Highlights

- With the surge in demand for EV batteries, investors are of the view that lithium prices would continue to rise.

- The lithium stocks plummeted after Argentina opted to end suspected unfair pricing practices by exporters.

- Argentina's Customs Agency has set a reference price of US$53 per kilogramme for lithium carbonate exports.

The shares of Lithium mining companies plummeted on Wednesday (June 1) after Argentina opted to end suspected unfair pricing practices by exporters, undermining the sector's trust.

According to the AFIP federal tax agency, Argentina's Customs Agency has set a reference price of US$53 per kilogramme for lithium carbonate exports to prevent under-invoicing and promote transparency.

With the surge in demand for electric vehicle (EV) batteries (most of which are lithium-ion batteries), most investors assumed lithium prices would continue to rise.

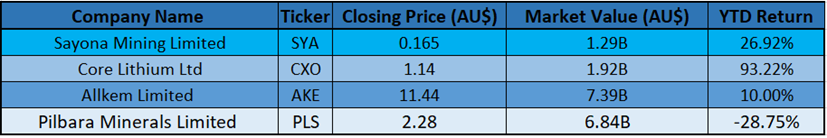

In this article, we will look at YTD performance of four ASX-listed lithium companies.

Image Source: © 2022 Kalkine Media ®

Data Source- ASX website dated 02 June 2022

Sayona Mining Limited (ASX:SYA)

Sayona Mining Limited is a lithium producer with properties in Québec, Canada, and Western Australia.

Sayona's holdings in Québec include North American Lithium, the Authier Lithium Project, and the Tansim Lithium Project, all of which are backed by a strategic collaboration with American lithium producer Piedmont Lithium Inc. (ASX:PLL). In addition, Sayona owns a 60% share in the Moblan Lithium Project in northern Québec.

The Company owns a substantial tenement portfolio in Western Australia's Pilbara region, which is rich in gold and lithium. In the world-class Pilbara region, Sayona is exploring Hemistyle gold opportunities, while its lithium properties are subject to an earn-in arrangement with Morella Corporation (ASX:1MC).

Also Read: Sayona Mining (ASX:SYA) shares gain on funding commitments

Source: © Miflippo | Megapixl.com

Core Lithium Ltd (ASX:CXO)

Core Lithium is working on the Finniss Project, Australia's newest and most advanced lithium project on the ASX in the Northern Territory. The Finniss Project places Core Lithium at the forefront of new global lithium production, with the first production scheduled for delivery by the end of 2022.

The Finniss Project will supply high-grade and high-quality lithium for lithium batteries used in electric vehicles and renewable energy storage worldwide.

Also Read: Here's why Core Lithium (ASX:CXO) shares gained 422% in a year

Allkem Limited (ASX:AKE)

Allkem is a mineral exploration and production company based in Argentina that specialises in lithium and potash exploration. The company was founded in 2021 after the merger of Galaxy Resources and Orocobre.

Source: © Zazimko | Megapixl.com

Pilbara Minerals Limited (ASX:PLS)

Pilbara Minerals is the world's largest, independent hard-rock lithium operation and the top ASX-listed pure-play lithium company. The Pilgangoora Operation, located in Western Australia's resource-rich Pilbara area, produces a spodumene and tantalite concentrate. The quality of operation has drawn the interest of high-quality global partners. Some of them include Ganfeng Lithium, General Lithium, Great Wall Motor Company, POSCO, CATL, and Yibin Tianyi.

Pilbara Minerals is pursuing a growth and diversification strategy to become a sustainable, low-cost lithium producer and fully integrated lithium raw materials and chemicals supplier in the years ahead while continuing to bring low-cost, high-quality spodumene to market.

Also Read: PLS, MIN, AKE: 3 ASX lithium shares to watch out for in June 2022