Highlights

- ASX 200 closed higher today, crossing its 20-day moving average.

- The benchmark index closed up, gaining 76.80 points or 1.08% to 7,182.70.

- Energy sector was the top performer followed by consumer discretionary.

Closing the week above its 20-day Moving Average (MA), the ASX 200 posted a 1.08% gain today to close at 7,182.70. The Aussie benchmark index has gained about 0.53% in the last five days, though it is still down by 3.51% on a year-to-date basis. It is the second week ending on gains for the ASX. Moreover, the Australian dollar climbed up to US$0.71, after retail sales touched record highs in April. The local currency is up 0.5% today.

How did sectors and indices perform today?

10 of 11 sectors closed the week’s trade higher, following the ASX 200 index. Energy was the best performing sector, gaining +2.25%. It is up by 2.13% over the last five days.

The Australian market’s volatility indicator- A-VIX also closed sharply lower, sliding down 1.78%. On the other hand, the All-ordinaries index gained 1.01% crossing above its 20-day moving average. Large cap representative ASX 50 index (XFL) rose 1.115%. The midcap index ASX Midcap 50 (XMD) was up 1.069% and the ASX Small Ordinaries index (XSO) were up 0.708%.

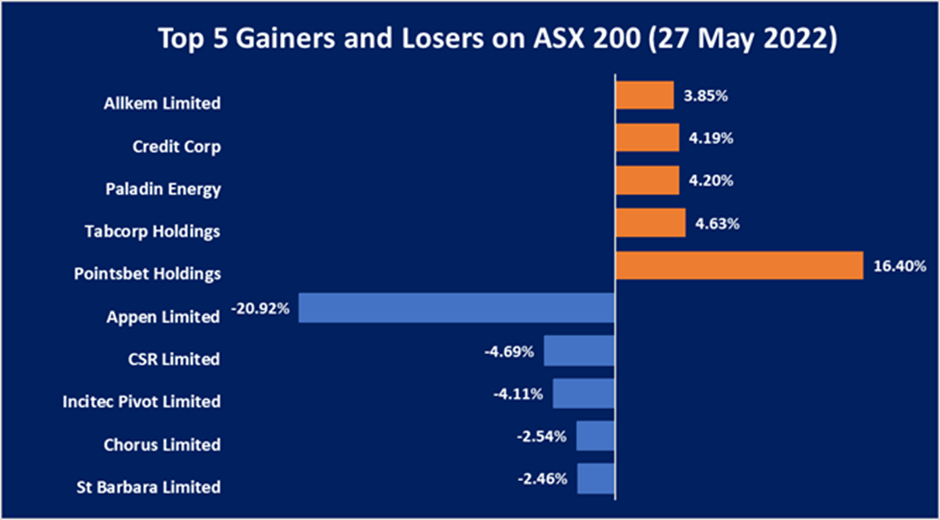

Top gainers and losers on ASX

©2022 Kalkine Media®, Source- ASX

While Pointsbet Holdings gained over 16% to become the top gainer, Appen Limited lost over 20% to be the worst performer. The second top performing stock in the index- Tabcorp Holdings has been in media limelight for three days after it announced its demerger with The Lottery Corporation Limited.

Newsmakers of the day

- Newcrest Mining Limited (ASX: NCM) gained attention after reporting new gold copper targets identified at its IGO Paterson and Wilki Farm-in project exploration programmes.

- Battery materials company, Novonix Limited (ASX:NVX) was in news for the retirement of its board member Trevor St Baker AO. While St Baker reportedly was holding excessive company board representations for St Baker Energy Innovation Fund, he quit Novonix with immediate effect to be replaced by Chris Hay.

- Virtus Health Ltd (ASX:VRT) shares went down after its Board recommended BGH’s takeover offer superior to that of CapVest.

- Appen Limited (ASX:APX) plummeted after Canadian Telus International revoked its takeover offer.

Related Read-Newcrest (ASX:NCM) shares move up on finding new gold-copper targets in WA

On the global markets front

Stocks were enticing investors ending the earlier dry spell caused by worries of inflation and higher interest rates. China’s downbeat economic outlook posed some tension alongside the ongoing war amongst Russia and Ukraine.

Asian stocks remained upbeat as Chinese tech majors Alibaba Group and Baidu Inc. beat sales forecasts taking Hong Kong stocks on a rally. Meanwhile Japan’s Nikkei also climbed a bit. Overnight in the US, shares jumped as consumers showed resilience against inflationary pressures.

Major market influencing data to keep an eye for now is the US core PCE price index, data on personal income and spending, the wholesale inventories numbers, and the University of Michigan’s consumer sentiment data due today.

On the commodities front

Oil shone bright today, priced around a two-month high. Prices was bolstered by a market rally and on signs of declines in US stockpiles. Brent crude was looking forward to its biggest weekly leap in one-and-a-half months, with a possible European Union (EU) ban on Russian oil. Cleaner energy source LNG was being side lined for high prices by LNG buyers in developing countries.

On the metals side, Copper and Aluminium stabilised on concerns that Chinese economic slowdown is affecting demand. Gold sparkled after the dollar retreated from its 20-year peak. In other precious metals, silver edged down by 0.2% while Palladium lost 0.2%.

Also read- Why Aussies' power bills are set to go through the roof