Highlights

- Australian share market overcame a speedy decline for lithium miners to edge higher, gaining 22.80 points or 0.32% to 7,234.00.

- Top three biggest declines among blue chips were lithium producers- Pilbara Minerals, Liontown Resources and Allkem.

- Australian economy recorded 0.8% growth over in the first three months of the year and 3.3% annually.

Cheering the Australian GDP that grew 0.8% quarter-on-quarter, the ASX 200 started June 2022 on a positive note and gained 0.32% today. The Australian benchmark index closed the day’s trade at 7,234.00. In the last five days, the index has gained 1.10%, while remaining low by 2.83% on a last year to date basis.

How were the sectors and indices placed?

Despite the ASX 200 registering a gain, more sectors ended lower than higher. Telecommunications services sector was the best performer, taking a lead of 1.86%. Following suit were financials and industrials that gained 1.06% and 0.99%, respectively. On the other hand, the top loser today was the utilities sector, down 5.66%. Information technology and materials sectors were pulled down by 1.68% and 0.69%, respectively.

The volatility indicator- A-VIX index closed sharply lower sliding down 6.77%. The All-Ordinaries index closed up 0.10% and large cap illustrative ASX 50 index (XFL) rose 0.885%. However, the midcap index ASX Midcap 50 (XMD) dropped 2.242% and the ASX Small Ordinaries index (XSO) was down by 1.713%.

MORE FROM ASX 200- STO, SOL, ORG: Why These Energy Stocks Are Garnering Attention Today

Top gainers and losers

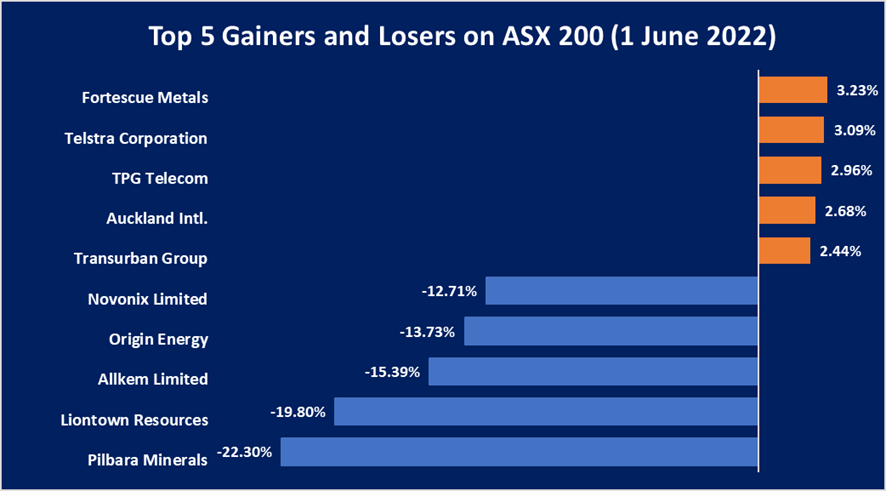

© 2022 Kalkine Media ®, Source- ASX website

The top gainer of the day was Fortescue Metals, gaining 3.23%. Following the lead were telcos Telstra and TPG Telecom gaining along the sectoral highs. On the flipside, Pilbara Minerals, Liontown Resources and Allkem were the biggest losers as lithium-focused stocks were hit by the Argentine customs’ decision to set a reference price to tackle irregularities. Besides, Goldman Sachs indicated a ‘sharp correction’ in the market, while Chinese EV giant BYD revealed its plans to buy six African lithium mines.

Newsmakers of the day

- Origin Energy Ltd (ASX:ORG) whose shares plummeted post the energy company withdrew its earnings outcomes for FY 23, based on the high uncertainty across commodity markets.

- On the mergers and acquisitions side, Woodside Energy Group was merged into oil and gas giant BHP Group Limited’s (ASX:BHP) portfolio.

- One of Australia’s big four banks, National Australia Bank (ASX:NAB) completed the acquisition of Citigroup’s Australian consumer business aiming to expand its personal banking segment.

- Earlier in the morning, Mesoblast Ltd (ASX:MSB) declared a loss for its financial term ending 31 March 2022. However, for the nine-month period, Mesoblast’s revenue surged 46% on the comparative period last year.

On the global front

In the US, the Fed is expected to shrink its balance sheet as investors await numbers from it, in a bid to tackle inflation. Investors are concerned about a possible recession from the monetary tightening. They are also expecting the US jobs report, due Friday.

In the UK, consumers are being warned to be prepared for inflation as soaring costs are forcing retailers to raise prices further. Reportedly, a survey by the British Retail Consortium said that fresh food prices were rising at the topmost speed in decade. The crisis is worsening more by the war in Ukraine, creating shortages in key inputs like fertilizer and animal feed.

In Asia Pacific, Shanghai has finally eased its lockdown, raising hopes of an economic recovery. As a result, China’s Shanghai Composite has firmed up 0.03% (2:32 AM GMT).The Caixin manufacturing purchasing index number revealed earlier today recorded better than predicted numbers. Japan’s Nikkei also gained to close Wednesday’s trade better.

On the commodities front

Oil prices have gained slightly post EU’s agreement on a partial and phased ban over Russian oil supply. Both benchmarks Brent and WTI closed May higher, making it the sixth straight month with higher prices.

Besides, the US gasoline prices have reportedly climbed up another record, making life more difficult for motorists as the summer driving season kicks in. Gasoline prices have been rolling higher since early April.

Gold edged lower today morning in Asia, as US Treasury yields, and the US dollar strengthened a little. In other precious metals, silver and palladium fell while platinum gained.