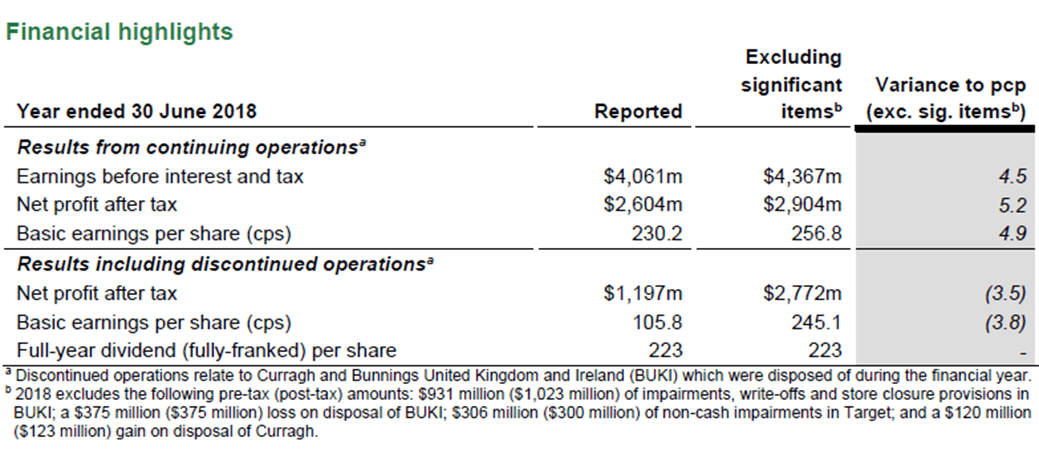

Decent Performance in FY 18 after excluding significant items: Wesfarmers Ltd.âs (ASX:WES) stock rose 3.22% on August 15, 2018 though the company for FY 18 delivered 58.3% fall in the reported net profit after tax (NPAT) to $1,197m. This includes a loss from discontinued operations of $1,407 million, on the back of the trading results and significant items for Bunnings United Kingdom and Ireland (BUKI) and Curragh, which were divested during FY 18. NPAT from continuing operations, excluding a $300 million non-cash impairment in Target, rose 5.2 per cent to $2,904 million. Further, during the year 2018, the retail earnings (from continuing operations and excluding significant items) grew 5.2 per cent as Bunnings Australia and New Zealand (BANZ), Department Stores and Officeworks achieved very strong results. Industrial earnings from continuing operations also rose driven by strong contributions from Chemicals, Energy and Fertilisers (WesCEF) and Bengalla.

[optin-monster-shortcode id="wxhmli4jjedneglg1trq"]Moreover, during FY 18, the cash generation remained strong and strict capital disciplines were maintained, which further strengthened the Groupâs balance sheet, as the net financial debt reduced to $3,580 million from $4,321 million in the prior year. Additionally, WES has declared a fully-franked final ordinary dividend of $1.20 per share, which brought the full-year ordinary dividend to $2.23 per share, in line with the prior year and consistent with WESâ policy of distributing franking credits to shareholders. Meanwhile, WES has announced that Guy Russo, who led to the successful turnaround of Kmart, would retire as chief executive of its department stores division, and will be replaced by Kmartâs managing director, Ian Bailey. The chief financial officer of the division, Marina Joanou, is appointed as the managing director of Target. On the other hand, WES stock has risen 14.04% in three months as on August 14, 2018.

FY18 Financial Performance (Source: Company Reports)

[pluginops_form template_id='23834' ]

The Income available from dividends remains attractive for many investors.

We take a look at the best yields on the market and assess what they say about a companyâs prospect.

One Thing is certain, though, Australia interest rates are still low, making income difficult to come by and keeping the focus for many investors on high yielding stocks. Kalkineâs team of analysts bought you handpicked report for âTop 25 Dividend Stocks For 2018.â

ASX-relevant Special Reports are published year-round to provide a detailed analysis into an investing opportunity or a potential risk to your portfolio.

Click here to get your free report.

Disclaimer

The advice given by Kalkine Pty Ltd and provided on this website is general information only and it does not take into account your investment objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. Kalkinemedia.com and associated websites are published by Kalkine Pty Ltd ABN 34 154 808 312 (Australian Financial Services License Number 425376). website), employees and/or associates of Kalkine Pty Ltd do not hold positions in any of the stocks covered on the website. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations.