Summary

- NAB share price has remained under investors radar in the ongoing COVID-19 environment with the Group taking varying strategic undertakings.

- NAB announced the sale of its 100 per cent MLC Wealth to IOOF Holdings Limited at a purchase price of $1,440 million.

- The Sale and Purchase Agreement is in line with the Banking Group’s strategy to maintain its focus on the core banking business.

- NAB remained in the spotlight as the decision for dividends cut were undertaken in the first half-year amidst the COVID-19 induced volatility.

- NAB’s 3Q20 results ended 30 June were impacted by the COVID-19 induced volatile scenario, subdued demand for credit and low-interest rates along with cost pressure and deterioration in asset quality.

The banking service provider, National Australia Bank Limited (ASX:NAB) driven by changes in the operational performance and recent undertakings continues to remain in the spotlight. The Group is once again garnering attention with its strategic implementations.

Significantly, NAB on 31 August 2020 announced the sale of its 100 per cent MLC Wealth to IOOF Holdings Limited.

The agreement appears to string along with NAB’s strategy to maintain its focus on the core banking business while also building future prosperity for MLC. Notably, NAB in its strategic decision, has announced an exit of MLC in 2018.

NAB earlier on 21 August 2020 had announced the issue of U.S.$1,500,000,000 subordinated notes due 2030.

Furthermore, on 14 August 2020, the banking group released its 2020 third quarter trading update, which indicated a decline in cash earnings growth by 7 per cent, while the unaudited statutory net profit remained at $1.50 billion.

The recent endeavours and performance of the Company in the current COVID-19 impacted landscape seem to steer investor’s interest. With the dividends being axed significantly in Australia, NAB cut back its dividend by 64 per cent to AU 30 cents (paid on 3 July 2020) in its first half-year results for the period ended 31 March 2020.

Adding to the current scenario, the low-interest-rate environment and the default risk is further accentuating the issues.

ALSO READ: Are Commonwealth Bank and Westpac Share prices worth a look post the changed dividend scenario?

All the factors together seem to impact the investors sentiments for the NAB stock, which has a significant market capitalisation standing at $58.99 billion (as on 1 September 2020).

NAB share price, by the end of the trading session, decreased by 2.956 per cent from its last close, and settled at $17.4, on 1 September 2020. The stock of the Company in the past three months fell by 0.11 per cent, while its value dwindled by 26.73 per cent in the last six months.

ALSO READ: Where is NAB share price seem to be moving on ASX200 Index?

With this backdrop, let us look at the latest news that seems to share synergy with the movement of NAB share price.

A Glimpse at the Transaction between NAB and IOOF

NAB entered into a Sale and Purchase Agreement to divest 100 per cent of MLC to IOOF Holdings Ltd (ASX:IFL) at a purchase price of $1,440 million. Notably, IOOF Holdings is an Australia-based financial services company providing advisers and their clients with several financial advice, superannuation, investment management and trustee services.

MLC is a provider of superannuation and investments, along with being a financial adviser to the institutional, corporate, and retail customers.

Commenting on the recent sale, NAB Group CEO, Mr Ross McEwan indicated that it would enable NAB to deliver simpler, more streamlined products and processes, with priority on investment. Mr McEwan expressed that the latest “consolidation has the potential for delivering benefits for clients and members”, with advantages including scale and reduction of complexity, costs, and risks.

Furthermore, he also expected that the combined business could be substantially competitive, an advice-led retail wealth manager.

ALSO READ: Are NAB and Westpac shares still among the best in banks post the axe around dividends?

Summary of the Proceeds

17.3 times multiple of MLC’s cash earnings of ~$83 million is represented by the purchase price worth of $1440. It comprises of:

- Cash proceeds worth $1, 240 million from IOOF Holdings

- $200 million through a 5-year structured subordinated note in IOOF Holdings. It will provide NAB with the chance of participating in the potential value created by combining MLC and IOOF Holdings over the medium term.

Furthermore, NAB is also expected to receive about $220 million of surplus cash in the form of a pre-completion dividend from MLC.

By entering into a transaction with IOOF Holdings, NAB would not incur further strategic investment and separation costs, which would have been necessary for a standalone MLC business.

The Company anticipated that the transaction would result in a post-tax loss on the sale of nearly $400 million. It includes transaction costs and post-tax separation for NAB of around $200 million.

Interesting Read: Banks need A change in Operating Strategy, straight from the horse's mouth- NAB

Scope of transaction

The transaction comprises of MLC Wealth’s advice, asset management businesses, platforms, and superannuation & investments.

As part of NAB’s ongoing customer commitments, the Group indicated that it would hold legal ownership of advice entities of MLC. It would be done in order to conclude advice-related remediation program.

Meanwhile, NAB signalled that as a part of the transaction, other assets of the advice entities, as well as associated personnel of the advice business would be transferred. At the completion of the transaction, the aligned advisers of MLC would be offered an opportunity for transferring to IOOF Holdings’ licenses. For some pre-completion conduct matters, NAB will also provide protection to IOOF Holdings through a combination of warranties, provisions, and indemnities.

NAB will continue offering targeted wealth management products and services via JBWere and nabtrade. A strategic partnership between NAB and IOOF Holdings will also be pursued in the future, covering a range of products and services. It will incorporate a referral agreement via which NAB customers would have access to financial advice.

2020 Third Quarter Trading Update

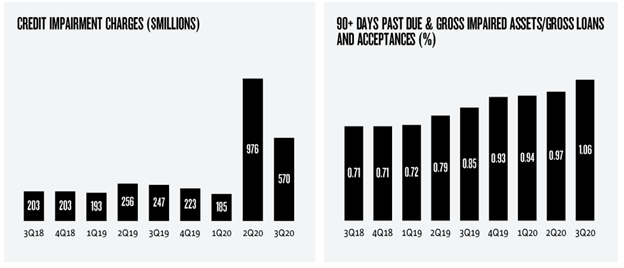

The impact of the pandemic lead volatile situation was largely felt on NAB’s third-quarter results ended 30 June 2020. The credit demand remained subdued and the Group also witnessed headwinds owing to the low-interest rates. Significantly, deterioration in asset quality along with the cost pressure continued to impact the operations of the Company during the quarter.

NAB’s cash earnings (excluding large notable items) rose by 24 per cent in comparison to 1H20 quarterly average. The Group stated its unaudited cash earnings of $1.55 billion. However, the growth earning growth in 3Q20 has dwindled by 7 per cent compared to the previous corresponding period.

ALSO READ: Australian Banking Space Amidst Virus-Induced Volatility; Digitalisation Turning Over a New Leaf

Source: NAB ASX Update, Dated 14 August 2020

Credit impairment charges dwindled 2 per cent to $570 million, compared with the 1H20 quarterly average. COVID-19 Economic Adjustment top-up at March was partially compensated by higher collective charges because of the declining retail asset quality and re-ratings across non-retail exposures, along with higher specific charges concerning some of the single name exposures.