Summary

- Despite the challenging environment caused by bushfire and COVID-19, ASX 300 listed SeaLink Travel Group delivered robust FY2020 results which aided its price to soar ~7%.

- Impressive contribution from the acquired Transit System Group strong 1H performance from Marine and Tourism division bolstered SeaLink’s performance.

- The results were also aided by effective cost control measures, renewed intrastate marketing focus, and wisely bringing the assets back online.

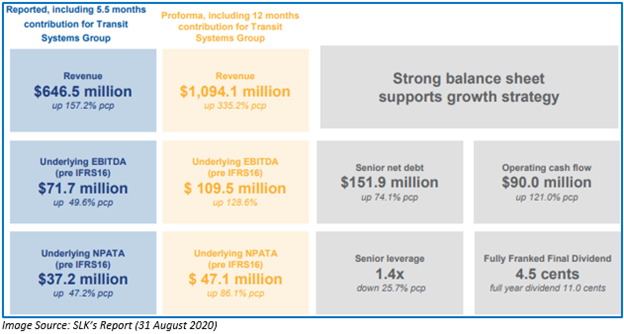

- Underlying Net Profit After Tax and before Amortisation improved by 47.2% to A$37.2 million while total revenue jumped ~153% to A$646.5 million.

- SLK declared a fully franked final dividend of 4.5 cents.

ASX 300 listed Company, SeaLink Travel Group Limited (ASX:SLK) has reported a notable performance in FY2020 (period ended 30 June 2020). The results gave a thrust to the SLK share price, which settled at A$4.750, up 6.742% from the previous close. SLK has a market capitalisation of A$971.88 million, with nearly 218.4 million outstanding shares.

SeaLink Travel Group Limited is the largest integrated land and marine, tourism and public transport service provider in Australia and has established international operations in London and Singapore. The Company is amongst the most experienced and diverse multi-modal transport businesses, boasting performance-driven capabilities across the ferry, bus, and light rail. SeaLink comprise of Australian marine and tourism operations and Transit Systems’ domestic and international public bus and light rail transport operations.

Despite the impact of bushfire and COVID-19 across Australia, the results announced by SeaLink reflects the strong underlying nature of the essential services which the Company provides to the cities and islands that it serves.

GOOD READ: Is there a scope for these Logistics Companies to see a Comeback- TCL, QAN, SLK, AQZ, QUB?

The Company gives credit to its global network of transport experts for its performance. These experts collaborated to use international learnings and experiences and focused on critically analysing and improving services, adjusting safely and rapidly to transforming and challenging operating situations.

Interestingly, 87% of SeaLink’s revenue is presently contracted to large government clients. With time, the Company has renewed and expanded most of these operating contracts. This is proof of SeaLink’s focus on delivering safe, efficient, accessible, and sustainable travel.

The public transport operations were able to deliver as per the expectation. However, the Marine and Tourism division were impacted due to border closure. Unique cost control, along with a renewed intrastate marketing focus and wisely bringing these assets back online helped the Marine and Tourism business to deliver a positive contribution to the Group result.

Amid the COVID-19 pandemic, the business has had a laser focus on operational risk management plus financial judgment. Also, it focused on immense opportunities in its various markets. During this period, SeaLink was able to secure contracts worth more than A$3.8 billion in revenue for future years, after the acquisition of Transit Systems Group (TSG) in January 2020.

On that note, let us first view SeaLink’s results for FY2020.

- Underlying Net Profit After Tax and before Amortisation was up 47.2% to A$37.2 million as compared to the previous corresponding period.

- The total revenue grew by 152.8% to A$646.5 million on pcp.

- Statutory loss after tax was A$13.5 million primarily due to non-cash and one-off items.

- SLK had a strong gross operating cashflow. The balance sheet was robust, with the net senior debt of A$151 million and gearing of 1.4x.

- Contribution from TSG in line with acquisition metrics

- In the present times, the Group now comprises of 87% contracted revenue plus non-discretionary commuter transport.

- In the last six months, the Company has secured over A$3.8 billion of total contracted revenue.

- Decisive action was taken to slash costs, preserve cash and scale back Marine & Tourism businesses due to COVID-19 restrictions.

- JobKeeper payment eligibility for ~ 15% of SLK’s Australian staff.

- SLK declared a fully franked final dividend of 4.5 cents. Thus, taking the full-year dividend of 11 cents.

INTERESTING READ: How is the Global Shipping Industry Placed Amid COVID-19 Crisis?

Outlook:

The outlook for the Group remains positive. SeaLink is pursuing a strong pipeline of bus contracting opportunities. The Company’s tourism assets are unique and a source of attraction to domestic travellers. SeaLink’s robust balance sheet would help to take advantage of prospects that are coming to market.

The Company has entered FY2021 and is in line with the expectations. The coming year includes a considerable number of organic deals providing opportunities with work already going on proposals for various bus contracts in Sydney. Also, SeaLink expects that during Q2 or Q3 of FY2021, a large bus tender contact in Melbourne will be taken to market.

SLK’s Marine and Tourism division is on the way to re-building its revenue base from domestic travel. However, the challenge might be because of the ongoing border closures domestically as well as internationally. Further, the Company highlighted that they expect a continuing depressed market for Sydney harbour cruises, touring on Kangaroo Island plus Captain Cook Cruises on the Swan River in Perth.

SLK also pointed out that the service improvements in the Sydney bus network will enhance the contribution of the NSW bus operations. The Group will also be taking the chance to use the promising commercial negotiating atmosphere and level to hit better terms for key inputs and drive margin growth throughout its current portfolio.

ALSO READ: Value amid Jittery Earnings Outlook for Travel and Tourism Stocks - WEB, HLO, SLK, FLT

Conclusion:

Despite the challenging environment posed by the bushfire and COVID-19, SeaLink was successful in delivering robust results. The favourable part here is that ~87% of the revenue comes from the government, which indicates a stable incoming revenue. Further, the strategic acquisition of TSG, effective cost control measures, and increased efforts on bus contracting prospects, is instilling confidence in the market participants that helped SeaLink share price end ~7% higher.