Highlights

- The ASX 200 benchmark index closed down today (22 August 2022), losing 0.95% to end at 7,046.90 point.

- Over the last five days, the index is virtually unchanged, but is down 5.34% for the last year to date.

- Consumer Discretionary was the worst performing sector today, losing 1.93%.

Australian share market closed on a negative note today (22 August 2022) with the benchmark S&P/ASX 200 losing 0.95% to end at 7,046.90 points.

The stock market experienced its steepest decline in five weeks amid growing concerns that rate cuts in China would add to the woes of the global economy.

Key pointers from ASX close today

- The ASX 200 benchmark index closed down today, losing 0.95% to end at 7,046.90 point.

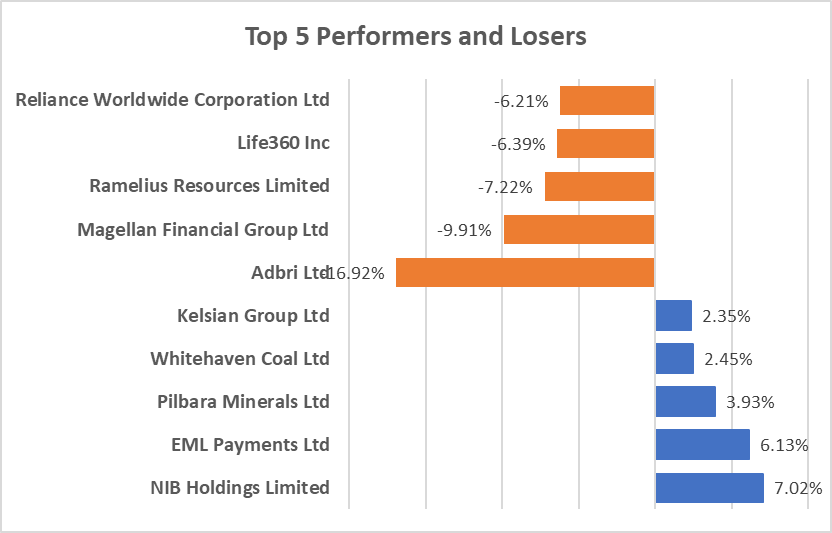

- Top performing stocks were NIB Holdings Limited (ASX:NHF) and EML Payments Ltd (ASX:EML), up 7.83% and 6.60% respectively.

- Bottom performing stocks in this index were Adbri Limited (ASX:ABC) and Magellan Financial Group Ltd (ASX:MFG), ending 16.92% and 9.56% lower respectively.

- Over the last five days, the index is virtually unchanged, but is down 5.34% for the last year to date.

- All 11 sectors ended the day in red zone.

- Consumer Discretionary was the worst performing sector today, losing 1.93%.

- Volatility indicator A-VIX index was up 5.32% at 4.27 PM AEST.

- The All-ordinaries Index fell 0.97%.

Newsmakers

Adairs (ASX:ADH): Adairs posted a record sales for 2022 fiscal year despite experiencing store closures in the first half.

The retailer of home goods posted group sales of AU$564.5 million, up 12.9% over the previous equivalent quarter.

Meanwhile, shares of Adairs closed trading at AU$2.20 each, down 13.73% on ASX today.

Security Matters (ASX:SMX): As it is ready to list on the NASDAQ, Security Matters has fully repaid the first loan it received from one of the biggest industrial associations in Israel.

With the original loan amount being just under AU$1 million, the company decreased their premium on the debt by approximately 60%, from ILS6 million (AU$2.7 million) to ILS2.5 million (AU$1.1 million).

Meanwhile, shares of Security Matters closed trading at flat AU$0.17 each on ASX today.

Image Source: © 2022 Kalkine Media ®

Data Source- ASX website dates 22 August 2022

Bond yield

Australia’s 10-year Bond Yield stands at 3.54% as of 4.46 PM AEST.

Image Source: © Rido | Megapixl.com

In global markets

The decrease in mega-cap equities caused Wall Street indices to end last week down on Friday (August 19). After losing four consecutive weeks' worth of gains, the S&P 500 and Nasdaq had a poor week's conclusion.

Investors appeared to be trading cautiously and staying away from risky assets as they waited for more information on how quickly the Fed might tighten its monetary policy.

The S&P 500 fell 1.29% to 4,228.48. The Dow Jones was down 0.86% to 33,706.74. The NASDAQ Composite lost 2.01% to 12,705.22, and the small-cap Russell 2000 fell 2.17% to 1,957.35.

In Asia, the Asia Dow was down 0.31% and Nikkei in Japan fell 0.47%, the Hang Seng in Hong Kong decreased by 0.29% while Shanghai Composite in China increased 0.57% at 4.53 PM AEST.

In Commodities markets

Crude Oil WTI was spotted trading at US$89.42/bbl while Brent Oil was at US$95.45/bbl at 4.53 PM AEST.

Gold was at US$1742.82 an ounce, copper was at US$3.67/Lbs and iron ore was at US$104.00/T at 4.54 PM AEST.