The Information Technology sector in Australia is ever evolving with a wide range of emerging new technologies that are anticipated to transform the basic everyday tasks and interactions for businesses and people. Especially, in limelight across the world are technologies such as Artificial intelligence (AI), blockchain and quantum computing that are posing massive opportunities for people, businesses and the broader economy today. Letâs take a look at the following three Australia-based tech companies that are revolutionising tasks and supporting their clients in different areas.

Mint Payments Limited

Mint Payments Limited (ASX: MNW), based in New South Wales, Australia, is engaged in processing mobile payments and transactions. In addition, the company has developed and offers a mobile payments technology platform which allows for corporate enterprises to accept credit and debit card payments on various devices including mobile phones, tablets and mobile devices.

To date, Mint Payments; market capitalisation stands at around AUD 18.06 million with approximately 785.3 million shares traded. On 26 July 2019, the MNW stock is trading at AUD 0.023 with ~ 121,000 shares traded (as at AEST 01:31 PM).

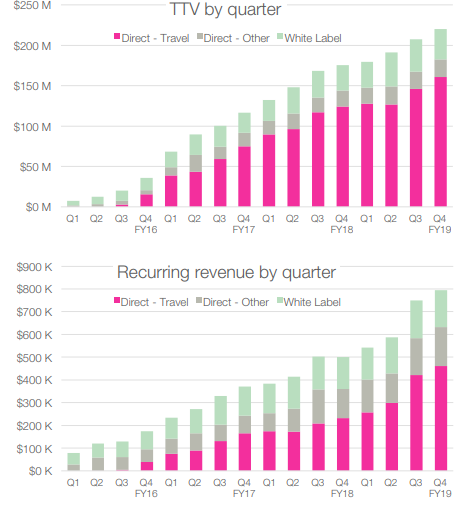

Results FY19 (unaudited)- Mint Payments announced its FY19 Unaudited Financial Results & Investor Update on 26 July 2019 demonstrating a strong performance. The company recorded a 28% increase in the Total Transaction Value (TTV) to over $ 799 million while the total revenues increased by 34% to $ 4.9 million. Also, the recurring revenues also exhibited an upward movement by 48% to $ 2.7 million and the EBITDA was posted at -$ 3.7 million.

Source: FY19 Unaudited Results and Investor Update

Segment wise, companyâs travel vertical emerged as the key driver of the stellar performance and represented 73% of Mintâs TTV and 58% of recurring revenues in the last quarter (Q4). The verticalâs recurring revenue in Q4 were up 100% on the prior corresponding period. Going forth, the travel vertical is expected to continue the trend into FY20 with unlocking its TTV and revenue margin and deliver monthly cash flow break-even.

Currently, Mint is developing market leading payment solutions for small and medium enterprise (SME) travel agents that are largely misunderstood by traditional payment services providers. This would unlock new growth in the travel vertical that is already performing well.

As at 30 June 2019, Mint had $ 1.4 million in cash and $ 2.0 million in debt available. Besides, the existing debt facilities have been extended through to September 2021.

Orcoda Limited

Source: May 2019 Investor Update

Source: May 2019 Investor Update

The company serves clients across a diverse array of industry sectors such as resources and infrastructure, transport and logistics and healthcare sectors.

Orcodaâs market capitalisation stands at around AUD 17.85 million with approximately 101.98 million shares outstanding. On 26 July 2019, the ODA stock was trading at AUD 0.175 with approximately 101.98 million shares traded as of AEST 01:50 PM. Besides, the ODA stock has generated positive return yields of 90.22 % in the last three months and 66.67% in the last one month.

Recently, Alium Alpha Fund became a substantial shareholder in the company upon purchase of 15,536,454 ordinary fully paid shares, translating into a voting power of 15.24%.

Community Transport Contract â On 1 July 2019, Orcoda announced that Orcoda Healthcare Logistics Pty Ltd has signed a multi-year contract, valued at approximately $ 640,000, with TransitCare Pty Ltd, a not-for-profit innovative community transport provider headquartered in Brisbane, Queensland. The deal would allow TransitCare to optimise, allocate and coordinate its fleet of Community Flyer vehicles and the Orcoda optimisation solution will initially support TransitCareâs customers in Brisbane and Townsville.

Calendar Cheese Contract Renewal â On 28 June 2019, Orcoda updated the market about a contract renewal signed with the Calendar Cheese Company for a further period of two years with a contract value of approximately $ 50,000.

Calendar Cheese Company are well-known distributors of International and Australian specialty cheeses and utilises Orcoda Logistics Management Software (OLMS) to ensure their deliveries are scheduled, allocated and delivered to their customers.

In addition to the above, Orcoda informed that the option agreement with OpenDNA (ASX:OPN) had ended and they would not be purchasing the China VIE structure as expected. Currently, the company has around two other prospective purchasers and the market would be updated in case of a binding contract with the companies.

Tymlez Group Limited

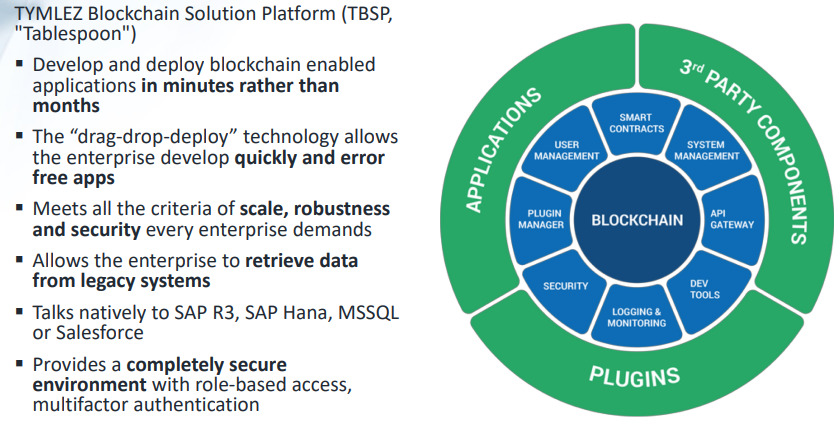

Tymlez Group Limited (ASX:TYM), based in Victoria, Australia, operates as a software development company and offers a scalable multi-tenant, enterprise-grade smart blockchain solution platform, called Tablespoon, that allows businesses worldwide to develop, deploy, and manage distributed blockchain applications in their organizations.

Source: AGM Presentation

Source: AGM Presentation

The companyâs current market capitalisation stands at around AUD 17.64 million with approximately 130.68 million shares outstanding. On 26 July 2019, the TYM stock was trading at AUD 0.150, edging up 11.11% by AUD 0.015 with approximately 170,793 shares traded.

In addition, the TYM stock has generated positive return yield of 12.50% in the last one month.

Recently, in May 2019, company Director Rodney Hannington acquired an indirect interest in Tymlez Group by purchasing 90,000 Unlisted options exercisable at $ 0.35 expiring 115 March 2021 in accordance with resolution 6 as approved by shareholders at the Annual General Meeting held on 14 May 2019.

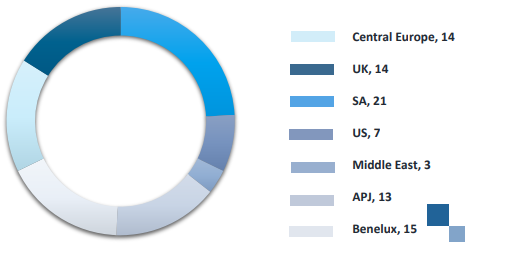

AGM Presentation - Tymlez Group reported total receipts of $ 492k and sales order of $ 700k with a 23% hike in the recurring revenue for the year 2018. Following this, the company recorded $ 189k in receipts and $ 204k in sales orders for the first quarter (Q1) of 2019. Besides, new order worth $199k were also secured during the three months. Besides, the company also stated that its partner network was also growing.

Source: AGM Presentation

The balance sheet remained strong with cash of $ 3.338 million.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.