Highlights:

- The electric vehicle market is experiencing high demand worldwide as countries look to cut down both environmental pollution and fuel costs.

- This type of battery-driven vehicle was first introduced in the 19th century.

An electric vehicle (EV) is a battery-driven vehicle. It was first introduced in the 19th century. EVs are environmentally friendly and cost-effective as they eliminate the usage of fuel.

Of late, the EV market has been experiencing high demand across the world due to several factors. The primary reason behind the rising demand for EVs is their ability to cut down on environmental pollution.

This article features three ASX-listed EV stocks and their performance on the ASX: Pilbara Minerals Limited (ASX:PLS), Ampol Limited (ASX:ALD), and Liontown Resources Limited (ASX:LTR).

Pilbara Minerals Limited (ASX:PLS)

Shares of Pilbara Minerals Limited opened Friday’s trading session on a positive note on the ASX. The company’s share price gained marginally by 0.751% on the ASX to AU$5.360 per share at 11:00 AM AEDT today.

With a market capitalisation of AU$15.93 billion, Pilbara is an ASX-listed lithium and tantalum explorer and producer. Pilbara’s headquarters are in Western Australia.

Today Pilbara Minerals announced that it has successfully secured a debt facility from the Australian government through the Export Finance Australia (EFA) and Northern Australia Infrastructure Facility (NAIF).

NAIF has agreed to finance up to AU$125 million and EFA will fund a US$ equivalent of AU$125 million as a part of this debt facility. The term of the debt facility is 10 years.

The funding will be solely for the purpose of supporting Pilbara Minerals’ expansion of the Pilgangoora Operation in the Pilbara region of Western Australia.

However, the debt facility is dependent on several factors, such as approval of financial documents and the satisfaction of conditions precedent to drawdown. On the other hand, the NAIF facility is also pending approval from the Western Australian government.

Meanwhile, the share price of Pilbara has increased significantly, by over 129%, on the ASX in the last 12 months. On a year-to-date (YTD) basis, its share price has shot up over 52% on the ASX (as of 11:00 AM AEDT today).

Ampol Limited (ASX:ALD)

Image source: © Patongens | Megapixl.com

Shares of Ampol Limited were buzzing in the green territory on the ASX during the morning trading hours on Friday. The company’s share price gained by 1.226% to AU$28.050 per share at 11:06 AM AEDT.

Ampol is involved in the business of petroleum and vehicle fuels in Australia. It has a market capitalisation of AU$6.60 billion. Ampol’s headquarters are located in New South Wales, Australia.

On 25 October 2022, Ampol released its unaudited financial results for the nine-month period that ended on 30 September 2022. The following are key highlights from Ampol’s financial results:

- Ampol delivered an EBIT of over AU$1 billion in the given period, with AU$272.3 million of EBIT in the third quarter itself. As per Ampol's ASX release, the company is on track to deliver record full-year earnings.

- Ampol’s Lytton refiner margin in the third quarter remained above historical averages at US$15.46/bbl, compared with US$6.76/bbl in the previous corresponding period. The total production of Lytton during the quarter was 1,546 million litres.

- Convenience Retail and Z Energy have shown improvement in business as a result of higher demand and ease in fuel prices.

- The company recorded a 20% gain in sales volume in Australia during this period compared with the previous corresponding period. Ampol’s Australian quarterly sales volume touched 3,661 million litres, the highest level since the start of the pandemic.

- Ampol also reported a 22% sales volume gain in its Australian wholesale business. Total group sales volume for the quarter touched 5,615 million litres.

Meanwhile, the share price of Ampol has declined by 7.40% on the ASX over the last 12 months. Furthermore, on a YTD basis, the company’s share price has fallen by almost 7% on the ASX (as of 11:06 AM AEDT today).

Liontown Resources Limited (ASX:LTR)

Image source: © Miflippo | Megapixl.com

Shares of Liontown Resources Limited were spotted trading in the green zone on the ASX during the morning trading hours on Friday. The company’s share price stood at AU$2.035 per share after gaining 2.261% on the ASX at 11:33 AM AEDT.

Liontown is an ASX-listed base and precious metal explorer in Australia with its headquarters in Perth, Western Australia. It has a market capitalisation of AU$4.37 billion.

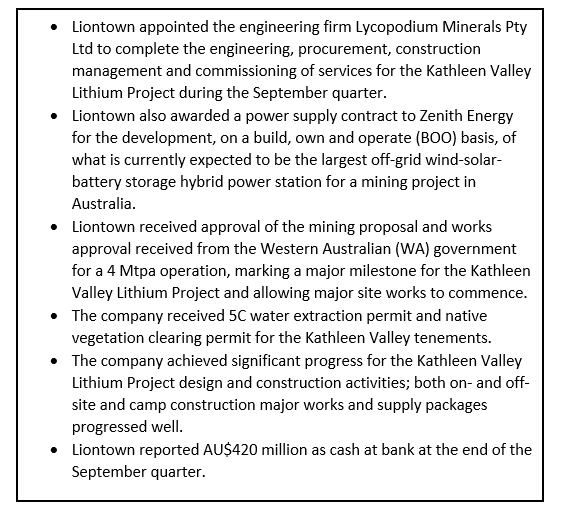

On 31 October 2022, Liontown shared its quarterly activity report for the period that ended on 30 September 2022. The following are key points from the quarterly activity report:

The share price of Liontown has gone up by almost 24% on the ASX over the last year. Furthermore, on a YTD basis, the company’s share price has gained by 16% (as of 11:33 AM AEDT today).

Meanwhile, the S&P/ASX 200 Materials sector (INDEXASX:XMJ) was quoted at 16,914 points, up by 3.419% or 559.2 points, at 11:53 AM AEDT today.

On the other hand, the S&P/ASX 200 Energy sector (INDEXASX:XEJ) was quoted at 11,563.5 points, up by 0.945%, on the ASX at 11:54 AM AEDT today.