Summary

- Gold spot has been the best performer of the year so far with prices reaching a new seven-year high of USD 1,818.13 per ounce recently.

- The surge in gold prices has drawn attention of the market participants towards ASX-listed gold stocks, propelling them to gain considerable momentum.

- While for some miners, the high gold prices has transcended into a strong financial position, some have faced operational challenges over the restriction imposed by various governments, leading to lower production.

- However, despite several challenges, the high gold prices along with the overall market sentiment have supported the share price of many gold stocks on the exchange despite a poor performance in June 2020 quarter.

The gold spot has been the commodity of the year 2020 so far with prices rallying considerably on back of considerable market risk that has emerged across the global front. The global market has witnessed a lot of turmoil since the beginning of the year 2020 with several economic segments witnessing lower activity, posing a lot of unprecedented challenges.

In the middle of such challenges, gold prices have skyrocketed to a seven-year high over market pessimism and need for safety to safeguard returns. In the wake of such events, ASX-listed gold stocks have captured a lot of interest from the market, leading to a surge in their share price.

Furthermore, amidst spiked prices, many ASX-listed gold miners have cemented their financial position by fast-tracking the sales and production procedures; however, for some, the restriction imposed by several governments to contain the COVID-19 spread had posed a lot of operational headwinds, which is has impacted their quarterly performance.

To Know More, Do Read: Gold Rush and Eight ASX Momentum Gainers- SAR, NST, NCM, EVN, RMS, WAF, GOR, PRU

St Barbara Limited (ASX:SBM)

Record Gold Production for FY20

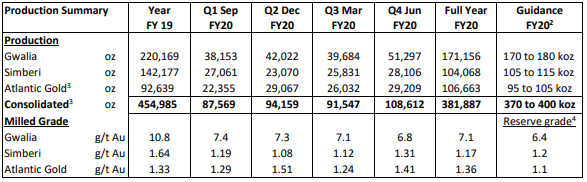

The miner produced 381,887 ounces of gold during the financial year 2020 (FY20), which remained in line with the full-year production guidance of 370,000 to 400,000 ounces of gold.

Furthermore, the quarterly production stood at 108,612 ounces during the June 2020 quarter, up by ~ 18.64 per cent against the previous quarter, with this, St Barbara has for the first time produced more than 100,000 ounces in a quarter since Q4 June FY18.

- The Company witnessed a record production of 106,663 ounces of gold at the Atlantic Gold prospect for FY20 while producing 29,209 ounces at an average milled grade of 1.41 gram/tonne during the June 2020 quarter, supported by higher than forecasted mill throughput and recovery during the period.

- The gold production from Gwalia prospect stood at 171,156 ounces for FY20 while the production for June 2020 quarter standing at 51,297 ounces. Also, the prospect milled 224 kt of ore with an average grade of 6.8g/t, representing the highest mill throughput since 2014.

SBM informed the exchanges that the improved production from the prospect was mainly due to the implementation of improved processes and procedures post an external operational review.

- The Simberi prospect produced 104,068 ounces of gold in FY20 while producing 28,106 ounces at an average grade of 1.31g/t during the June 2020 quarter, higher than the anticipation due to the mining of higher grade zones in Botlu and Sorowar central pits.

On the liquidity front, total cash at bank and term deposits stood at $406 million at the end of the June 2020 quarter, up by ~ 26.87 per cent against the previous quarter, with a total debt of $316 million, unchanged against the previous quarter.

The snippet of the production for FY20 and the June 2020 quarter is as below:

Source: Company’s Report

The stock of the Company last traded at $3.540 (as on 14 July 2020), down by 1.39 per cent against its previous close on ASX.

Dacian Gold Limited (ASX:DCN)

DCN produced 31,883 ounces of gold during the June 2020 quarter, down by ~ 3.38 per cent against the lower range of the guidance of 33,000-36,000 ounces; however, the full-year production remained in line with the production guidance of 138,000 to 144,0000 ounces.

DCN suggested that the production for the June 2020 quarter was mainly impacted by a slower than planned open-pit mining rates at the Heffernans open pit, which in turn, further delayed the access to higher-grade ore.

However, the Company stated that mining rates at Heffernans are now improving and set to increase overall as mining at Doublejay reaches steady state while Mt Marven ramps up.

Three-Year Updated Outlook

- The Company downgraded the FY21 production guidance from 12,000-13,000 ounces of gold to 110,000-12,000 ounces due to a combination of the cessation of mining activities at Westralia four months earlier than planned and rescheduling of the Jupiter open pit.

- Furthermore, DCN increased the estimation of all-in sustaining cost from $1,250-$1,350 per ounce to $1,400-$1,550 per ounce in order to reflect the new expenditure accounting for Mt Marven expansion and Morgans North open pits.

The Company anticipates that the average annual production to remain at 110,000 ounces from FY2021 to FY2023 with an AISC of $1,425 per ounce with total operating (AISC) and development capital change of ~ $60 million or $185 per ounce.

Underground Strategy and Exploration Plans

DCN has developed a holistic underground strategy across the MMGO complex, which hosts a total underground Mineral Resource of ~ 1 million ounces, and at present, numerous workstreams to formulate an operating strategy is underway, including a $6 million drill drive and DD program.

Furthermore, a $15 million exploration program is underway with drilling campaigns across several deposits, including Phoenix Ridge, and McKenzie Well.

Corporate Update

Just like its peer, Northern Star Resources (ASX:NST), the Company is reducing down the hedge book with ~ 84,589oz at a gold price of $2,055/oz remaining on 30 June 2020, reflecting approximately 25 per cent of the Company’s three-year outlook.

To Know More, Do Read: Elevated Gold Spot Prices Transcending into Strong Financial Position for Saracen and Northern Star

The stock of the Company last traded at $0.310, (as on 14 July 2020), down by 3 per cent against its previous close on ASX. The stock is down 20% in the past 2 days.

_09_03_2024_01_03_36_873870.jpg)