Highlights:

- Outbreak of Omicron, Russia-Ukraine war and inflation have had significant impacts on the Australian stock market.

- Since the beginning of 2022, till date, Australian stock market’s benchmark index S&P/ ASX 200 has registered a fall of 7.79%.

- On 30 August 2022, the benchmark index closed higher with all major eleven sectors closing in green.

Australian stock market index, S&P/ASX 200 has been quite volatile since the beginning of 2022 as inflation kicked in at the beginning of the year. Also, the breakout of the omicron variant in Australia and the Russia-Ukraine war had a substantial impact on the stock market.

On a year-to-date basis, ASX 200 has dropped by 7.79%, and in the last six months, it has corrected by 1.38%. On Tuesday (30 August 2022) ASX 200 closed 0.47% up at 6,998.30 points.

To get a better picture of the volatility in the Australian market, let’s take a look at the real time volatility index, S&P/ASX 200 VIX (INDEXASX:VIX), which has gained 41.01% on a year-to-date basis and in last five trading sessions, it has increased by 6.90%. Today, it closed 1.84% lower than the previous close at 15.29 points.

On the backdrop of these statistics, let’s see how some of major ASX50 stocks have performed in the volatile market. Discussed here are, BHP Group Limited, Fortescue Metals Group Limited, Telstra Corporation Limited, CSL Limited, Coles Group Limited and Rio Tinto Limited.

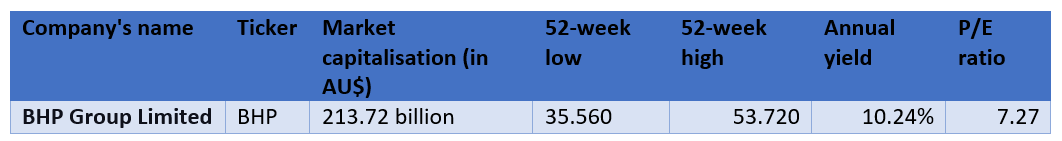

BHP Group Limited (ASX:BHP)

Australian mining giant, BHP produces potash, nickel, metallurgical coal, iron ore and copper. As per the company’s website, it operates in over 90 locations, including Canada, the United States, South America and Australia.

In the financial year 2022 (FY22), BHP reported a surge of 34% in profit from operations and delivered a record underlying EBITDA of US$40.6 billion and a free cash flow of US$24.3 billion.

BHP’s board has announced a final dividend of US$1.75 per share, taking the full-year dividend to US$3.25 per share. The tentative payment date is 22 September 2022.

Today, BHP closed 1.042% down at AU$41.750 per share. With this, the year-to-date fall reached 1.49%.

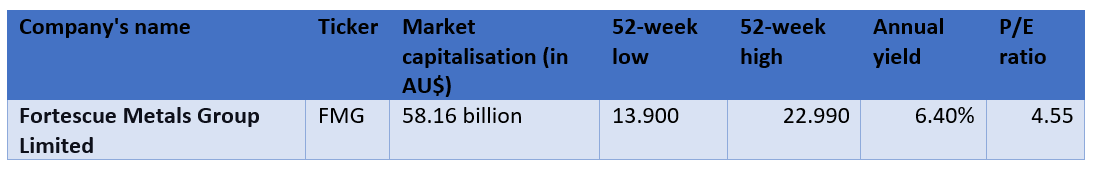

Fortescue Metals Group Limited (ASX:FMG)

Global green energy and resources company, Fortescue has delivered record annual shipments during FY22. 189.0mt of iron ore was shipped, 4% higher than FY21. Record shipment resulted in the second highest operating cash flow and earnings in the company’s history.

Net profit after tax of US$6.2 billion and net cash flow from operations of US$6.6 billion was recorded.

For the full year of 2022, the company has distributed AU$2.07 per share in dividends. The final dividend announced by the company is AU$1.21 per share, payable on 29 September 2022.

Fortescue share price closed 0.317% up at AU$18.950 per share. With this, the year-to-date fall reached 4.53%.

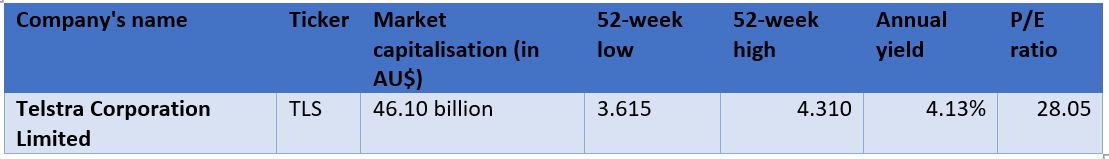

Telstra Corporation Limited (ASX:TLS)

Provider of information and telecommunication services, Telstra is an AU$46.10 billion market cap company. Four years ago, the company launched Telstra2022 strategy, and after its completion in FY22, Telstra announced a hike in its dividend.

Telstra’s board declared a dividend of 8.5 cents per share, taking the yearly dividend to 16.5 cents per share. The dividend is fully franked, and the tentative payment date is 22 September 2022.

Despite the successful completion of the T22 strategy, the company posted a fall of 4.7% in the total income. EBITDA declined by 5% to AU$7.3 billion, and NPAT diminished by 4.6% to AU$1.8 billion.

Telstra share price closed 0.250% down at AU$3.980 per share. With this, the year-to-date fall reached 5.69%.

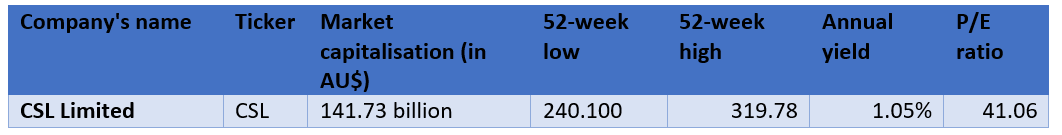

CSL Limited (ASX:CSL)

Manufacturer, developer and marketer of diagnostic and pharmaceutical products, CSL has reported a net profit after tax of AU$2.255 billion in FY22. The revenue during the year grew by 3%. Reportedly, the company met the top end of its guidance despite the challenging environment presented by the ongoing Covid-19 driven pandemic.

The company announced a final dividend of US$1.18 per share, franked at 10%. It brought the total dividend to US$2.22 per share.

The tentative payment date of the final dividend is 5 October 2022.

CSL share price closed 0.115% down at AU$293.900 per share. With this, the year-to-date fall reached 0.71%.

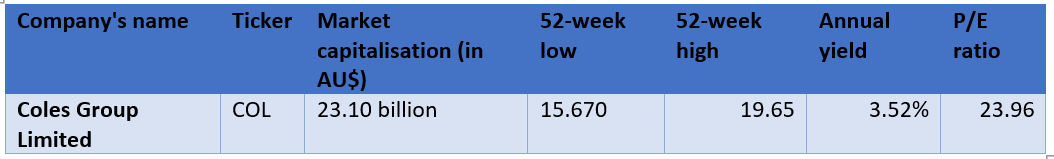

Coles Group Limited (ASX:COL)

Australian retailer, Coles reported a 2% surge in its sales revenue despite the disruption created by the flood and Covid-19 driven pandemic. Net profit after tax surged by 4.3% to AU$1,048 million. EBITDA and EBIT were stable during the year. Basic earnings per share grew by 4.6% to 78.8 cents.

Despite a little growth in the NPAT, the company increased its final dividend by 7.1% to 30 cents per share, bringing the total dividend to 63 cents per share.

Coles share price closed 0.64% up at AU$17.40 per share. With this, the year-to-date fall reached 2.79%.

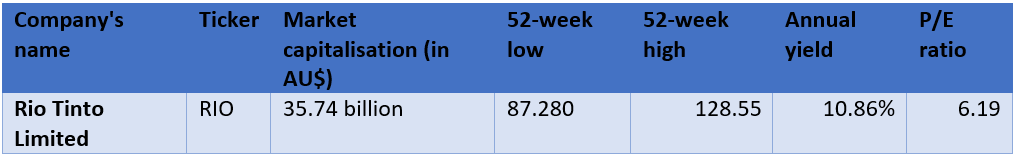

Rio Tinto Limited (ASX:RIO)

Rio is a minerals exploration organisation that produces those minerals which are essential for low-carbon transition, such as iron ores, copper, and Aluminium, to name a few.

In the first half of FY22, the company reported a 28% decrease in profit after tax and a 26% fall in underlying EBITDA. Free cash flow during these six months fell by 30% and sales revenue by 10%.

The company announced an interim dividend of AU$4.3 billion or 267 cents per share. The dividend amount represents 50% of Telstra’s underlying earnings, consistent with the company’s policy of paying out 50%.

Rio share price closed 0.799% down at AU$95.520 per share. With this, the year-to-date fall reached 4.18%.

.jpg)