Highlights:

- The ASX 200 benchmark index closed down today (02 September 2022), losing 0.25% to end at 6,828.70 points.

- Over the last five days, the index has lost 3.88% and 8.78% over the last 52 weeks.

- Financial was the best performing sector today, gaining 0.72%, while materials was the worst performing sector, going down 1.94%.

Australian share market closed on a negative note today (02 September 2022) with the benchmark S&P/ASX 200 losing 0.25% to end at 6,828.70 points.

The Australian benchmark lost 275.40 points, or about 3.9%, for the week, its worst weekly result since a 6.6% drop in mid-June. Today's gains in real estate, banking, and healthcare stocks were offset by losses in commodities producers.

Key pointers from ASX close today

- The ASX 200 benchmark index closed down today, losing 0.25% to end at 6,828.70 points.

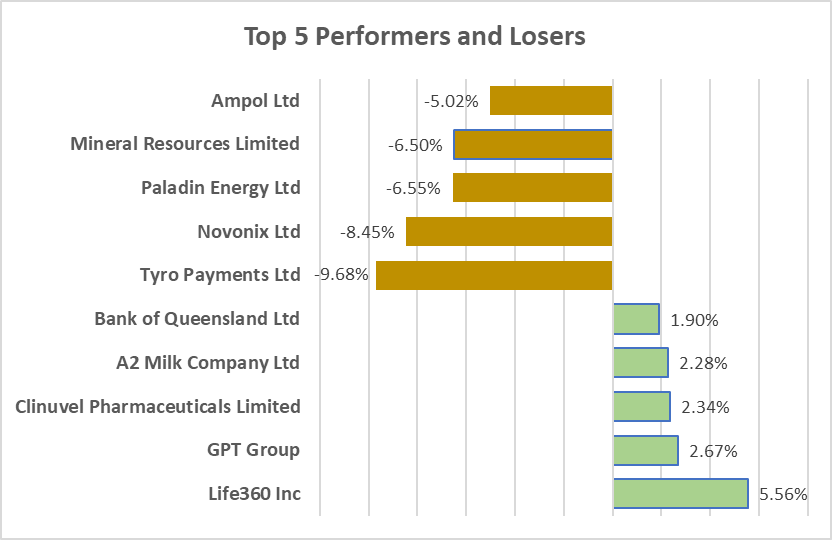

- Top performing stocks were Life360 Inc (ASX:360) and GPT Group (ASX:GPT), up 5.56% and 2.67% respectively.

- Bottom performing stocks in this index were Tyro Payments Ltd (ASX:TYR) and Novonix Ltd (ASX:NVX), ending 9.68% and 8.45% lower respectively.

- Over the last five days, the index has lost 3.88% and 8.78% over the last 52 weeks.

- Six of 11 sectors ended the day in red zone.

- Financial was the best performing sector today, gaining 0.72%, while materials was the worst performing sector, losing 1.94%.

- Volatility indicator A-VIX index was down 1.20% at 4.28 PM AEST.

- The All-ordinaries Index fell 0.33%.

Newsmakers

Woomera Mining (ASX:WML): Woomera Mining has advanced exploration activities at its South Australian sites - Labyrinth and Musgrave.

Labyrinth recently discovered abnormal targets while auger digging.

It has sought regulatory authority to drill test these abnormalities and will provide market updates following program approval, start-up, and outcomes.

Meanwhile, shares of Woomera closed flat at AU$0.015 each on ASX today.

Epsilon Healthcare (ASX:EPN): Epsilon Healthcare has received commitments for an AU$1.65 million investment to develop its domestic medicinal cannabis activities.

The shares will be available for purchase at 2.7 cents per share, representing a 16% reduction to the previous closing price and a 23.5% discount to the 15-day volume-weighted average price.

Meanwhile, shares of the stock last traded at AU$0.026 per share, down 21.21% on ASX today.

Image Source: © 2022 Kalkine Media ®

Data Source- ASX website dated 01 September 2022

Bond yield

Australia’s 10-year Bond Yield stands at 3.67% as of 4.44 PM AEST.

In global markets

The S&P 500 and Dow Jones closed in the green on Thursday, September 1, halting a four-session losing streak, as investors focused on the Labor Department's upcoming payroll data, which would be issued on Friday, September 2.

The S&P 500 rose 0.30% to 3,966.85. The Dow Jones was up 0.46% to 31,656.42. The NASDAQ Composite lost 0.26% to 11,785.13, and the small-cap Russell 2000 fell 1.16% to 1,822.82.

Despite the improvements in the two indices, the Nasdaq index remained negative as investors stayed away from the mega-cap tech stocks due to concerns about tighter monetary policy.

Meanwhile, according to the Labor Department's September 1 data, weekly jobless claims fell to a two-month low in the previous week. The encouraging job statistics has also raised some concerns, as it provides another rationale for the central bank to raise interest rates.

In Asia, the Asia Dow was down 2.07%, the Hang Seng in Hong Kong decreased by 0.77%, Nikkei in Japan fell 0.038% while Shanghai Composite in China increased 0.063% at 4.54 PM AEST.

In commodities markets

Crude Oil WTI was spotted trading at US$88.38/bbl while Brent Oil was at US$93.96/bbl at 4.56 PM AEST.

Gold was at US$1702.69 an ounce, copper was at US$3.41/Lbs and iron ore was at US$99.00/T at 4.57 PM AEST.