Australian energy company, Sun Resources NL (ASX:SUR) is now a 100% operator and holder of a low CapEx, high margin oil appraisal/development project, Bowsprit Project. The company is currently preparing for the drilling of the first Bowsprit well and has already advanced the commercial and funding arrangements to support the drilling.

Earlier, the company had a 50% working interest in the Bowsprit Project (via Sun Louisiana LLC), with the remaining owned by Pinnacle Energy International (USA) I LLC, which had a 50% working interest in SL21754 and SL21787 in Louisiana, US. Recently, in July 2019, the company announced a buyout of co-lessees to move to 100% working interest and 74% net revenue interest in both the leases.

Terms of the Agreement: As per the terms of the legally binding Memorandum of Understanding signed between Pinnacle and Sun Resources, Sun needs to pay a cash consideration of US$250,000, prior to the drilling of the first well, and a royalty of 5% of the gross production revenue to Pinnacle. It is to be noted that prior to the royalty payment, Sun Resources is entitled to collect the first US$12 million in gross revenues.

The transfer of ownership is subject to payment of the cash consideration and execution of Agreements, namely Sale and Purchase Agreement and Royalty Agreement. If the transaction is not completed by 1st March next year, the Agreement will be dismissed, and the project will revert to the original partnership.

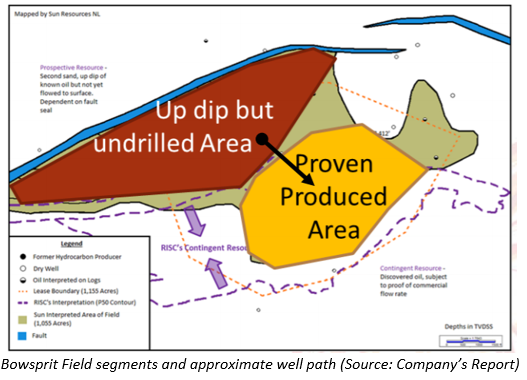

Project Economics and Objective: In order to understand the true potential of the project, the company conducted extensive internal work and appointed three independent consultants to review the project. It has been assessed that the project area contains an undeveloped conventional Miocene aged oil sand at a depth of around 7,400 ft, located above a deeper 9,500 ft gas field, which was developed in the 1960s.

Subsequent to the 3D geological modelling of the Bowsprit Field, the company selected a primary well location and has already commenced the permitting of the well.

The main objectives of the first well are as follows:

- To prove the field reserves:

- Test/Prove the Prospective Resources in the âundrilledâ portion of the field with the vertical pilot well and;

- Prove that the Contingent Resources are commercial, by flow testing a horizontal well in the Proven Produced Area;

- To conduct a data gathering of seismic velocity data and rock attributes for quantitative seismic interpretation;

- Detailed reservoir parameters and oil properties for full field development planning and implementation.Â

Progress Towards Drilling: The company is planning to drill a vertical pilot hole in the middle of the field to maximise data gathered. Following this, the company intends to drill a horizontal section towards the southeast area of the field, across the crest of the four-way dip structure, where the crestal sand previously produced approximately 75,000 bbls of oil. The company aims to flow test the horizontal well for a short period to prove a commercial flow rate, and if the results are satisfactory, the well will be suspended as a future producer.

After selecting the well location, the company commissioned FensterMaker to commence permitting for the well and an initial seabed site survey has been conducted.

It is expected that the first well will be drilled in Q1 2020, and in the meantime, the company will prepare a detailed drilling program. The company expects that around 2.5 million barrels of oil and 3.5 Bscf of gas can be produced from five horizontal development wells with a breakeven oil price of ~US$25 to US$30/barrel.

June Quarter Cash Position: During the June quarter, the company spent $15,000 of cash on exploration and evaluation activities, taking the total year-to-date cash expenditure to $72,000. For the period, the company spent $94,000 on administration and corporate costs and $16,000 on staff costs. The total net cash used in operating activities during the June quarter was around $105,000. The net cash inflow from financing activities during the June quarter was $135k.

At the end of the June quarter, the company had cash and cash equivalents of around $62,700.

For the September quarter, the company expects a cash expenditure of around $330k on exploration and evaluation, significantly higher than the previous quarter. The total estimated cash outflow during the September quarter is around $470k.

In June 2019, the company announced a placement to raise $150,000 by issuing 75 million shares at $0.002, with two free attaching options for every three shares subscribed by investors. The options carry an exercise price of $0.004 per share and will expire on 31st December 2020. The placement was completed in the month of July.

Stock Performance: On 6th August 2019, Sun Resourcesâ shares were suspended from the official quotation at the request of the company, pending an announcement on the completion of a capital raising. The proceeds of the capital raising will be used to fund the payment of lease rentals for the companyâs main asset, the Bowsprit Project.

The stock last traded at a price of $0.003 on 2nd August 2019 with total outstanding shares of ~956.06 million. In the last one month, the companyâs stock price has increased significantly by 133%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.