Highlights

The Australian share market opened higher on Tuesday.

The ASX 200 index rose 11.90 points or 0.18% to 6,801.80 at the open.

The index has gained 2.29% in the past five days.

The Australian share market opened higher on Tuesday despite US stocks finishing on a mixed note in overnight trade. The ASX 200 index rose 11.90 points or 0.18% to 6,801.80 at the open.

The index has gained 2.29% in the past five days. But it is down 8.63% on a year-to-date (YTD) basis. The ASX All Ordinaries index rose 0.158% to 7,017.5, while the A-VIX rose 1.326% to 16.587 at the open.

In the first ten minutes of trade, the benchmark index was trading at 6,799.10, up 9.20 points or 0.14%. Meanwhile, on Monday, the benchmark index declined 1.6 points to 6,789.9 points.

Global equity indices

Global markets are closely monitoring Thursday’s monetary policy meeting by the US Federal Reserve. According to experts, the US Fed may announce a 75-bp interest rate hike in the meet. Additionally, traders are also awaiting earnings from major tech companies such as Meta, Apple, Microsoft, and Amazon.

Meanwhile, German business confidence fell below the expected lines, touching a two-year low on concerns related to increased energy prices and likely natural gas shortage.

On Wall Street, the Dow Jones rose 0.3%, the S&P 500 edged 0.1% higher, and the NASDAQ dropped 0.4%.

In Europe, the Stoxx 50 rose 0.2%, the FTSE surged 0.4%, the DAX gained 0.3%, and the CAC ended 0.3% higher.

Market action

On Monday, the US bond yields rose ahead of the Fed’s policy meet and expectations of looming recession. While the yield on benchmark 10-year notes last fell to 2.8105%, the yield on 2-year notes declined to 3.0266%. The US dollar index fell 0.253%. On the other hand, euro rose 0.13% to US$1.0223.

Data Source: ASX (as of 26 July 2022, 10:30 AM AEST)

Image Source: © 2022 Kalkine Media®

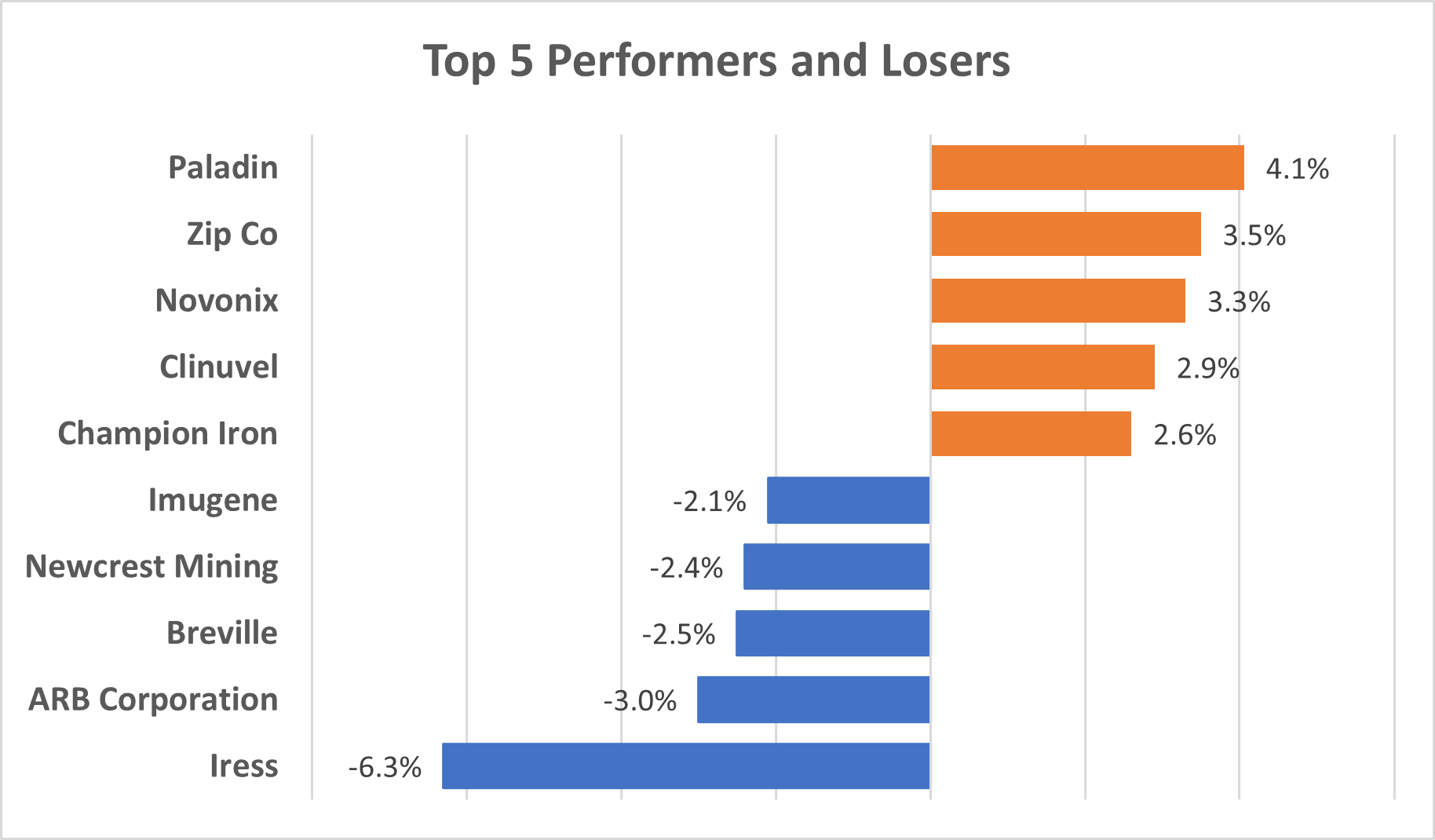

While Paladin Energy (ASX:PDN) and Zip (ASX:ZIP) were the top gainers, Iress (ASX:IRE) and ARB Corporation (ASX:ARB) were the top laggards.

Energy was the best performing sector with a gain of over 1.4%. Materials was down nearly 1%.

Newsmakers

- Origin Energy has increased its stake in Octopus, a UK energy tech company.

- Woolworths Group’s Gordon Cairns will retire as chairman following the annual general meeting (AGM) in October.

- Australian Prudential Regulatory Authority (APRA) chairman Wayne Byres will step down on 30 October 2022 after a more than eight-year stint.