Summary

- The e-learning sector has been growing swiftly ever since the pandemic outbreak, with an uptick in the number of public and private courses being offered to advance the students' skills.

- Amid COVID-19, 3PL’s people and services did not witness a negative impact. Instead, the Company experienced a rising demand for its products, though with local market dynamics.

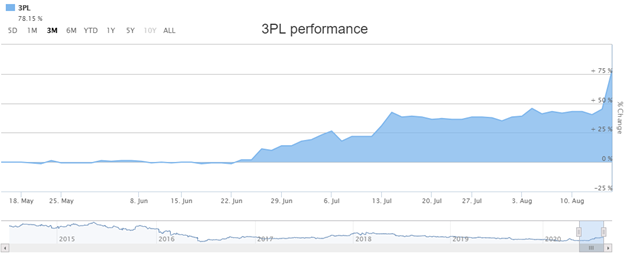

- On 14 August 2020, 3PL’s share price witnessed a whopping increase of 22.374 per cent in its share price. The soared share price was buoyed by the announcement that 3P Learning had entered into a Scheme Implementation Agreement (SIA) with a global online learning platform, IXL Australia. The agreement would witness 3PL’s shareholders receiving AU$1.35 for every share held.

- Furthermore, on the same day, 3PL unveiled its FY20 results ended 30 June and divulged that the Company’s FY20 results ended with a robust product portfolio along with enhanced teacher and student experiences.

- 3PL entered FY21 with strong operating leverage, authorising its existing headcount to drive considerable revenue growth at high margins.

While numerous nations and businesses are still battling with COVID-19, one of the sectors that had garnered attention and has emerged stronger from the unprecedented crisis is the online education sector.

E-learning space has been experiencing expansion as numerous schools, colleges, educational institutions, and universities across the globe have been leveraging online learning platforms to sustain the teaching-learning process.

Numerous players in the online education space have been swiftly adopting new technologies such as cloud-based services and AI, to cope up with the ever-changing world.

Did you read; What Could Be the New Technology Trends Post-COVID-19?

Moreover, with the prolonged crisis, e-learning could potentially thrive as an auxiliary service to traditional teaching post the lockdown phase, as well.

Did you read; Impact on e-learning business post lockdown

One of the Australia-based online education company, 3P Learning Limited (ASX:3PL) with a suite of learning resources designed for schools as well as families, is booming in the present technology-driven scenario.

Source: ASX, dated 17 August 2020

3PL’s share price has been swaying on ASX and has generated a 78.15 per cent return over the last three months. On 14 August 2020, 3PL closed the day’s trade at AU$1.345, up by 22.831 per cent. However, on 17 August, 3PL was trading at AU$1.335 (at AEST 1:43 PM), down by 0.743%.

Moreover, on 14 August, 3P Learning released its financial results for full year ended 30 June 2020 and notified that it had entered Scheme Implementation Agreement (Scheme) with IXL Australia, as discussed in the article.

Did you read; Will Governments encourage WFH, e-learning in the future? What does it mean for IT infrastructure development?

With this backdrop, let us apprise ourselves with the latest updates from the Company.

Scheme Implementation Agreement (SIA) with IXL Learning, Inc. and IXL Australia Pty Ltd

3P Learning entered into a Scheme with a global online learning platform, IXL Learning, Inc. (IXL) and its 100% owned subsidiary, IXL Australia Pty Ltd (“IXL Australia”).

As per the agreement, IXL Australia would acquire 100 per cent of the share capital of 3PL by way of a court-approved the Scheme (Scheme of Arrangement) in an all-cash offer and 3PL’s shareholder would obtain cash consideration of AU$1.35 for each 3P Learning share held.

The consideration values 3PL’s equity at ~ AU$189.0 million with an enterprise value (EV) of AU$166.7 million while implying an EV/EBITDA multiple of 11.4x.

The Scheme Consideration illustrates a 32.3 per cent premium to 1-month VWAP (Volume Weighted Average Price), a 45 per cent premium to the 3-month VWAP and a 54.1% to 6- month VWAP of $0.88of 3PL, as on 13 August 2020.

Furthermore, the board of 3P Learning, unanimously suggested shareholders vote in favour of The Scheme.

Notably, The Scheme is anticipated to be executed by early December 2020, subject to a few conditions.

Did you read; Edtech Industry Expected to Gain Further Momentum in Australia - OLL, JAN, 3PL, RTE, RCL, SCL.

Financial performance

On 14 August 2020, 3PL unveiled its FY20 performance and highlighted Group’s Statutory Revenue of AU$54.9 million for the period.

This marginal increase of 1 per cent on last year was echoed by double-digit revenue growth accomplished by the American segment on the sale of subscription-based products of AU$1.139 million offset by a decline in sub-lease revenue of AU$0.592 million (as a result of the adoption of AASB16 ‘Leases’, effective 1 July 2019).

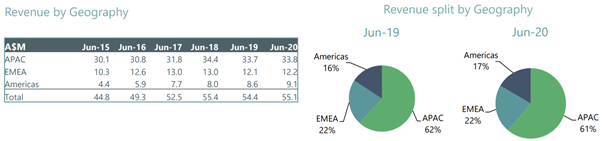

Source: Company’s Presentation, dated 14 August 2020

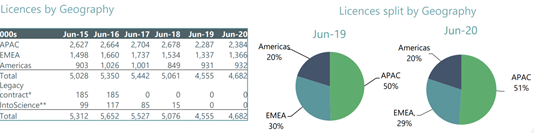

Furthermore, licence revenue increased 1 per cent to stand at AU$51.4 million driven by an improvement of 1 per cent in EMEA and 11 per cent in the Americas. Notably, the agreement worth US$10 million with Ministry of Education from the Middle East would begin contribution to revenue from FY21 (as flagged at the announcement, on 23 June 2020).

Source: Company’s presentation, dated 14 August 2020

3PL’s underlying earnings before interest, tax, depreciation, and amortisation (EBITDA) noted a plunge of 18 per cent y-o-y and was noted at AU$14.6 million.

Additionally, 3PL underlying net profit after tax (NPAT) witnessed a decrease of 71 per cent to AU$1.7 million, and Statutory NPAT noted a fall of 73 per cent to AU$1.6 million.

Furthermore, 3PL also divulged its bolstered financial position with AU$27.1 million cash and cash equivalents with no debt, as on 30 June 2020.

The Company witnessed a change in working capital standing at AU$0.3 million driven by enlarged H2 FY20 billings in EMEA and APAC region coupled with supplier centred working capital management.

Notably, the Company did not announce any dividend and retained cash to assist working capital, as well as growth opportunities.

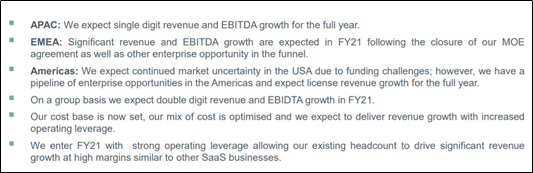

Outlook for FY21

3PL anticipates reporting double-digit growth in group revenue and EBITDA in FY21; increment in capex to AU$12.0 million to facilitate the development of features, which would further open up new markets and enlarge opportunities within existing markets.

FY21 Group outlook, Source: Company’s presentation, dated 14 August 2020