Summary

- With the earnings season on, companies reporting better-than-expected results, or an impressive outlook are garnering investor attention which is getting reflected in the stock movement.

- ST Barbara reported an increase in gold production from 91,547 ounces in Q3 FY2020 to 108,612 ounces in Q4 FY2020.

- Aurelia Metals noted a significant increase in the cash balance from A$51.4 million in Q3 FY2020 to A$79.1 million in Q4 FY2020.

- Dacian Gold was able to repay A$30.6 million debt during the period.

The earnings season is on, and market participants are actively looking out at firms reporting better than anticipated financial numbers or indicating a favourable outlook. The companies have been announcing financial and operational updates over the previous quarter that help gauge the position of a company in this volatile environment.

Many businesses were impacted adversely while some were able to tackle the COVID-19 pandemic, which is validated by their impressive numbers over the challenging period.

In this article, we have covered a few ASX-listed companies from diverse sectors that have recently announced their quarterly results and ended in the green at the end of the trading session.

ST Barbara Limited (ASX:SBM)

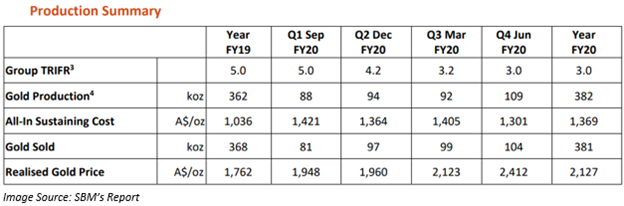

Australian gold producer and explorer ST Barbara Limited released its Q4 quarterly reports for the quarter ended 30 June 2020 on 29 July 2020. Below are the key highlights:

Q4 FY2020 Highlights:

- Gold production, which was 91,547 ounces in Q3 FY2020, increased to 108,612 ounces in Q4 FY2020.

- All-In Sustaining Cost was A$1,301 per ounce.

- Operational cash contribution in Q4 was A$126 million.

FY2020 Summary:

- 12-month rolling TRIFR which was five as on 30 June 2020 declined to three by 30 June 2020.

- FY2020 consolidated gold production was in line with the guidance, and it stood at 381,887 ounces.

Financial Highlights:

- Total cash at bank and term deposits increased from A$320 million in Q3 FY2020 to A$405 million in Q4 FY2020.

- Total debt with the company was A$316 million. Out of this, A$200 million was supposed to be paid by July 2020.

- Average realized gold price in Q4 FY2020 was A$2,412 per ounce. It includes 26,890 ounces provided into hedge contracts in Q4.

Outlook:

- In FY2021, the company expects the consolidated gold production in the range of 370k -410kounces at an AISC of between A$1,360 and A$1,510 per ounce.

- Sustaining capex would lie in the range of A$97 million and A$115 million.

- The exploration expenses would range from A$30 million and A$35 million.

Stock Information:

SBM stock ended the session at A$3.620 on 5 August 2020, up 5.233% from the previous close.

Aurelia Metals Limited (ASX:AMI)

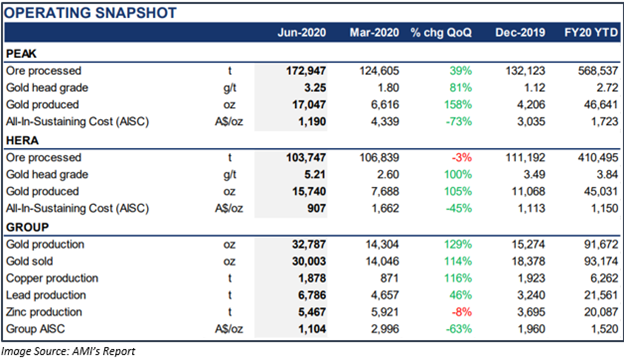

Engaged in gold and base metal mining & exploration, Aurelia Metals Limited released its Q4 FY2020 report for the period ended 30 June 2020.

- The Group gold production during the quarter was 32.8 koz at Group AISC of A$1,104/oz.

- High-grade gold mineralization intercepted in drilling at Kairos and Peak North.

- The estimate for Maiden Federation Mineral Resource was 2.6 Mt at 7.7% Pb, 13.5% Zn, 0.8g/t Au & 9g/t Ag.

- Cash balance which was A$51.4 million in Q3 FY2020 increased significantly to A$79.1 million in Q4 FY2020 and has no debt.

Stock Information:

AMI stock ended the session at A$0.595 on 5 August 2020, up 6.25% from the previous close.

Mesoblast Limited (ASX:MSB)

Mesoblast Limited, a global leader in allogeneic cellular medicines for inflammatory diseases, has provided an update on the upcoming milestones for its lead product candidate remestemcel-L. It also provided an activity report for Q4 FY2020.

Remestemcel-L Update:

The independent Data Safety Monitoring Board (DSMB) has fixed a date for early September to finalize the first interim assessment of the Phase 3 study of remestemcel-L in COVID-19 patients who are on ventilator support having mild to severe acute respiratory distress syndrome.

The trial’s first 90 patients will have finished 30 days of follow up during August. Post that the DSMB will do an interim assessment review of the safety and efficacy data. Based on the outcome, DSMB will update the company whether it should proceed as Vs Host Disease:

The Oncologic Drugs Advisory Committee (ODAC) of the US Food and Drug Administration (FDA) scheduled a meeting for 13 August 2020 to access the data which support the MSB’s Biologics License Application for the consent of RYONCIL in the treatment of steroid-refractory acute graft vs host disease in children.

Cash Flow Highlights:

- Net cash used in operating activities: US$19.582 million.

- Net cash used in investing activities: US$1.868 million.

- Net cash from financing activities: US$88.915 million.

- Cash and cash equivalents at the end of the period: US$129.328 million.

ALSO READ: Mesoblast Soars 10% on ASX, US FDA Set To Review Remestemcel-L Data

Stock Information:

MSB stock ended the session at A$4.300 on 5 August 2020, up 4.369% from the previous close.

Dacian Gold Limited (ASX:DCN)

Gold exploration and mining company, Dacian Gold Limited released its Q4 FY2020 results for the period ended 30 June 2020.

Mt Morgans Gold Operation (MMGO):

- In June 2020 quarter, 31,883 ounces of gold was recovered at an MMGO AISC of A$1,562 per oz.

- Gold recovery for FY2020 was 138,814 ounces at MMGO AISC of A$1,619 per oz. The gold recovery was within the guidance range.

- For FY2021, the company expects its operating guidance to range from 110,000-120,000 ounces at an AISC of A$1,400 to A$1,550 per oz.

Exploration:

- Noted considerable intercepts from infill & expansionary drilling at the Phoenix Ridge, McKenzie Well and Mt Marven deposits.

- In 1H FY2021, the drilling program at the Cameron Well and Mt McKenzie deposits started.

- Resource definition drilling is under progress at Ganymede and Morgans North deposits.

Corporate:

- The post of cash and the unsold gold on hand at 30 June 2020 stood at A$57.3 million.

- Total debt by the end of 30 June 2020 was A$64.1 million after the repayment of A$30.6 million.

Cash Flow Highlights:

- Net cash used in operating activities: A$13.357 million.

- Net cash used in investing activities: A$5.266 million.

- Net cash from financing activities: A$60.798 million.

- Cash and cash equivalents at the end of the period: A$51.976 million.

Stock Information:

DCN stock ended the session at A$0.380 on 5 August 2020, up 8.571% from the previous close.