Tyranna Resources Limited (ASX: TYX), an Australian Securities Exchange listed metal miner and explorer, notified on 24th May 2019 that an independent mining consultant- Entech completed a review of a restart study at Eureka Gold Project, which is 50km north to the Kalgoorlie-Boulder in Western Australia and is a wholly-owned project of the company.

The company recently provided an update on its cobalt and gold projects.

The restart study demonstrates that a viable cash flow positive early mining opportunity exists at the Eureka project; however, the results are subjective to a word of cautions.

The restart study is based on a lower-level technical and economic assessments, which would not suffice to support estimation of the Ore Reserves, nor it would be able to assure an economic development case at the present stage, or that the conclusion of the restart study would be realised.

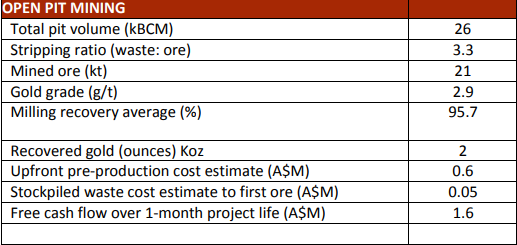

Key Outcomes of the Re-start Study:

Source: Companyâs Report

The production target of the study is the Indicated Mineral Resources, and the financial assumptions based are based on a price of A$1,800 per ounce. The company would provide the contract of mining to mining contractors for Open pit and adit mining.

Local contractors would conduct the ore haulage, and the processing activities would be through conventional third-party carbon in conventional leach plant nearby. TYX assumes a metallurgical recovery rate of 96%.

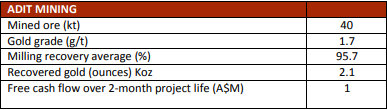

Proposed adit mining details are as follows:

Source: Companyâs Report

Like the assumptions mentioned above, Tyranna took inputs and premise on various factors to conclude the restart study.

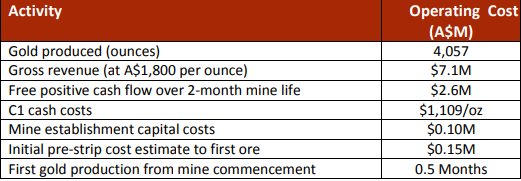

Mineral Resource and Financial Evaluation:

The total Indicated and Inferred resources stand at 762,000 tonnes with an average grade of 1.8g/t of gold and 43,100 ounces of gold. The 100% targeted Indicated Resources are at 434,000 and accounts for 25,200 ounces of gold.

The pre-production operating cost is estimated to be at A$0.6m, and the projected financial evaluations are as follows:

Source: Companyâs Report

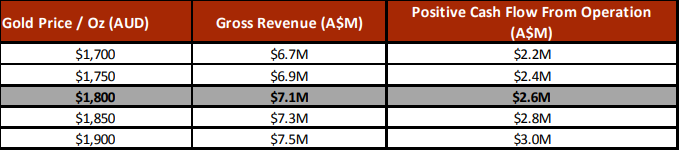

Economic price sensitivity of the financial metrics based on an average price assumption of A$1800 per ounce is as follows:

Source: Companyâs Report

Source: Companyâs Report

However, in its cautionary statement, TYX mentioned that there is no certainty that the projected cash flows would be realised.

On the funding front, the company mentioned that the project requires no environmental clearance, and TYX plans to fund the restarting the project by $1.06 million cash at the bank along with the invested value of $0.6 million. Tyranna, on a sound basis, would consider internal funding, traditional debt/equity, profit share arrangements, sale or partial sale of an asset to finance the project.

Risk Considerations:

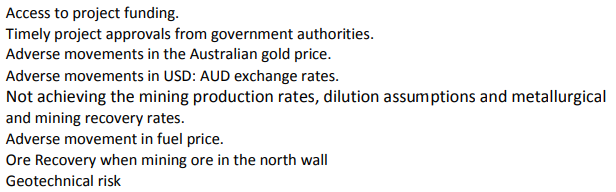

Following are the risk factors identified by the independent mining consultant- Entech:

Source: Companyâs Report

Eureka Gold Project:

TYXâs 100% owned- Eureka, located on granted mining leases in Kalgoorlie, consists of oxide and transition material contained in the updated Mineral Resource.

The previous owner of the prospect mined 53,000 tonnes with a grade of 3.3g/t, which resulted in the production of 5,400 ounces of gold, between October 2017 and April 2018. The company acquired the Eureka prospect in September 2018 and undertook two drilling programs.

One of the programs included a close space drilling, which targeted the mineralised material below the existing floor, to confirm the high-grade continuity. The program returned some significant shallow oxide intercepts, which are as follows:

The drill hole identified as 19ERC12 intercepted 5m @ 25.6 g/t Au from 33m including 1m @ 89.7 g/t Au from 34m.

The drill hole identified as 19ERC04 intercepted 7m @ 3.0 g/t Au from 39m.

The drill hole identified as 19ERC17 intercepted 12m @ 2.6 g/t Au from 20m including 1m @ 15.8 g/t Au from 26m.

The drill hole identified as 19ERC18 intercepted 5m @ 3.7 g/t Au from 23m including 1m @ 13.5 g/t Au.

The drill hole identified as 19ERC20 intercepted 9m @ 2.5 g/t Au from 12m.

The shares of the company were trading flat at A$0.005 (as on 24th May 2019, AEST 02:48 PM).

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.