Summary

- Crown Resorts, one of Australia's prominent entertainment groups, reported significant impact on FY20 performance, owing to closure of gaming activities and a significant part of non-gaming operations amid COVID restrictions.

- CWN received financial assistance under government's JobKeeper scheme and rolled out additional programs to support its employees.

- Gaming activities re-commenced at Crown Perth and Crown Aspinalls, while Crown Melbourne remains closed, owing to Victoria being in Stage 4 restrictions.

Crown Resorts Limited (ASX:CWN) is one of Australia’s largest entertainment groups, making a significant contribution to the Australian economy. ASX200 Stock CWN has delivered a return of more than 9 per cent in the last one-month period, while its one-year return was noted at a negative 13.81 per cent, as of 19 August 2020. On 20 August 2020 (AEST 02:31 PM), CWN was trading at AUD 9.48, down by 3.27 per cent, with a market cap of AUD 6.42 billion.

On 19 August 2020, CWN released its full-year results for the period ended 30 June 2020, which its CEO and Managing Director, Ken Barton, highlighted as an extremely challenging year.

Mr Barton stated that the Company began to experience softer trading conditions from late-January 2020, owing to COVID-19 driven travel restrictions and general community uncertainties. Results for FY20 reflect the impact of closure of gaming activities and a significant part of non-gaming operations for an extended period.

Financial Highlights for FY20

- Reported EBITDA of AUD 504.6 million, down by 40.6 per cent.

- Reported NPAT attributable to the parent of AUD 79.5 million, down by 80.2 per cent.

- Theoretical EBITDA before closure costs and significant items of AUD 503.8 million, down by 37.2 per cent.

- Theoretical NPAT attributable to the parent before closure costs and significant items of AUD 161.0 million, down by 56.3 per cent.

- Closure costs of AUD 81.6 million (net of tax).

- CWN decided not to declare a final dividend, consequently, total full-year dividend stood at 30 cents per share.

FY20 Australian Resorts Performance

- Actual revenue of AUD 2,214.9 million, down by 25.7 per cent

- Theoretical revenue of AUD 2,091.1 million, down by 29.2 per cent

- Main floor gaming revenue of AUD 1,235.2 million, down by 26.9 per cent

- VIP program play turnover of AUD 20.4 billion, down by 46.5 per cent

- Actual VIP revenue of AUD 398.2 million, down by 26.0 per cent

- Non-gaming revenue of AUD 581.5 million, down by 22.7 per cent.

Digital Platform Update

Crown's digital offerings include -

- Betfair Australasia, a 100 per cent owned, online betting exchange

- DGN Games, an 85 per cent owned, online social gaming business

Wagering and online social gaming operations continued throughout the year with EBITDA noted at AUD 34.7 million, up by 32.9 per cent year-on-year, on the back of robust performances from both Betfair and DGN.

Good Read: Five tips for Investors looking at Casino and Entertainment Stocks

COVID-19 Impact on Business

Business shutdown amid challenging environment: In March 2020, during the lockdown implementation, CWN had to close its gaming activities and some part of non-gaming operations in Melbourne and Perth. The actions followed directions by relevant State and Federal Governments.

Gaming activities at Crown Melbourne and Crown Aspinalls remained closed through to end-June 2020.

Supporting Employees: Owing to the mandated closure of its properties, approximately 95 per cent or more than 11,500 of the staff was stood down during the closure.

Due to the impact on businesses, the Company qualified for the JobKeeper program, recording AUD 43.4 million in payroll subsidies for employees that continued to work in either a full or partial capacity, and AUD 67.9 million in payments on behalf of employees that were stood down, both relating to the period through to 30 June 2020.

Furthermore, Crown has established a Hardship Fund for additional support to the employees facing severe financial hardship. The Company is also running other programs to aid employees during the unprecedented crisis.

Cash Flow and Debt Condition

For FY20, net operating cash flow stood at AUD 326.9 million, significantly down from AUD 778.1 million in FY19. Capital expenditure for the period was noted at AUD 746.2 million that included the acquisition of 50 per cent ownership interest of Schiavello Group in the One Queensbridge development site as well as all pre-development assets for nearly AUD 80 million, and dividend payments of AUD 406.2 million.

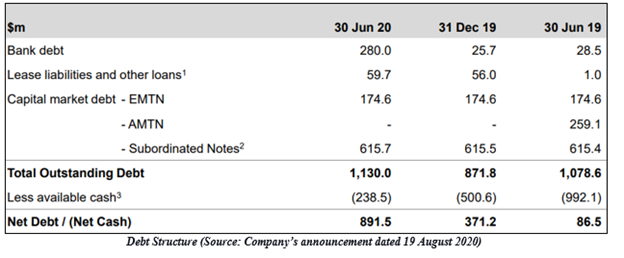

At end-June 2020, Crown's net debt position was AUD 891.5 million, including a total debt of AUD 1,130.0 million and cash (excluding working capital cash) of AUD 238.5 million.

Total liquidity, excluding working capital cash, was AUD 639.8 million including AUD 238.5 million in available cash and AUD 401.3 million in committed undrawn facilities, at 30 June 2020.

Business Update

Crown Perth re-started operations from 27 June 2020, including gaming activities and majority of its food & beverage venues, under temporary restrictions agreed with the state government. The Company reported encouraging initial training.

Gaming activities re-commenced at Crown Aspinalls on 15 August 2020; however, Crown Melbourne remained closed, as Victoria remains in Stage 4 restrictions.

Construction work at Crown Sydney in New South Wales continued uninterrupted and is on track for its scheduled opening in December 2020. The project is already offering significant employment for Australian businesses with nearly 1,300 people currently employed. In future, the facility is expected to employ more than 2,000 people.

Amid this challenging environment, CWN’s priority remains on health and well-being of team members, guests and community at large. To ensure the business is well-placed, the Company is focused on liquidity management. The update highlighted support received from relationship lenders, implementation of new bilateral facilities during the year and execution of the Crown Sydney financing facility following year-end.

Must read: Casino, Wagering and Gaming Stocks to Look at: CWN, ALL, PBH, BET