Highlights

The Australian share market opened in the green on Friday.

The ASX 200 index surged 14.40 points or 0.21% to 6,904.10 at the open.

On Thursday, the ASX 200 rose 1% to 6,889.7 points.

Australian shares rose at open on Friday after Wall Street closed on a strong note in the overnight trade. The ASX 200 index rose 14.40 points or 0.21% to 6,904.10 at the open.

The index has advanced 1.66% in the past five days. But the ASX 200 has dipped 7.26% on a year-to-date (YTD) basis. The ASX All Ordinaries index rose 0.195% to 7,129.8, while the A-VIX fell 4.796% to 15.246 at the open.

The benchmark index was trading at 6,967.50, up 77.80 points or 1.13% in the first ten minutes of trade. Meanwhile, on Thursday, the ASX 200 rose 1% to 6,889.7 points.

Global equity indices

Wall Street climbed to a seven-week high despite the country’s economy shrinking from April to June for a second straight quarter.

The second quarter GDP of the US fell at a 0.9% annualised rate, higher than market expectations. The weakness in the US economy may mean a less hawkish Fed.

In the US, the S&P 500 surged 1.2%, the Dow Jones jumped 1%, and the NASDAQ ended 1.1% higher.

Market action

The yield on the benchmark 10-year notes last fell to 2.6723%, from 2.732% late on Wednesday.

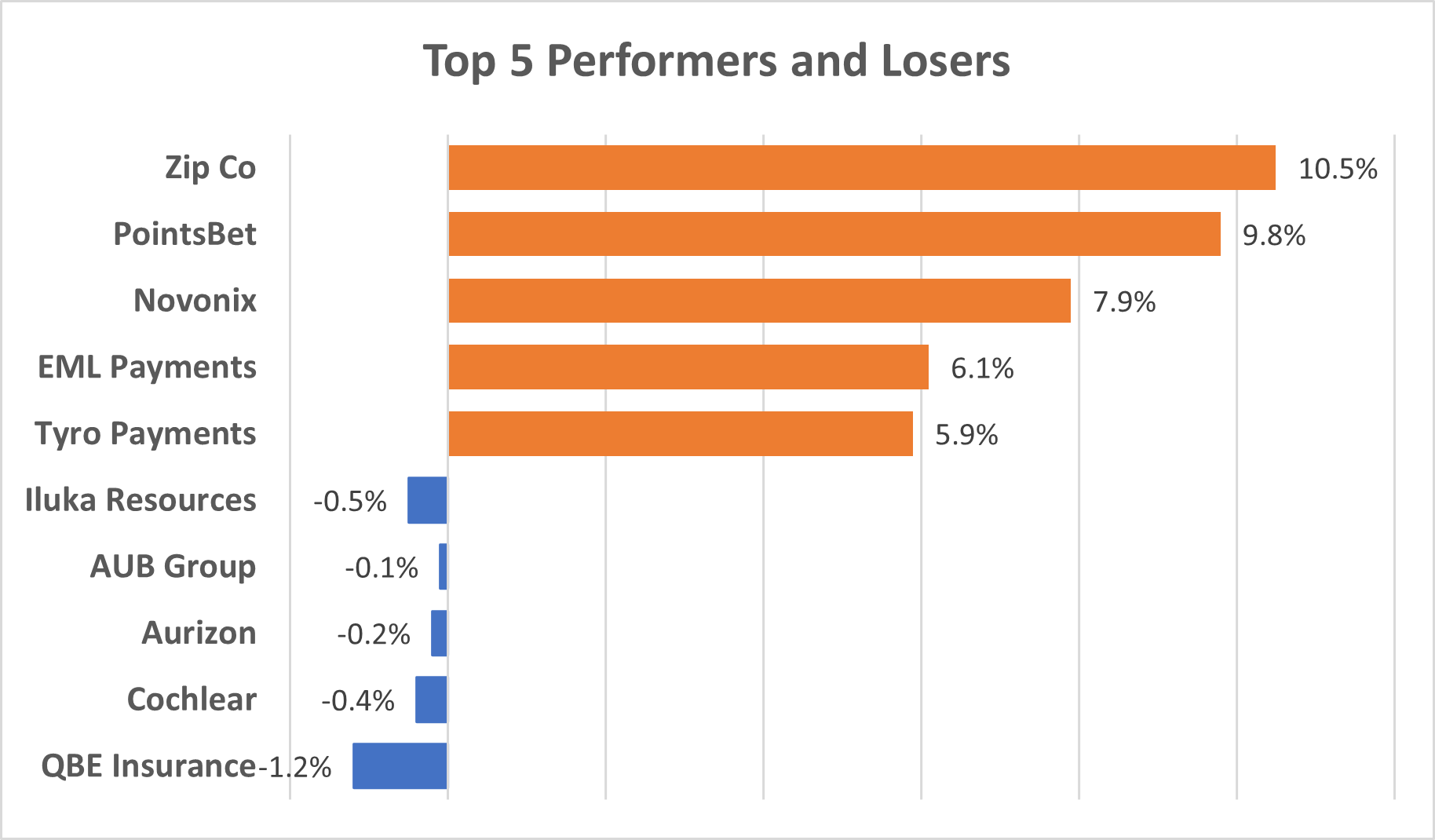

Data Source: ASX (as of 29 July 2022, 10:30 AM AEST)

Image Source: © 2022 Kalkine Media®

While Zip (ASX:ZIP) and PointsBet (ASX:PBH) were the top gainers, QBE Insurance (ASX:QBE) and Cochlear (ASX:COH) were the top laggards.

Shares in real estate, tech and utilities were leading the rally. All the 11 sectors of the index were trading in the green.

Newsmakers

- Prospa reported record full-year earnings before interest, tax, depreciation and amortisation (EBITDA) of nearly AU$12 million.

- PointsBet posted a 28% rise in net win in the Q4 of FY 2022.

- Sezzle informed the ASX that its total revenue surged 6.8%in the June quarter.

- The Star Entertainment Group said that it expected AU$1.53 billion in revenue in the year to June.

- Lake Resources reported an operating cash loss of AU$7.2 million for the 12 months to 30 June.