Highlights

The ASX 200 fell 9.90 points or 0.15% to 6,611.70 in the first 10 minutes of trade on Thursday.

The ASX All Ordinaries index rose 0.022% to 6,809.3 at open.

The A-VIX was down 0.3.503% at 17.603 at open.

The Australian share market opened flat on Thursday after US stocks ended lower in overnight trade. The benchmark ASX 200 index fell 1.40 points to 6,623 at the open. The benchmark index slipped further into the red, falling 9.90 points or 0.15% to 6,611.70 in the first 10 minutes of trade on Thursday.

The ASX All Ordinaries index rose 0.022% to 6,809.3, while the A-VIX was down 0.3.503% at 17.603 at open. The index has shed 0.38% in the past five days, and 9.95% in the past 52 weeks.

Meanwhile, on Wednesday, the benchmark ASX 200 index ended 0.2% higher at 6,621.6 points.

Global equity indices

Global equities ended in the red on Wednesday following the release of latest US inflation numbers. US inflation surged to 9.1%, hitting a 40-year high. With this, the market now anticipates a 100-point interest rate hike. Investors are also awaiting US labour force data for June.

On Wall Street, the Dow Jones fell 0.7%, the S&P 500 declined 0.45%, and the NASDAQ ended 0.15% lower.

In Europe, the Stoxx 50 fell 1%, the FTSE declined 0.7%, the CAC slipped 0.7%, and the DAX ended 1.2% lower.

Market action

The US Treasury yield curve witnessed its largest inversion since November 2020 following the release of US inflation numbers. Additionally, the latest growth forecast cut by International Monetary Fund’s (IMF) also impacted the yields. On Wednesday, the yield on 10-year US Treasury notes fell 5 basis points to 2.908%.

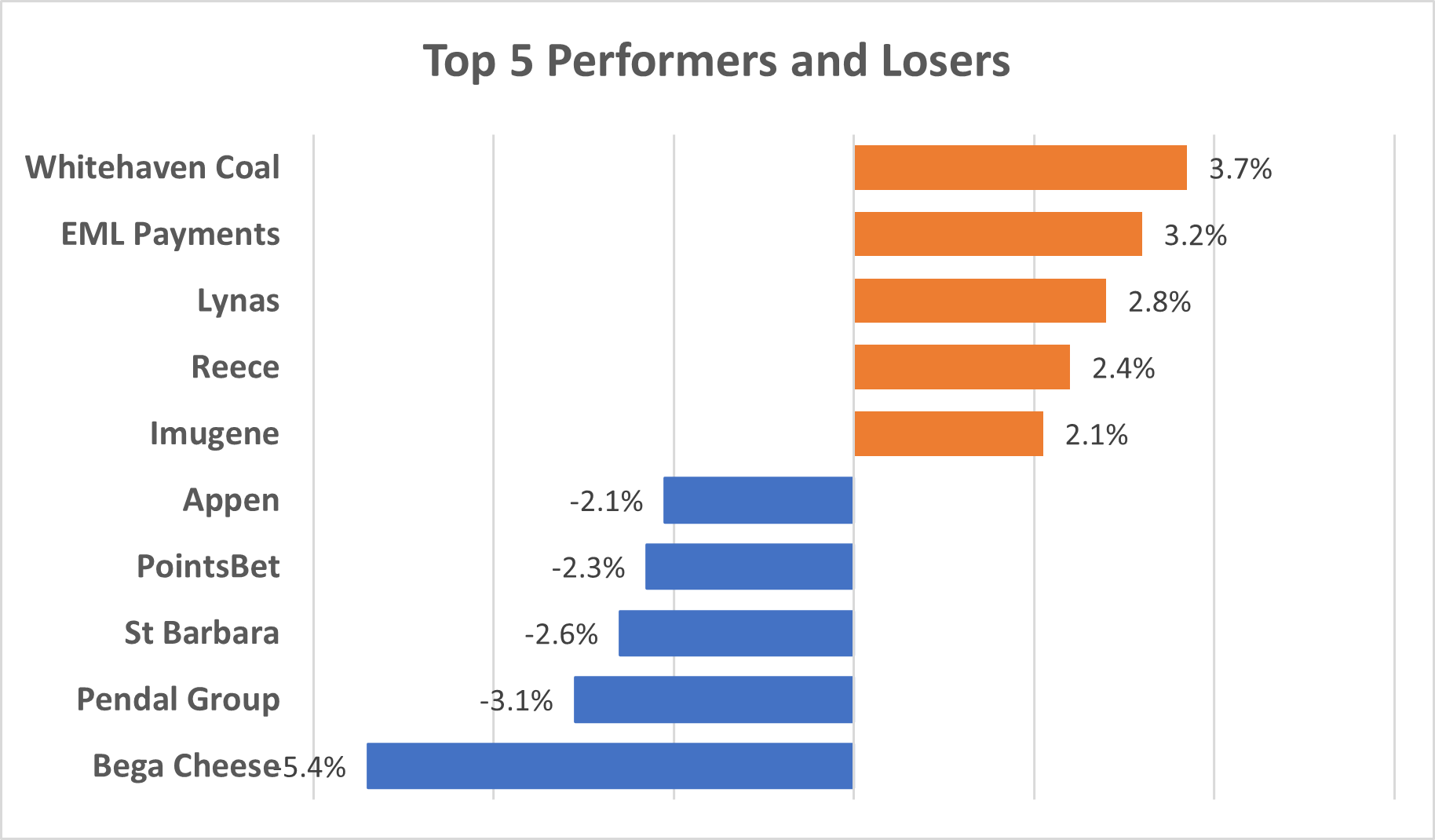

Data Source: ASX (as of 14 July 2022, 10:30 AM AEST)

Image Source: © 2022 Kalkine Media®

While Whitehaven Coal (ASX:WHC) and EML Payments (ASX:EML) were the top gainers, Bega Cheese (ASX:BGA) and Pendal Group (ASX:PDL) were the top laggards.

Materials was the best performing sector, recovering from its recent decline to gain nearly 1%. On the other hand, the financial sector was down over 0.6%.

Newsmakers

- Pengana Capital’s total funds under management (FUM) declined to AU$3.33 billion, as of 30 June 2022.

- Netwealth’s total funds under administration (FUA) fell 3.4% in the June quarter.

- Australian Ethical Investments’ FUM fell 9% in the June quarter.

- Pilbara Minerals has auctioned a cargo of 5000 dry metric tonnes of lithium spodumene concentrate to China.

- Bega Cheese said that rising input costs may lower its normalised EBITDA in FY23, compared to its earnings guidance for FY22.