Syrah Resources Limited (ASX: SYR) provided a transcript from Chairmanâs address and presentation at the Annual General Meeting, which held today on 24 May 2019.

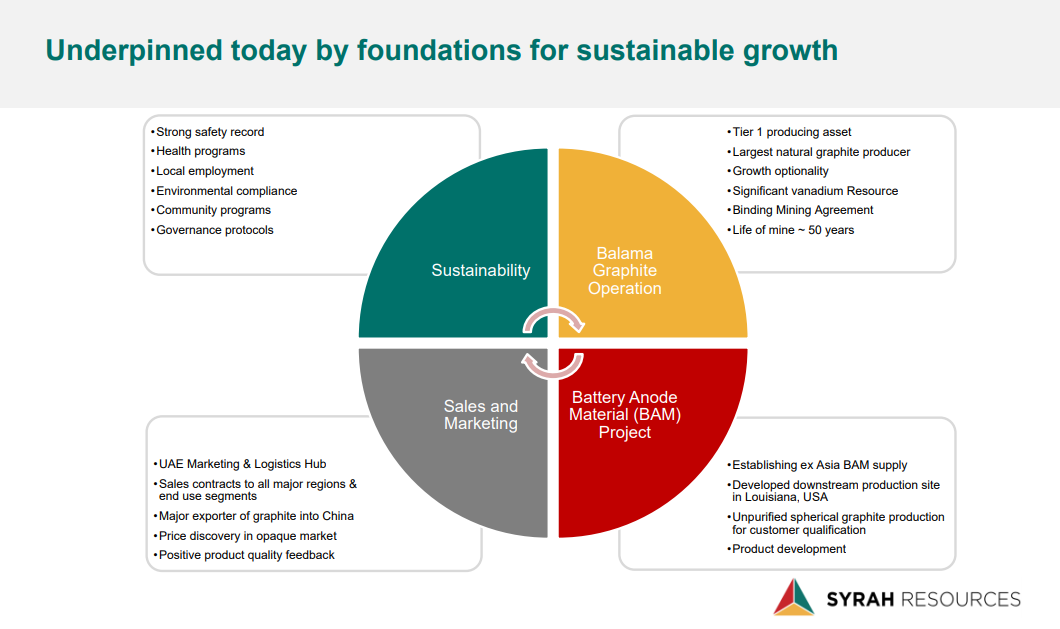

The announcement read that Syrah is dedicated to achieving the status of worldâs leading supplier of natural graphite product along with adding value to the battery and industrial markets through the solid supply chain and customer engagement. Accomplishing this vision would be underpinned by highest standards of health, safety, environment and community performance.

In 2018, SYR did not meet the expectations which resulted in a negative impact on Syrah shareholderâs wealth and valuation. As of now, Balama project is its largest natural graphite operation outside China in a generation. Syrah importing into China for the first time altering the global trade flows for natural graphite. Thus, SYR is offering lower cost and higher quality for natural graphite anode material to underpin the growth in lithium ion battery market along with the growth in electric vehicles and energy storage industry, as reported.

Sustainable Growth Plan (Source: Companyâs AGM Presentation)

Sustainable Growth Plan (Source: Companyâs AGM Presentation)

The company is sustainably developing the Balama and the USA Battery Anode Material (BAM) operation to maximise the shareholder value in the long-term. Development of operation and market had not been as expected. However, improved performance and expanding sales would place SYR in a more integral part of the global battery supply chain. Since 2015, graphite markets had not performed in line with the assumption from the Balama feasibility study.

2018 performance remained briefly impacted by production ramp-up challenges at Balama. But on the bright side, Syrah witnessed an evolution during last year on the back of growing production of over 100,000 tonnes of high grade and low impurity natural graphite and became the worldâs largest integrated natural graphite producer.

It is reported that plant size and remote location of Balama pose challenges, but maintains tremendous commitment towards safety, environmental programs and community initiatives supported by the companyâs license to operate. The board of company indicated Balama cashflow & cost along with sales and volume did not meet expectations. However, there were areas where expectations exceeded including Sustainability and Social Performance, Battery Anode Material Progress, Health, Safety and Compliance & Governance.

Sustainable Growth Achievements (Source: Companyâs AGM Presentation)

Sustainable Growth Achievements (Source: Companyâs AGM Presentation)

Last year, SYR witnessed a number of changes to the board. Ms Sara Watts agreed to act as a Non- Executive Director. Audit and Risk Committee Chair, Sara brings the experience of more than 25 years in technology transformation with International financial and operational acumen. Lisa Bahash also joined the board as a director. She possesses experience in advanced energy storage, lithium ion technologies and automotive original equipment manufacturing (OEM) industry.

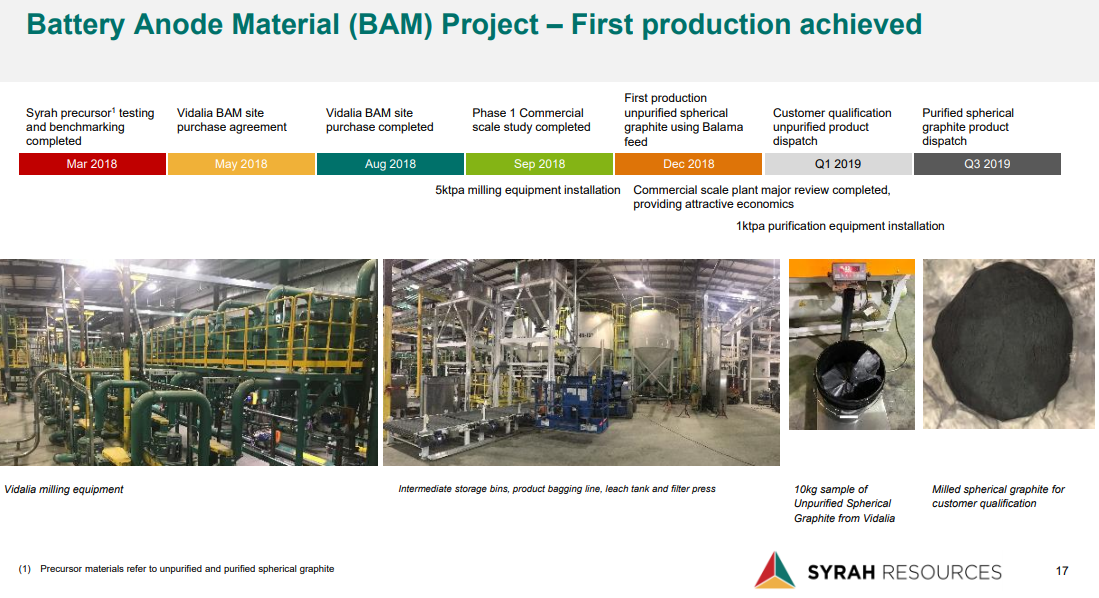

Syrah is focused on continued market penetration of graphite products at competitive prices along with the qualification of anode materials out the BAM plant in the United States.

BAM Project (Source: Companyâs AGM Presentation)

BAM Project (Source: Companyâs AGM Presentation)

At market close, stock of the company settled at A$ 1.165, up 0.43%, from the prior close. The market capitalisation of SYR stands at approximately A$399.39 million and year to date returns is negative 24.43%. The 52-week high and low of the stock are A$3.60 and A$0.975, respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.

_09_03_2024_01_03_36_873870.jpg)