Summary

- The super pit duo – Northern Star Resources Limited (ASX:NST) and Saracen Mineral Holdings Limited (ASX:SAR) are going strong at super pit gold mine with both miners improving reserves and projecting bumper production.

- As on 30 June 2020, NST’s resources jumped by 67 per cent to stand at 31.8 million ounces, post including depletion of 912,000 ounces and acquisitions of KCGM and the Bronzewing Project.

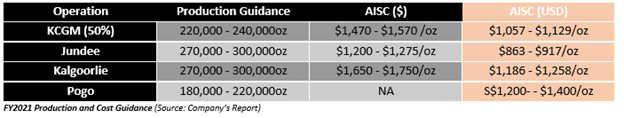

- NST now presents strong FY2021 production guidance of 760,000 to 840,000 ounces of gold for Australian operations with an all-in sustaining cost (or ASIC) of $1,440 to $1,540 per ounce.

- Likewise, the super pit partner – SAR, which reported a record profit for FY2020 is strongly betting on the development of the super pit to hit another year of record production.

The super pit duo – Northern Star Resources Limited (ASX:NST) and Saracen Mineral Holdings Limited (ASX:SAR) are once again the talk of the town after smashing performance delivered by these gold miners in FY2020.

The year 2020 has been the year of a gold gush with gold spot prices rallying from a seven-year high to a record high, fuelling gold stocks across the global front.

The surge in gold prices has opened new investment gates for gold mining companies, especially across Western Australia, leading to a surge in production volumes with some such as Ramelius Resources Limited (ASX:RMS), and Saracen Mineral Holdings Limited (ASX:SAR), witnessing record productions.

Also Read: Ramelius Upgrades Record Production Guidance for FY20, While NST Offloads Ashburton Project in WA

Post an impeccable year, the super pit duo is back in action with the latest turnaround in reserve and resources and future guidance.

NST Reserves Surges Twofold

As on 30 June 2020, resources of the Company jumped by 67 per cent to stand at 31.8 million ounces, post including depletion of 912,000 ounces and acquisitions of KCGM and the Bronzewing Project.

- The resource per share surged by 179 per cent in the last five years while the Measured and Indicated Resources soared by 94 per cent at 20.8 million ounces, underpinning continued replacement of Reserves in coming years.

- Out of the increased resources, the Kalgoorlie Consolidated Gold Mine (or KCGM) held 9.6 million ounces while the other assets held 22.3 million ounces, marking an increase of 3.2 million ounces.

On the reserves counter, as on 30 June 2020, the reserves of the Company soared twofold to stand at 10.8 million ounces, including depletion of 912,000 ounces, underpinning strong growth in forecast production.

- The reserves per share surged by 348 per cent over the last five years, and NST suggested that the reserve calculation is conservative with an assumed gold price of $1,750 per ounce and USD 1,350 per ounce against the current spot of ~ $2,700 per ounce (Australia) and USD 1,940 per ounce (international).

- The KCGM reserves stood at 4.85 million ounces while other assets held 6 million ounces, representing a gain of 12 per cent.

In the wake of solid growth in resource and reserve estimates, NST presented strong FY2021 production guidance of 760,000 to 840,000 ounces of gold for Australian operations at an all-in sustaining cost (or ASIC) of $1,440 to $1,540 per ounce.

On the exploration counter, the Company has budgeted $101 million for exploration in FY2021 as a part of its strategy for ongoing growth in production, mine lives and cashflow. The exploration budget is further subdivided into $21 million for Pogo, $28 million for Jundee, $35 million for KCGM, and $11 for regional exploration.

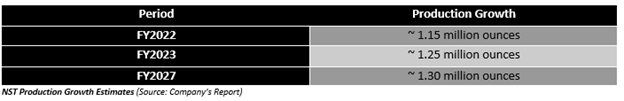

In a nutshell, the Company estimates the production to grow over coming years while the AISC would decline in the wake of increased production base.

Furthermore, NST estimates the AISC would fall by 10 per cent to stand below USD 1,000 per ounce over the next two or three years.

Saracen Inks Record Profits for FY2020 and Updates Production Estimates

SAR reported a record statutory NPAT of $189.7 million, up by 105 per cent against the prior year while the underlying NPAT of the Company surged by 173 per cent to reach a record of $257.5 million.

- The yearly revenue of the Company jumped by 93 per cent to reach $1,074.0 million while reporting an EBITDA of $447.6 million, up by 104 per cent against the prior year.

To Know More, Do Read: Gold Player That Has Beaten Guidance Over Many Years! Strong Tailwinds An Icing on the Cake

Furthermore, the strong revenue growth was well supported by the record gold production of 520,414 ounces of gold, which remained 47 per cent up against the prior year.

Just like its super pit partner, SAR is also focusing on developing its KCGM asset and increasing the production line.

- The Company is now making to the latest headlines post updating its resources and reserves from 12 million ounces and 6.3 million ounces of non-JORC complaint to 19.0 million ounces and 9.7 million ounces of JORC compliant, respectively.

Moreover, SAR suggested that the current reserves now support a 15-year of mine visibility.

In the wake of a surge in reserves estimate, the Company is aiming a strong production from KCGM with the FY21 guidance of 440,000 to 480,000 ounces of gold at an AISC of $1,470 to $1,570 per ounce.

Moreover, SAR aims for another record year of production for FY2021 with production guidance of 600,000 to 640,000 ounces of gold at an AISC of $1,300 to $1,400 per ounce.

Also, SAR stated that it is on course to produce 800,000 ounces of gold per year.

To summarise, post witnessing a bumper year of strong production and profit, the super pit duo is now focussing on developing KCGM asset to bring a turnaround in the production profile of the super pit.

And, considering the recent upgrade is resources and reserves profile, both miners are projecting record production over the years ahead with a sustainable cost.