Highlights:

- ASX 200 ends Friday session marginally lower, pulled by Materials sector.

- Defensive sectors, Consumer Staples, Healthcare and A-REITs clocked some gains.

- Falling iron-ore prices seem to have weighed heavily on metal and mining companies.

The benchmark ASX 200 index closed the week down 0.68% to 6,605.60 points. Yesterday’s gainers Materials, Telecom and Energy were today’s top losers. In fact, Materials sector was down 3.21% as iron ore and copper prices continued to fall. Meanwhile, defensive sectors - Consumer Staples, Health Care and A-REITs were on the gaining side. Over the week, the index has lost 1.08% and 9.96% in last 52 weeks.

Other noteworthy trends

Volatility indicator -A-VIX index was up 1.24% today. The All-ordinaries index followed the broader market trend falling 0.74%. Large cap representative, ASX 50 index (XFL) lost 0.548%. Mid-caps shown by Midcap-50 index and small caps by ASX Small ordinaries index lost 1.335% and 0.935% respectively.

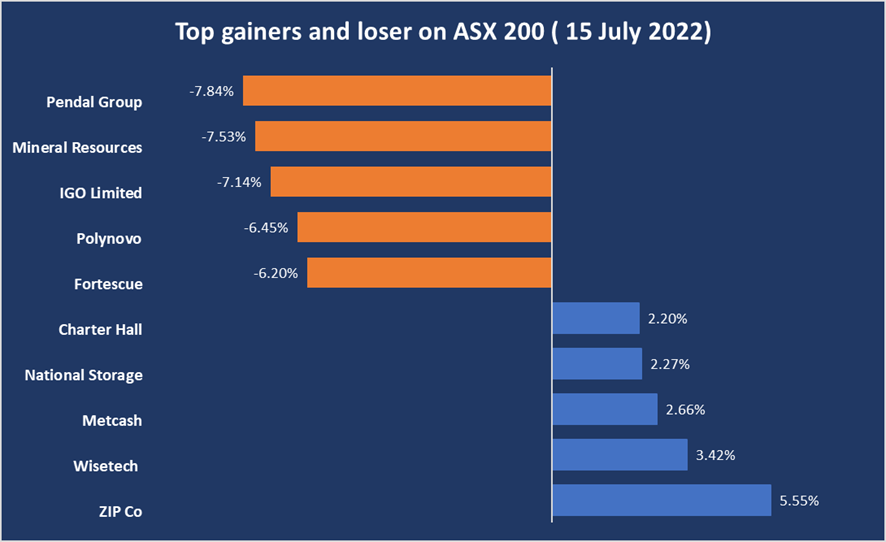

Top gainers and losers on ASX 200

Image Source © 2022 Kalkine Media ®, data source- ASX website

Market movers

- Michael Hill (ASX:MHJ) shares gained 3.70% after the jeweller reported increased sales and expanded margins for the June quarter. The management claims it to be a remarkable achievement considering the ongoing challenges. Store sales grew 17% in the quarter and 7.3% y-o-y.

- On the gaining side, even WiseTech Global (ASX:WTC) shares were up 3.42% post lifting its annual earnings forecast. The pushing factor being a stronger top-line growth and improved cost savings.

- Investment manager Pendal’s (ASX:PDL) shares lost more than 7.8% after reporting worse than expected outflows of managed funds in June quarter. Pendal’s assets under management have dropped and investors have taken out AU$4.2 billion from the group.

- Shares of lottery operator Jumbo Interactive (ASX:JIN) plunged close to 15% after it shared that there was a lower jackpot activity in March and April 2022.

- ASX-listed iron-ore big-shots lost heavily due to the sliding iron ore prices. The dip in commodity price was attributed to the fall in Chinese GDP, its lockdown-hit property market and broader economy. BHP group shares (ASX:BHP) fell 3.48%, Fortescue metals (ASX:FMG) lost 6.2% while Rio Tinto (ASX:RIO) slid 2.85%.

In global markets:

Asian stock markets were brighter. Japan’s Nikkei Index and South Korea’s KOSPI closed higher. Chinese CSI and Shenzhen component indices followed along. Meanwhile, Hing Kong’s Hang Seng index closed lower. In the west, investors anticipate European stocks to open in green.

On commodities front:

Oil prices continued to rise on expectations of a less aggressive rate hike by US Fed. Both Brent and WTI were higher on Friday. Popular safe haven, Gold also firmed up with an eased dollar on uncertainty w.r.t US Fed’s interest rate hikes.