Highlights

- The day on which a declared stock dividend is scheduled to be paid to qualified investors is known as the payment date.

- The pay date can be up to a month after ex-dividend date.

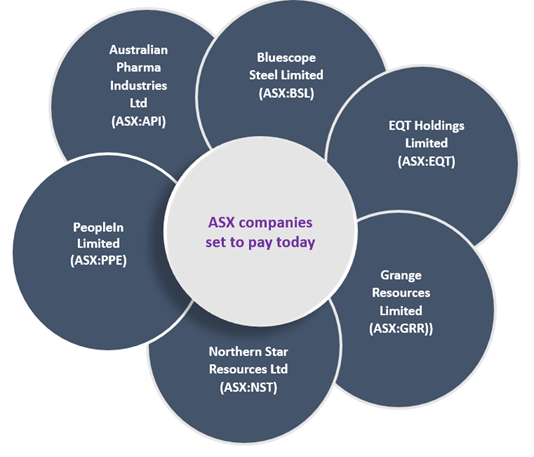

- Companies like EQT Holdings, Grange Resources are set to pay dividend today.

Many ASX-listed companies are set to pay dividend today, according to their ASX filings shared earlier. Some of the companies include Australian Pharma Industries Ltd, Bluescope Steel Limited, EQT Holdings Limited, Grange Resources Limited, Northern Star Resources Ltd and PeopleIn Limited.

Image Source © 2022 Kalkine Media ®

What is a dividend payment date?

The day on which a declared stock dividend is scheduled to be paid to qualified investors is the payment date, sometimes known as the pay or payable date. The pay date can be up to a month after the ex-dividend date. It's worth noting that the stock price may drop on the payment day to reflect the dividend payment, even if it hasn't been credited to investors yet.

In this article, we will discuss the above-mentioned companies and their stock performance of the day.

Australian Pharma Industries Ltd (ASX:API)

API is an Australia-based pharmaceutical distributor and health and beauty retailer company. Australia and New Zealand are two of the company's segments.

The Australia segment is involved in the distribution of pharmaceutical, medical, health, beauty, and lifestyle products and retail services to pharmacies. Pharmaceutical drugs and consumer products are manufactured and owned by the New Zealand segment.

How Are Dividends Paid In Australia?

Update on API's acquisition by Wesfarmers

On 22 March 2022, API confirmed that it had lodged a copy of the orders made by the Federal Court of Australia with the Australian Securities and Investments Commission. As announced a day before (21 March 2022), the Court approved the scheme of arrangement between API and its shareholders, under which WFM Investments Pty Ltd, a wholly-owned subsidiary of Wesfarmers Limited, will acquire 100% of the shares in API.

Dividend payment

API went ex-dividend on 24 March 2022 and is set to pay the dividend to its shareholders today (29 March 2022). This is a fully franked dividend of AU$0.030 per share.

Also Read: Australian Pharma (ASX:API) shareholders support WES takeover

Source: © Tanyashir | Megapixl.com

Bluescope Steel Limited (ASX:BSL)

Bluescope Steel provides steel materials, products, systems and technologies across Australia and New Zealand. It is also involved in the production of painted and coated steel.

In mid of this month, the Australian federal government announced to invest around AU$55.4 million into BlueScope Steel’s redevelopment project at Port Kembla.

With this funding, the federal government intends to safeguard steel supplies used by the Australian military and renewable energy projects.

Bluescope Steel which went ex-dividend on 25 February 2022, is set to pay a dividend of AU$0.25 per share today (29 March 2022).

Stock performance

On Tuesday (29 March 2022), Bluescope Steel's shares last exchanged hands at AU$21.74 each, up 0.14%. The company saw around 1.71 million shares traded on ASX today.

In the last six months, Bluescope Steel recorded a growth of 8% in its share price.

Also Read: RIO, BHP, BSL: Mining stocks help ASX200 end week on a positive note

EQT Holdings Limited (ASX:EQT)

EQT Holdings is a trustee and executor firm established in Australia. Trustee & Wealth Services (TWS), Superannuation Trustee Services (STS), and Corporate Trustee Services are the company's segments (CTS).

Last month (on 25 February 2022), EQT Holdings had shared its half-yearly results for the financial year 2022. The company had a net profit of AU$12.7 million for the period, which increased 29% on revenue of AU$55.9 million, which was 16% up compared with the pcp.

The board of EQT Holdings declared an interim dividend of AU$0.48 per share, up 9% from the last interim dividend. It went ex-dividend on 9 March 2022 and is set to pay its fully franked dividend today (29 March 2022) to its shareholders.

Stock performance

EQT Holdings shares closed at AU$26.50 each on ASX today, up 1.72% from its previous close at a market capitalisation of AU$548.63 million. In the last six months, the company recorded negative growth of almost 9% in its share price.

Source: © Kiosea39 | Megapixl.com

Grange Resources Limited (ASX:GRR)

Grange Resources is a Tasmanian company that specialises in integrated iron ore mining and pellet manufacturing. The company is involved in iron ore mining, processing, sale, and mineral resource exploration, appraisal, and development. It has a stake in the Tasmanian Savage River project, the Port Latta project, and the Western Australian Southdown magnetite project.

Grange Resources is also set to pay its 100% fully franked dividend of AU$0.10 per share today (29 March 2022). The company went ex-dividend on 11 March 2022.

Stock performance

Grange Resources' shares ended 0.47% lower today (29 March 2022) at AU$1.07 each. In the last six months, the company's shareholders have pocketed around 140% profit on their portfolio.

Northern Star Resources Ltd (ASX:NST)

Northern Star is mainly engaged in gold exploration, development, mining, processing, and selling refined gold. Kalgoorlie Operations, Yandal Operations, Pogo, KCGM Joint Venture, and Exploration are the company's five segments.

In its half-yearly result of FY22, the company reported a net profit after tax (NPAT) of AU$261 million, driven by higher production and portfolio optimisation. Its underlying EBITDA was AU$699 million, up 47% from pcp.

Northern Star's board declared a fully franked interim dividend of AU$0.10 cents per share, up 5% from pcp, which it is set to pay today (29 March 2022). The ex-date of the dividend was 7 March 2022.

Stock performance

Northern Star's shares closed 0.09% higher today (29 March 2022) at AU$10.79 apiece. The company has provided 27% returns to its shareholders in the last six months’ time.

Also Read: What is pushing Northern Star's (ASX:NST) share price on ASX?

PeopleIn Limited (ASX:PPE)

PeopleIn Limited, formerly People Infrastructure Limited, is a workforce management firm based in Australia. The company specialises in staffing, business services, and operational services.

In its 1HFY22 results, PeopleIn reported substantial revenue and EBITDA growth. With its 1HFY22 revenue of AU$315.9 million, PPE's revenue was 30% higher than the prior six months, while PeopleIn's EBITDA grew 27% to AU$21.6 million compared to 2HFY21.

The company had also declared a fully franked interim dividend of AU$0.065 per share, an over 8% increase on the final dividend for FY21, which it is set to pay today (29 March 2022).

Stock performance

On Tuesday (29 March 2022), PeopleIn shares ended 5.13% higher at AU$4.1 each at a market capitalisation of AU$372.25 million. It recorded more than 7% growth in its share price in the last six months.

Also Read: PeopleIn (ASX:PPE) raises FY22 dividend to 6.5cps on solid H1FY22 results