Highlights

- The ASX 200 benchmark index closed in the green today (November 17), gaining merely 13.50 points or 0.19% to end at 7,135.70 points.

- Over the last five days, the index has gained 2.47%, but is down 4.15% for the last year to date.

- Consumer staples was the biggest gainer, advancing 1.92%, followed by utilities, which ended 1.25% up, while energy fell 1.99%.

The ASX 200 benchmark index closed in the green today (November 17), gaining merely 13.50 points or 0.19% to end at 7,135.70 points.

Key pointers from the ASX closing today

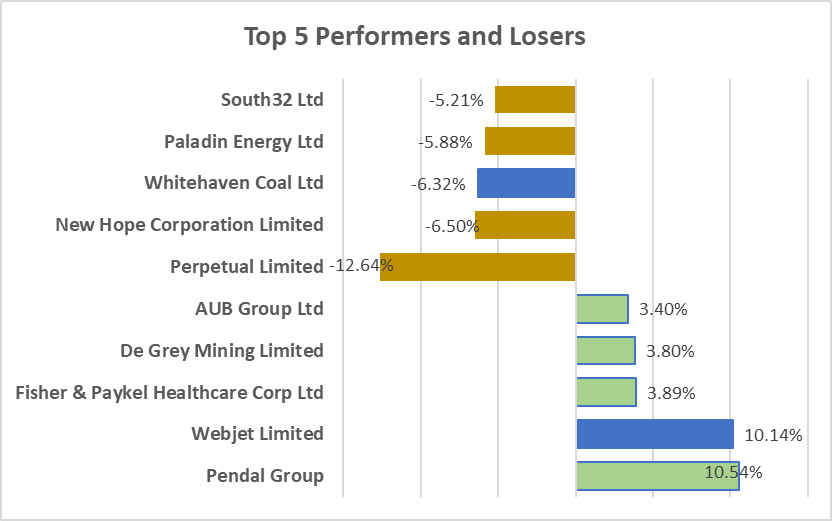

- Pendal Group (ASX:PDL) and Webjet Limited (ASX:WEB) gained the most on the index, moving ahead 10.54% and 10.14%, respectively.

- Perpetual Ltd (ASX:PPT) and Whitehaven Coal Ltd (ASX:WHC) fell 12.64% and 6.50% respectively.

- Over the last five days, the index has gained 2.47%, but is down 4.15% for the last year to date.

- 9 out of 11 sectors closed in green today.

- Consumer staples was the biggest gainer, advancing 1.92%, followed by utilities, which ended 1.25% up, while energy fell 1.99%.

- The All-Ordinaries Index gained 0.16%.

Newsmakers

Nuheara (ASX:NUH): In addition to receiving certification for domestic unregulated products, Nuheara has received certification for the quality of its international medical devices, according to an ASX filing.

As a result of the business receiving 13485:2016 certification, Nuheara has successfully passed all requirements, most notably if it is efficient while being safe to use.

Tesoro Gold (ASX:TSO): To expand its El Zorro gold project in Chile, Tesoro Gold has started an AU$8 million capital campaign.

The AU$4.2 million placement, which will be made by Gold Fields subsidiary Corporate International as a strategic investment, and the AU$3.8 million entitlement offer make up the capital raise.

Image source: © 2022 Kalkine Media®

Data source- ASX website dated 17 November 2022

Bond yields

Australia’s 10-year Bond Yield stands at 3.63% as of 4.11 PM AEDT.

Global markets

A tentative recovery lost steam when ABS data revealed that the unemployment rate dropped from 3.5% to 3.4% last month as the economy added 32,200 new jobs. More than twice as many jobs were added as the anticipated 15,000 gains.

The S&P 500 fell 0.83% to 3,958.79. The Dow Jones was down 0.12% to 33,553.83. The NASDAQ Composite lost 1.54% to 11,183.66, and the small-cap Russell 2000 decreased 1.91% to 1,853.17.

In Asia, the Asia Dow lost 1.16%, Nikkei in Japan fell 0.38% while the Hang Seng in Hong Kong was 2.42% down and the Shanghai Composite in China decreased by 0.88% at 4.16 PM AEDT.

In commodities markets

Crude Oil WTI was spotted trading at US$84.36/bbl, while Brent Oil was at US$92.04/bbl at 4.17 PM AEDT.

Gold was at US$1762.17 an ounce, copper was at US$3.73/Lbs, and iron ore was at US$99.00/T at 4.17 PM AEDT.