note that in March 2020, the total ETF (exchange-traded funds) holding touched an all-time high of 3,185 tonnes of Gold.

Furthermore, Gold has presently become “The Commodity”, taking the place of Crude oil which has dropped to multiyear low levels. The year 2020 has been so far been a year of multiple surprises and shocks, something that any intelligent market observer could not have fathomed. COVID-19 has caused contraction in industrial activities across the globe with major consequences and Crude oil being a new causality.

On 17 April 2020, Gold traded at USD 2,683 an ounce, the rising investment in this commodity would require definite backing of an increased supply. The demand for gold is expected to further expand in 2020.

Ora Banda’s District Scale Flagship Asset in WA – Davyhurst Gold Project

As many gold stocks are observing brighter sunlight and closing in positive territory with large gains leading an uptick in the gold spot price, the interest among the investors who are looking at gold players on the ASX is on the rise ever since 2019 and continuing into 2020.

Ora Banda Mining Limited (ASX: OBM) is one such attractive gold player that emerged in a strong position after its $ 30 million recapitalisation process was competed in June 2020 following which the Company began an aggressive exploration drive at its huge district scale Davyhurst Gold Project (covering sub project areas as tabulated below), which spans nearly 1,336 km2 across a 200 strike kilometre on Western Australia’s highly prospective Greenstone Belt.

Ora Banda Mining’s Project Portfolio

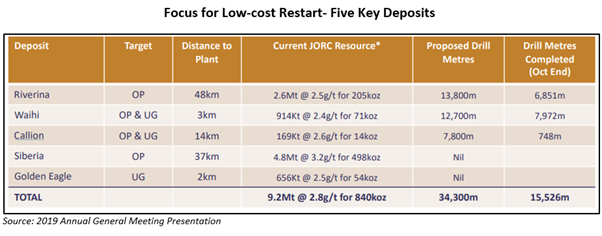

A mining project has to undergo multiple evaluation and planning stages before it can come onstream. Over the last few months, Ora Banda Mining’s initial focus for infill and extensional drilling has been five well-analysed and advanced priority targets being Riverina, Waihi, Callion, Siberia and Golden Eagle, that are located within different project areas and close to the Davyhurst processing plant (@1.2 Mtpa). These advance targets present a near-term production opportunity as well a significant exploration upside. Therefore, Ora Banda has also been conducting a regional exploration program examining a number of advanced prospects to ultimately define a 5-year mine plan encompassing both open pit and underground mining operations.

The Company has been encouraged by the high-grade results from the drilling program conducted to date at all five priority targets.

For an eye over the Company’s Half Year FY20 and Resource Definition Drilling Overview, Please Read: Ora Banda’s Half Year 2020: Exploration, Evaluation And Development Of Davyhurst Gold Project

In December 2019, a mineral resource increase was reported at the Riverina deposit, which uplifted the Company’s Mineral Resource statement to 22.2Mt @ 2.6g/t for 1.85 million ounces of contained gold. Meanwhile, the Reserve position for Siberia project stands at 2.8Mt @ 2.3g/t Au for 213,000 ounces and Ora Banda expects to declare reserves at the other four projects in the coming months.

Ora Banda Mining plans to utilise the upgraded mineral resources and reserves into a Definitive Feasibility Study (DFS) for the Davyhurst Project, which is scheduled to be delivered by June 2020.

Stock Information: On 24 April 2020, the OBM stock closed the trading at $0.195. The stock has delivered positive returns of 10.81% YTD, 13.89% in the last six months, 20.59% in the last three months and an outstanding 111.34% in the last one month.